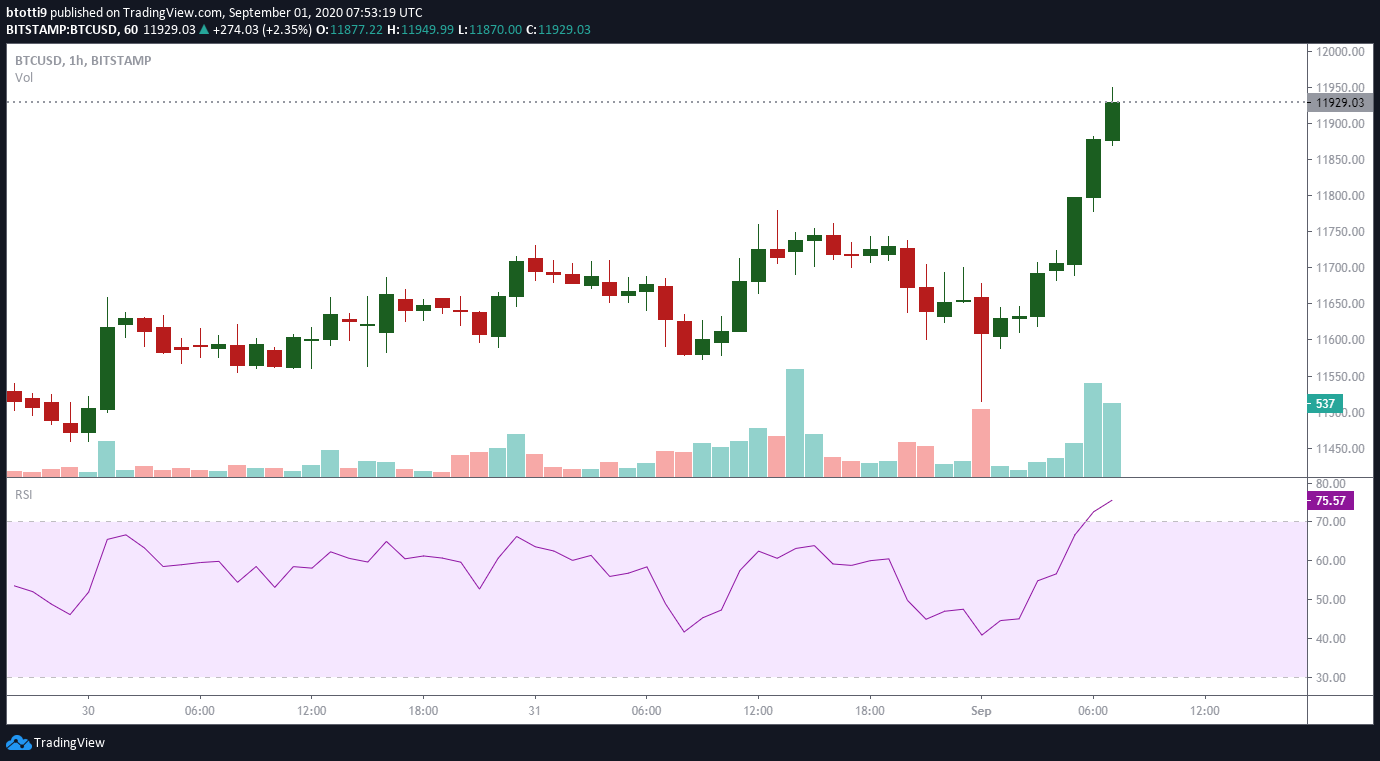

BTC/USD monthly close of $11,655 is second-highest in history, and bulls have pushed to $11,920 during the Asian session

Bitcoin traded above the $11,000 mark for most of August, breaching $12k before a close at $11,655 on August 31.

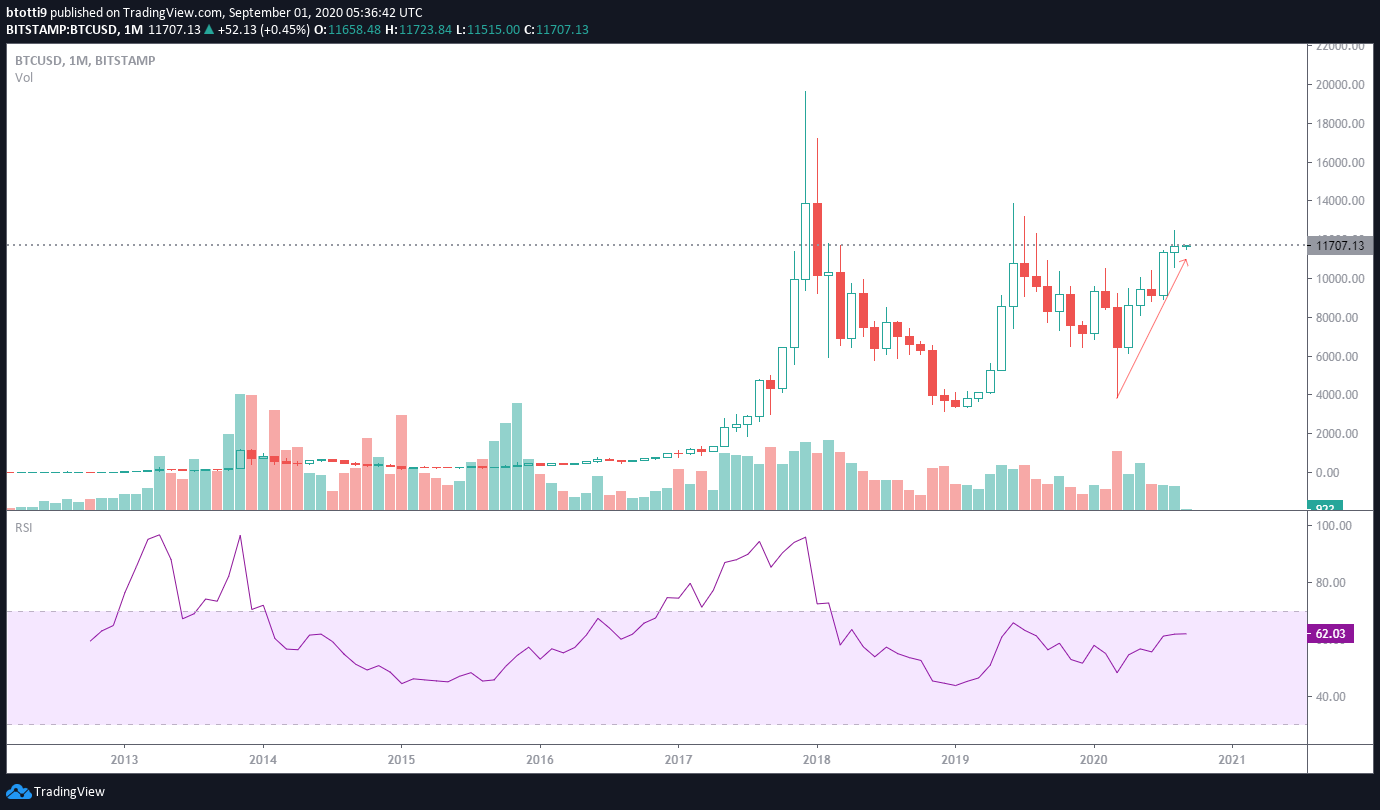

Despite the setbacks suffered around the $12,000-$12,500 range, the monthly candle is its second-highest close since December 2017.

On a week-on-week basis, Bitcoin edged slightly lower than the previous close as bears stood ground around $11.8k. After opening around $11,680, prices remained largely unchanged as movement was capped by a $600 range: BTC/USD fell to lows of $11,200 and failed to breach resistance at $11,800.

Bitcoin’s dominance also dropped to lows of 57.2% as the altcoin market rallied, led by some spectacular moves within the DeFi space.

What next for Bitcoin price?

Just before the monthly close, cryptocurrency trader and technical analyst Josh Rager tweeted this:

“Monthly close soon – and the chart looks good as support held and next target on monthly is $13,880+. The high time frames say bullish.”

The last time Bitcoin price on a monthly close was this high was on December 31, 2017. Unlike then, however, Bitcoin is much in a bullish cycle and a 20% rally in 30 days is all possible.

Notably, the crypto king has printed higher monthly candles in five of the past six months- except for bJune when closing at $9,13×2.

Fundamental trends likely to support Bitcoin’s move towards the $14k resistance area include increased network activity and rising inflation.

The number of active addresses has increased over the last few weeks, with over 1 million daily active addresses recorded only for the second time since January 2018.

Miners have also become increasingly bullish about Bitcoin as hash rate and mining difficulty surged to new all-time highs. Additionally, BTC/USD is likely to benefit from the likelihood that the Federal Reserve is poised to print more money as the economy continues to flounder following COVID-19.

On the technical front, BTC/USD bulls need to confront the bears around $11,800-$12,500. Currently, bulls have an upper hand with price ticking above $11,900.

Sustaining the upside will likely extend gains to $12,500, with the level to watch at $13k. On the downside, strong support is at $11k and $10,500.

https://coinjournal.net/news/next-target-for-btc-usd-is-13880-after-highest-monthly-close-since-2017/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD