Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

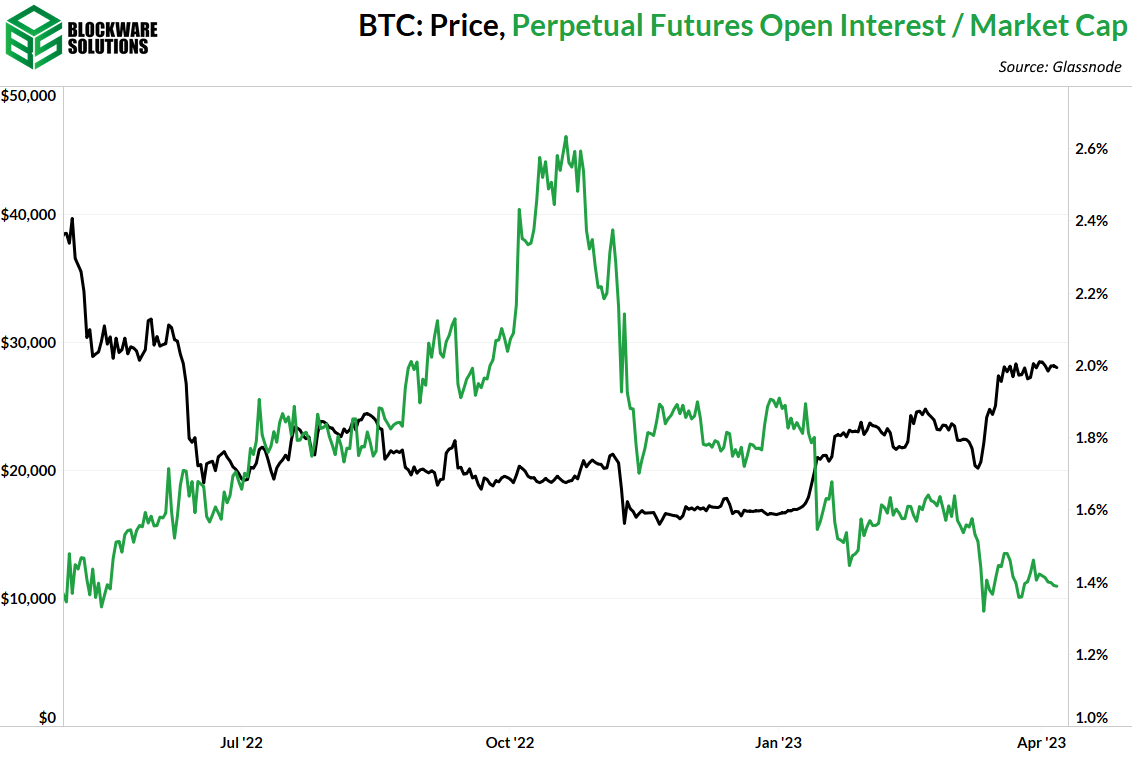

Bitcoin (BTC) has surged 70% this year, hitting nine-month highs of over $29,000. While the sharp rally has brought the derivatives market back to life, the overall use of leverage remains muted, suggesting a low risk of “liquidations-induced” wild price swings.

Liquidations refer to the forced closure of bullish long and bearish short positions in leveraged perpetual futures markets, which allow traders to open positions worth much more than the money deposited as margin. The forced closure for cash or cash equivalent happens when the trading entity fails to meet the margin shortage stemming from the market moving against its bullish/bearish bet.

When the degree of leverage in the market – measured by the ratio between the dollar value locked in perpetual futures (open interest) and the cryptocurrency’s market capitalization – is high, short liquidations tend to exacerbate bullish moves. That, in turn, shakes out more shorts, leading to a short squeeze. Similarly, long liquidations exacerbate bearish moves, leading to a long squeeze.

Long/short squeezes were quite common during the 2021 bull run and early bear market days of 2022 when the amount of leverage outstanding relative to the size of the market was quite high and price moves would shake out billions of dollars worth of leveraged trading positions. So far this year, the ratio has continued to drop.

“High open interest relative to market cap means the market could be vulnerable to a short-squeeze or liquidation cascade, which would result in a price swing being more volatile than it otherwise would have been due to forced buying or selling, respectively,” analysts at Blockware Solutions said in a weekly newsletter.

“The medium-term trend of decreasing open interest/market cap has not been broken, which is reassurance that, even in the event of downward volatility, price is most likely not going to decrease to the level it was at to begin the year,” analysts added.

Open interest relative to market capitalization continues to drop, signaling low odds of a liquidations cascade. (Blockware Solutions, Glassnode) (Blockware Solutions, Glassnode)

The perpetual futures open interest to market ratio has been falling since FTX, formerly the third-largest cryptocurrency exchange and one of the preferred avenues to trade perpetual futures, went bust in early November.

The ratio has stayed low despite the recent price consolidation, a sign of low investor risk appetite, according to Blockware Solutions.

“BTC has essentially traded sideways for the past three weeks, yet, we haven’t seen a build-up in open interest. This is a signal that the market is still in a risk-off mode,” Blockware’s analysts noted, saying the non-expiring perpetual futures are typically in demand during periods of sideways price action, as seen ahead of FTX’s implosion.

Bitcoin has been locked in the narrow range of $29,000 to $27,000 since March 21, according to CoinDesk data.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

https://www.coindesk.com/markets/2023/04/10/bitcoin-faces-low-risk-of-liquidations-induced-price-volatility-after-70-surge/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD