Everyone I know is making a fortune either holding or trading Bitcoin. In all reality, buying Bitcoin and holding it throughout the long term offers the potential for huge profits without having to stare at order books all day long.

However, the potential to double or triple holdings is often just a mere trade away, especially when trading on margin. This is why so many people are giving up their day job to trade Bitcoin and altcoins full time. Trading cryptocurrencies is the digital version of the 1849 Gold Rush where computers and trading software have replaced shovels and sluice boxes.

Anyone who is new to buying Bitcoin and trading Bitcoin on the exchanges may find it to be a bit daunting at first. However, trading Bitcoin and other cryptocurrencies isn’t all that complicated after breaking through the learning curve. So let’s take a look at the basics of trading cryptocurrencies and then examine the advantages and disadvantages to trading on margin.

How To Trade On Exchanges

Table of Contents

On any exchange, the process is relatively the same (with the exception of Shapeshift which simplifies trading immensely), as there will be an order book with both buy and sell orders.

Buying A Sell Order

The simplest strategy involves purchasing a cryptocurrency at the sell price, meaning that another trader has placed their order in the book and is willing to sell at this price. While the price for such a trade will be slightly elevated compared to the buy side, the order will execute nearly immediately.

Simply enter how many shares you would like to buy, look at the order total, click buy, and confirm the order. That’s it, you now hold this coin.

Place A Buy Order

Traders who are looking to purchase a coin at a more competitive price generally place a buy order and wait for someone to sell into them. This is often the strategy that most professional traders employ, as patience allows them to secure cryptocurrency for a lower price.

However, securing a coin in this fashion clearly isn’t a certainty, as buy orders may never end up filling, especially if they are far down the order book.

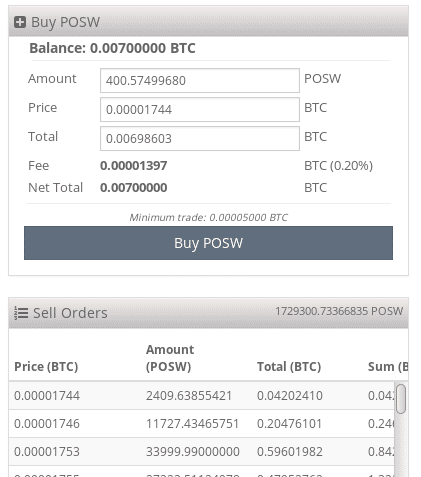

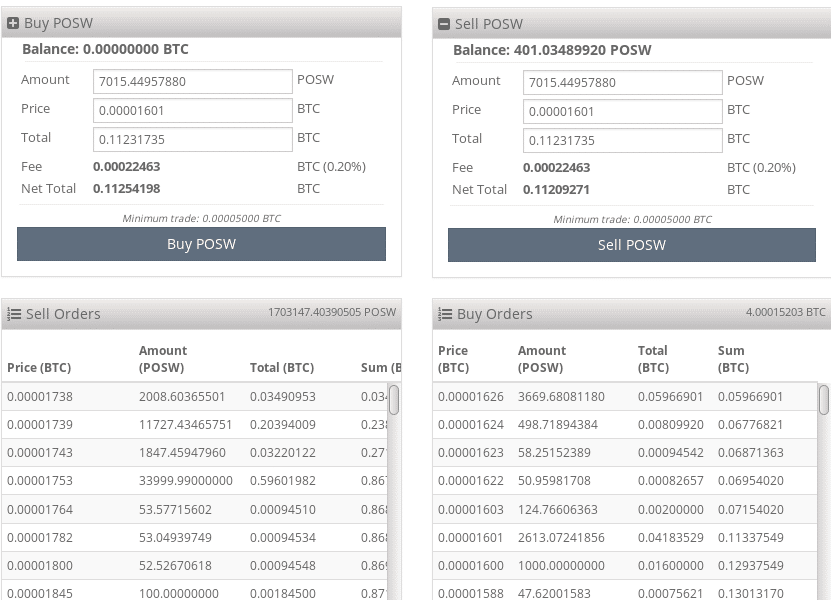

In the example below, I am looking to buy PoSW for 0.00001601 instead of buying it immediately for 0.00001744. After entering the amount I want to purchase, I click “Buy” and a buy order for that price is shown. Now I wait for a trader to fill my order at this price.

What Is The Spread?

The numerical difference between the top buy order and the top sell order is called the spread. Market makers, as they are called, place both buy orders and sell orders, in order to increase market liquidity, ideally, making a small profit on the difference between the spread.

Trading Volatile Markets Like Cryptocurrency

The biggest reason why so many people are attracted to trading cryptocurrency is due to its volatility, meaning that prices swing dramatically up and down, sometimes in a matter of seconds. This roller coaster ride allows traders the greatest potential to earn a profit, if they can capitalize on these huge price fluctuations.

In order to be successful trading Bitcoin and other cryptocurrencies, beginners must avoid becoming emotional whether their portfolio is way up or sitting in the red. Traders who use fundamental analysis and technical analysis, while understanding reward to risk ratio have the potential to make logical decisions, rather than emotional ones. This is what separates professional traders who earn consistent profits from beginners who often lose money.

Where Should I Trade Bitcoin?

Over the last couple of years, there have been a number of Bitcoin exchanges that either went belly up, were hacked, or faced some sort of regulation issues. Truthfully, no centralized Bitcoin exchange is a safe place to hold funds.

This is why the push for a reputable decentralized cryptocurrency exchange is the topic of discussion these days. However, at this point, most traders still stick with a few of the top volume Bitcoin exchanges, as they offer the greatest liquidity and ease-of-use. It should be noted that traders should stay away from Chinese based exchanges, as they are in the process of being closed down by the Chinese government.

At the current time, the number one Bitcoin exchange in the world in terms of volume is Bitfinex, with hundreds of millions of dollars in trade everyday. Many traders also prefer Bitstamp which also has over $100 million in exchange on most days. Others use GDAX, the exchange offered by Coinbase, while others use any number of smaller exchanges available. Most of the big exchanges mainly focus on trading BTC for USD and EUR, and in some cases, LTC, ETH, and DASH.

Individuals who want to trade Bitcoin for other cryptocurrencies generally choose an exchange like Poloniex or Kraken.

How Do I Begin Trading Bitcoin And Other Cryptocurrencies?

First, purchase Bitcoin and move it to the exchange of choice. As soon as Bitcoin appears in the exchange’s BTC wallet, it can be traded, often for US dollars, a number of other fiat currencies, and on some exchanges, a wide range of different altcoins.

It is not advised to keep Bitcoin or other cryptocurrencies on an exchange for a long period of time, yet day traders won’t have any other choice. Just realize that this is just one of the many risks of trading cryptocurrencies.

Let’s Up The Ante With Margin Trading

One extremely profitable, yet risky trading strategy is margin trading. This simply means that traders borrow capital at a relatively high interest rate to increase their leverage. If things go right, huge gains can be expected. On the other hand, the wrong move could end up breaking traders, as they are battling high interest rates, margin calls, and order liquidation, meaning that the position is closed at a total loss.

There are exchanges that offers 1:1 leverage, meaning that traders can borrow 100% of their holdings. For instance, a trader with a balance of 1 BTC will effectively be able to trade 2 BTC, increasing profit potential. Other exchanges offer 2.5:1, 3.3:1, 20:1, and even 100:1 margins. With 100:1 margin trading, I find myself either up 500% in minutes or liquidated in the blink of an eye. It’s more like playing the slot machines at the casino so I don’t necessarily recommend it.

How To Margin Trade

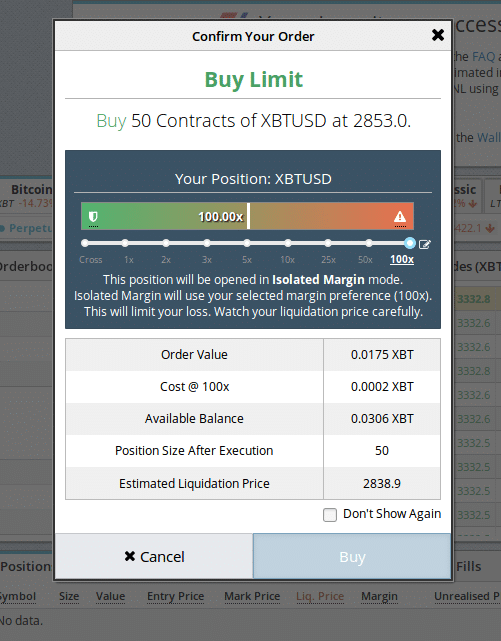

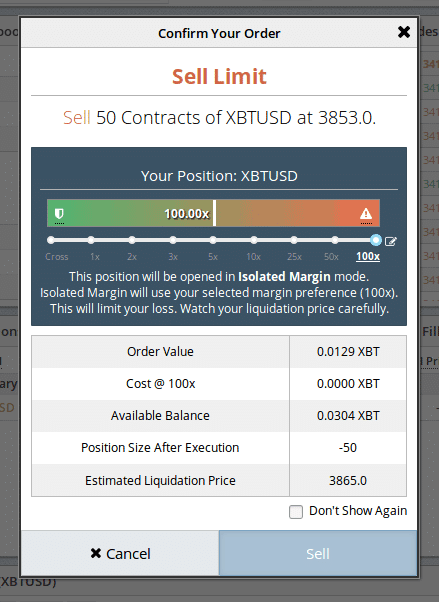

There are two options when margin trading, entering a long position (buying and betting that the price is going up) or entering a short position, (betting that the price is going down).

Below is an example of placing an order to enter a long position.

Below is an example of placing an order to enter a short position.

For traders who are fairly certain the price is moving in a particular direction can use margin trading to capitalize to the fullest on correct decisions.

What Are The Benefits Of Margin Trading?

When things go right, it is obvious that traders have the potential to earn a significant sum of money by leveraging capital through margin trading. Traders who understand risk management should be able to avoid losing their entire bank roll in a few trades and have the potential to earn way more money by leveraging capital than they could by using their personal funds only.

What Are The Drawbacks To Margin Trading

Realize that margin trading doesn’t come cheap, as borrowed funds are subject to high interest rates. These charges are automatically withdrawn the moment a position is closed out. In addition, trades that don’t go as planned often end up liquidated, resulting in a total loss.

Margin Calls

If a margin trade goes in the wrong direction, individuals will be required to add funds to their account (margin call) in order to avoid order liquidation. If a trader is unable to provide further funds to secure their order, it will be closed out automatically.

Bitfinex, CEX.IO, Whaleclub, GDAX, and Bitmex all offer margin trading, while Bitstamp is offering margin trading soon, yet is still in the closed BETA phase.

Margin Trading On Bitfinex

Bitfinex offers 3.3:1 margin trading. Simply put, traders can borrow $7 for every $3 they have in their account. Since Bitfinex is the biggest Bitcoin exchange in the world by volume, traders should start there.

Margin Trading On CEX.IO

CEX.IO offers 3:1 margin trading and is one of the most popular options for traders, yet their verification process is demanding.

Margin Trading On Whaleclub

Whaleclub offers 50:1 leverage on cryptocurrencies and 200:1 leverage on Forex pairs. This is a great place to be for traders who want to max out their magin trades.

Margin Trading On GDAX

GDAX offers 3:1 margin trading. They have a number of hoops to jump through before being able to margin trade and this platform is geared more to institutionalized investors who have a net worth of more than $1 million.

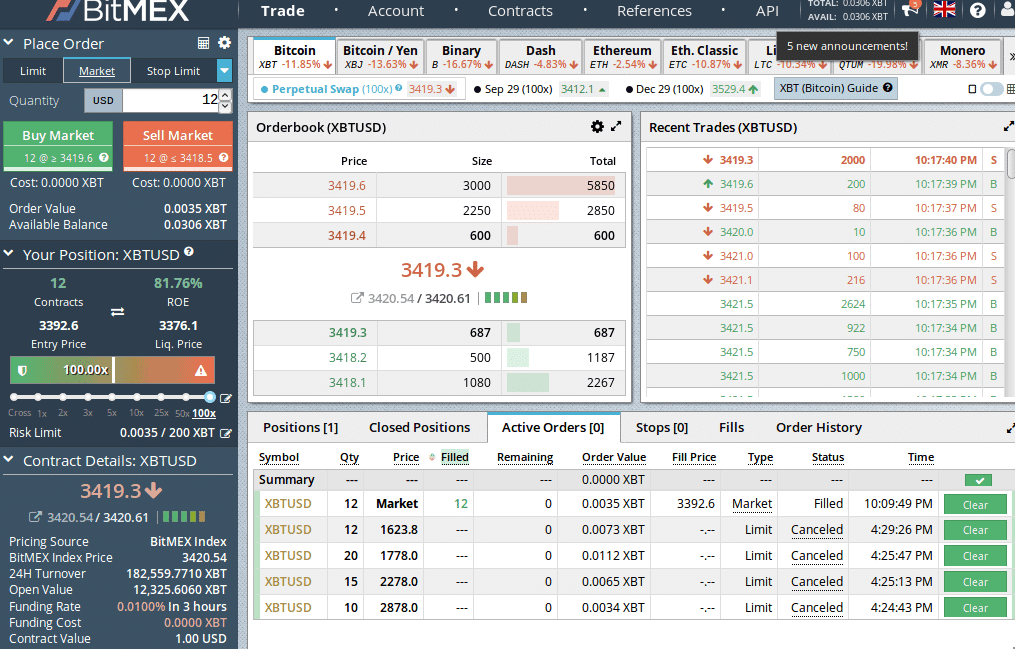

Bitmex Offers 100:1 Margin Trading

Investors who want to throw all caution to the wind and attempt to maximize their profits may want to margin trade at 100:1 leverage on Bitmex. When things go right, it’s like a rocket ship launching to the moon, yet one small move in the opposite direction will entirely liquidate that order. As a word of caution, start by trading small amounts.

Maximize Profit And Reduce Risk

A bit of risk management is required to make sure that traders are getting the most out of their leveraged funds. Beginners should start out trading small amounts at a margin of no more than 2:1. Ideally, never use 100% of funds in any one transaction. For instance, placing $1,000 into an account, yet using only $100 of personal capital with 2X leverage per transaction would still leave a trader with $900, if their margin trade doesn’t work out.

Make Margin Trading A Profitable Strategy

At the end of the day, traders have to decide how aggressive they want to be with their trading strategy. However, with margin trading, investors have the potential to earn significantly larger profits than they would with just their liquid capital alone. Investors who are able to properly manage their margin trades have the potential to profit substantially from the winners, while writing off their losers.

Is margin trading for you? The only way to really know is to give it a try, starting small, and get a feel for how the market moves.

Eric Wolff

Latest posts by Eric Wolff (see all)

- Bitcoin Margin Trading Options for Beginners – September 24, 2017

- The Billion Coin (TBC) Review – How a Scam Goes Bust – September 20, 2017

- Coinomi Wallet Review – A Mobile Wallet for Multiple Cryptocurrencies – August 27, 2017

https://99bitcoins.com/bitcoin-margin-trading-options-for-beginners/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD