Only bitcoin offers a truly sustainable path forward for the continent which prizes this attribute.

Recently we have been tragically exposed to a thought process of one Eero Heinäluoma, a Socialist member of the European Parliament. While it doesn’t seem like there’s actually any proposal to ban bitcoin mining at this moment, it’s safe to assume that such a proposal is just a matter of time.

The War On Reality

The brilliant idea of Mr. Heinäluoma is to “stop the use of the underlying technology” of Bitcoin, meaning banning proof-of-work. This misinformed stance is of course followed by a call for cryptocurrencies to move to a more “climate friendly” consensus in the form of proof-of-stake.

Sigh.

Does it even matter if we repeat for a thousandth time that proof-of-work is the fundamental breakthrough of Bitcoin, ensuring the neutral, predictable monetary policy that is so sorely lacking in today’s fiat-infested world? It doesn’t seem to matter to these people; it’s as if they’re waging a war on reality.

When the crusaders of governmental action such as Mr. Heinäluoma get to work, facts fly out the window. They need to sell a good-looking story. And the story in the context of bitcoin mining is that it is harmful to the environment and somebody should do something about it, meaning the government should ban it, as it usually goes.

The good news is that Bitcoiners have facts on their side.

According to Michael Saylor’s Bitcoin Mining Council (BMC) and its Q2 Global Bitcoin Mining Data Review, these are the recent findings on the nature of bitcoin mining:

- The energy mix of the Bitcoin Mining Council members, who constitute around 32% of the global Bitcoin hash rate, consists of 67% sustainable electricity generation (sustainable defined as: renewables plus nuclear plus carbon-based with net carbon credits).

- The above metric is then extrapolated to around 56% of sustainable energy usage for the whole bitcoin mining network.

Previous estimates on the renewable/sustainable energy proportion in bitcoin mining range between 39% (University of Cambridge study) and 73% (Coinshares study). Unlike the BMC report, these two studies do not include nuclear energy or carbon offsetting in their calculations. All in all, around 50 percent in sustainable energy seems plausible, especially when we understand the incentives at play: miners naturally look for the cheapest source of energy, which is often otherwise unused renewable energy (hydro, sun, wind in the peak times) or so-called stranded energy, like flared natural gas from oil rigs.

So how does the European Union compare to Bitcoin, sustainable energy-wise?

According to the official Eurostat energy statistics, the European Union utilizes 15% in renewables and 13% in nuclear energy, for a total of 28% in sustainable energy generation.

This is much less than Bitcoin’s lower-bound estimate of 39% in renewables (which excludes nuclear) and half of the BMC estimate of 56% (which includes nuclear).

Bitcoin mining is much greener than the whole European Union.

The beautiful thing is that while for the European Union the increasing share of renewables is achieved through a top-down, politically-motivated program that comes at huge costs and increased grid instability, for Bitcoin it’s just a natural outcome of economic incentives. Bitcoin is environmentally-friendly as a side effect, without anyone needing to push for it.

Put Frankenstein’s Monster To Rest

As the podcaster Marty Bent points out, no ratio of renewable/sustainable energy will appease the powers that be. Even if bitcoin was mined exclusively with hydro, solar, gas flares and volcanoes, it would still be criticized for wasting energy. It’s not a question of energy statistics, but rather of perceived legitimacy. Politicians and other fiat maximalists simply need to paint bitcoin as useless and harmful, and they will use any narrative that does the job, be it energy waste, terrorist financing, drug trade, malware, inequality or any other FUD.

The truth is that bitcoin is a disturbing reflection on the fiat establishment. Contrary to hundreds of predictions, bitcoin is thriving after 12 years of existence, with one country already adopting it as a legal tender with others looking on, and users being able to perform global, instant, near-costless transactions (via the Lightning Network) despite numerous claims of bitcoin’s unscalability.

Bitcoin is the money that Europe deserves after 20 years under a slapped-together monetary regime that has been disintegrating since the start. The euro was introduced in 2002, and already by 2008 had undergone a major crisis, when Greece needed to be bailed out. The problem there was that the single monetary policy acted as one huge subsidy to fiscally irresponsible countries. Greece, along with other PIIGS, used to be a risky country to loan to, but the single monetary policy allowed such countries to get artificially cheap credit. The result was that the country effectively went bankrupt when interest rates went up during the financial crisis. Since German banks were the major creditors of the Greek government, the whole scheme needed to be bailed out so that the eurozone didn’t fall apart, less than a decade after the euro’s inception.

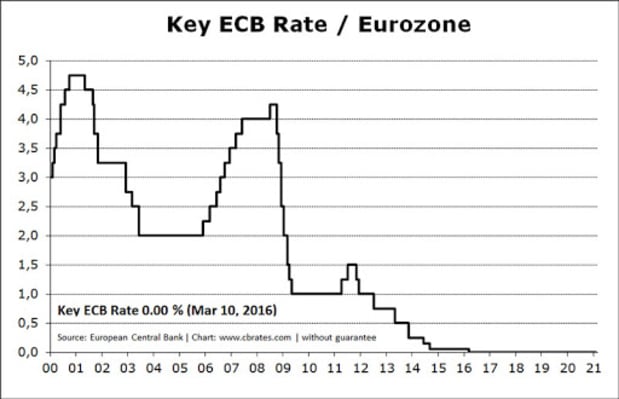

The whole eurozone has been kept on zero-interest life support since then. The perpetually easy-money policy had a disastrous effect on the public finance of the member countries. To initially adopt the euro, candidate countries had to fulfill the Maastricht criteria, one of them being keeping the public debt below 60% of the country’s Gross Domestic Product.

This is how the debt-to-GDP metric looked at the end of 2020:

The euro area consists of nineteen countries. Twelve of these countries would no longer pass the Maastricht debt-to-GDP criteria, and don’t fulfill the “mandatory” Stability and Growth Pact requirements.

But the biggest joke of all is that Greece’s government debt is now priced almost the same as German bonds – meaning it seemingly doesn’t carry more risk than the German bonds, even though the country went practically bankrupt a decade ago and is up to its ears in debt.

This isn’t a criticism of Greece or any other particular country. The politicians in these countries are just following incentives. And the incentives are to YOLO into massive amounts of debt. Why not? The market doesn’t care, as far as we can see on the bond spread chart. It doesn’t care because of the moral hazard effect: Greece went into default before, and it was bailed out. The current monetary policy is even more loose than a decade ago, if anything.

As some had feared when the euro was being introduced, the euro works more like an Italian lira than the German mark. This was inevitable, as the artificial political constructs like the eurozone necessarily have to cater to the weakest members, lest it fall apart fast.

The euro thus creates zombie countries and zombie economies, where all that matters is the free credit to keep the show running. But all debts need to be settled in the end, one way or another – either via cascading bankruptcies, or through total dilution of existing euro holders (aka hyperinflation).

It seems that it’s the euro that has a sustainability problem.

And the powers that be seem to be aware of this. When the conventional tools of monetary policy like the interest rates are depleted, central bankers need to get creative. With current fiat money, negative interest rates or helicopter money are unfathomable. That’s why the Orwellian digital euro is being actively developed by the European Central Bank.

The digital euro of course doesn’t change the monetary policy trend whatsoever. In Bitcoiner lingo, it would rightly be called a shitcoin: centralized and unpredictable monetary policy with an unlimited cap, based on proof-of-authority, premined, permissioned and perpetually surveilled. It may prolong the life of the Frankenstein’s monster that is the euro by a few years, but such abomination won’t survive for long nevertheless. And hopefully the whole premise of a fiat monetary regime will die with it.

[T]he energy needs of the [digital euro] infrastructure would be negligible compared with the energy consumption and environmental footprint of crypto-assets, such as bitcoin.–ECB

And that’s precisely the problem: fiat money can be created from thin air. The energy needs may be negligible, but so is the long-term value.

No Competition In The Fiat Land

If the environmental concerns were honest, bitcoin mining would be warmly welcomed in Europe, as bitcoin mining makes possible the economic use of otherwise wasted energy sources, and has the potential to stabilize the grid by utilizing the occasional over-generation of renewables. As has been argued many times over.

The real intention here is more prosaic: protecting one’s own turf. The money monopoly is sacred for the state and needs to be protected, especially when it cannot stand on its own merits. Already the central bankers are losing the battle of ideas – just check the comments on any recent International Money Fund, Bank of International Settlements, Federal Reserve, or European Central Bank tweet; you will be hard-pressed to find a single positive reply. Attempts at tarnishing Bitcoin’s reputation via false environmental concerns may work as a distraction for a while, but they won’t solve the euro’s underlying problems.

Europeans will witness an increasingly stark contrast in the coming years: ever more desperate attempts to salvage the monetary union and ever more reliable monetary policy of Bitcoin. The smear campaign will continue and probably will be much more hostile than today. Hopefully the public will be able to tell fact from fiction and adopt sound money by themselves, in spite of the official narrative.

This is a guest post by Josef Tětek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD