Key players in the crypto ecosystem are shoring up their defenses amid growing concerns over the state of Multichain, a major venue for moving assets between different blockchains.

Four days after apparent technical issues started throttling some users’ ability to withdraw tokens from the protocol, wild rumors over Multichain’s safety and the fate of its team are filling the void created by the platform’s silence. A single tweet blaming some cross-chain breaks on “force majeure” has only added fuel to the widespread speculation that something is amiss.

The light-on-facts landscape is pushing a growing number of entities to mitigate risk now – regardless of Multichain’s true state. Their responses are highlighting how crypto bridges create the potential for a world of hurt that goes well beyond the flashiest and well-trodden risk to bridges (getting hacked by North Korea).

The situation is compounded by Multichain’s prominence among bridges. It is the third-largest bridging protocol by transfer volume and total value locked, according to data from Messari and DeFiLlama.

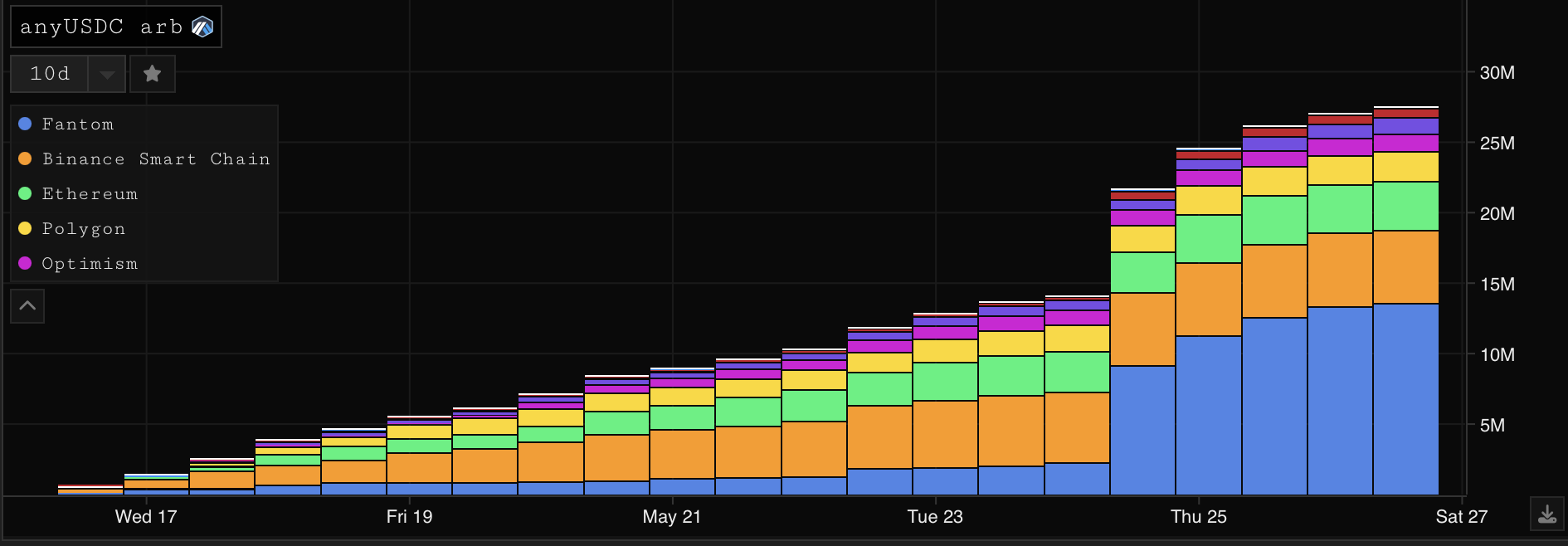

Like most bridges, Multichain uses a mint-and-lock mechanism to move assets between the 92 blockchains it interacts with. For example, if a holder of USDC stablecoin bridges the asset from Ethereum to Fantom via Multichain, the token gets locked up in a smart contract on Ethereum and then issued anew on Fantom – in this case, as a “wrapped” token called anyUSDC.

Multichain’s anyUSDC and other wrapped USDC tokens like it dominate 50% of Fantom’s stablecoin market, according to DeFiLlama. This is in spite of all USDC on Fantom being “bridged” assets instead of “native” that Circle issues directly onto the chain. Thus, all the USDC tokens on Fantom are reliant on bridges to retain their value.

This setup works as long as the bridge does. At the height of Multichain’s troubles this week, it didn’t, and wrapped USDC tokens on Fantom lost their dollar peg. Some arbitrage traders told CoinDesk they bought wrapped USDC tokens at a 30% discount during the fracas over Multichain, which is responsible for 80% of the stablecoins on Fantom.

Binance, the world’s largest crypto exchange, seemingly pointed to the risks of non-native assets Friday with a tweet imploring traders to “remember to check you trust the issuer behind stablecoins you hold.”

The Fantom ecosystem’s high reliance on Multichain hasn’t spooked market participants into a mass exodus quite yet. Overall numbers like total value locked remain rather steady despite some outflows to other chains, according to data from terminal-builder Parsec.

“The multichain bridge is fully operational and safe with Fantom. Whatever is happening internally with multichain has no impact on the bridged assets on Fantom,” Michael Kong, CEO of the Fantom Foundation, told CoinDesk.

Squid Router – a bridging protocol built on Axelar that unlike Multichain uses swaps instead of wrapped tokens to move value across chains – also reported a surge in activity during the Multichain madless. Bridge transactions on Axelar itself increased sixfold during the spike, people familiar with the matter said.

But Multichain’s method of wrapping assets to bridge them has spooked players beyond the stablecoin markets. On Thursday, Binance said it would temporarily suspend deposits in 10 Multichain-bridged tokens “while we await clarity from the Multichain team.”

Bridging aggregation service Li.Fi also took preventative measures yesterday and shuttered access to Multichain.

Amid all this Multichain’s namesake asset MULTI has suffered. It was trading at $3.8 at press time, a 54% drop from where it was before the crisis of confidence began.

Edited by Stephen Alpher.

https://www.coindesk.com/business/2023/05/26/binance-other-crypto-players-shun-multichain-as-bridging-rumors-swirl/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD