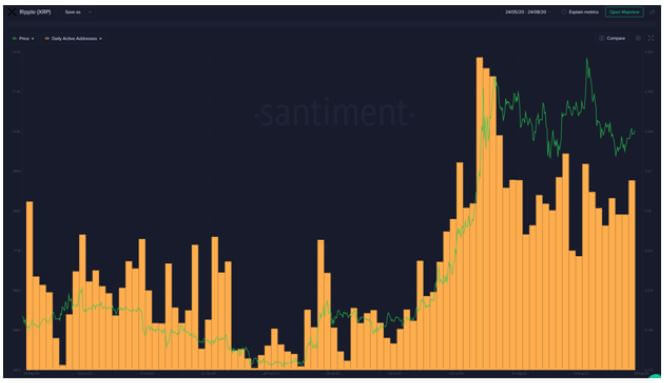

XRP daily active addresses have hit 9,499, even as XRP/USD corrected by roughly 9.2% last week.

According to the on-chain data platform Santiment, Ripple’s daily active addresses (DAA) output has surged despite the price decline seen over the past week.

XRP’s daily active addresses rose to 9,499 on August 24, a 7-day high recorded despite the price decline. Although a long way off its record 70,944 active wallets in February, the increase suggests a bullish divergence.

XRP/USD fell 9.2% this past week

Despite rallying to a high of $0.326 on August 17th, XRP prices fell 9.2% over the past week to drop to lows of $0.288.

The decline erased some of the gains made since bulls recorded eight successive green candles on the daily chart to push prices from $0.22 to highs of $0.32.

Like Bitcoin and Ethereum, XRP has lagged the majority of the altcoin market and looks likely to consolidate further in the short term.

However, the technical picture suggests XRP/USD could see a major uptick in value if bulls hold the current support area.

The altcoin will confirm an upside breakout if it prints a daily close above the upper boundary of the Bollinger bands at $0.311.

A break above this major resistance level could spur increased buying, which is likely to lead to bulls attempting to crack $0.33. Above this area is the major hurdle at $0.35, a resistance highlighted by the 127.2% Fibonacci retracement level.

Trading between the midline and the lower curve suggests a likelihood of a downwards breakout if there is selling pressure. To prevent this from happening, XRP/USD bulls need to hold $0.28. This is an area that recently provided a major resistance zone. Turning it into a support area could provide the base for an upside.

A break below the $0.28 support level or the lower boundary of the BB could provide a basis for more downside action.

In such a scenario, XRP/USD could drop to $0.24 and $0.22, two support areas marked by the 0.618 and 0.5 Fibonacci retracement levels respectively. The 200-day simple moving average also provides support at $0.21.

XRP/USD has declined 1.54% in the past 24 hours and currently trades around $0.283. The majority of the crypto market is also seeing unconvincing moves, with Bitcoin down 1.3% to trade around $11,580 and Ethereum 0.8% lower around $394.

https://coinjournal.net/news/xrps-active-wallets-hit-7-day-high-despite-9-2-retrace/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD