August 25, 2020

By Benson Toti

With $1.45 billion worth of total value locked, Aave has surpassed MakerDAO that has about $1.44 billion in TVL.

The total value locked in decentralized finance protocol Aave has hit $1.45 billion. According to data from DeFi Pulse, Aave’sTVL is now up more than 180% since the start of August.

Per the data, the protocol now has the most crypto deposits in collateral, ahead of MakerDAO that has about $1.44 billion worth of assets deposited in smart contracts. Curve Finance accounts for over $1.10 billion, Compound $798 million and Yearn.finance $794 million.

The total value locked in all the DeFi protocols is currently about $6.91 billion at the time of writing this. Aave’s dominance is about 20.9% according to DeFi Pulse, with the value up more than 3.8% in the past 24 hours.

The DeFi space has had four different projects hit the billion-dollar mark in total value locked over the past few months.

Apart from MakerDAO and Aave, other Ethereum-based projects to hit the milestone were Compound and Curve Finance. The former also saw its token COMP rally more than 300% in days as interest in yield farming skyrocketed.

Aave officially launched its protocol in January 2020 after being in development since November 2017. Initially called ETHLend, the P2P lending platform started with support for 13 digital assets for collateralized lending/borrowing.

Aavenomics is a token redistribution update that will introduce AAVE tokens, which will allow holders to stake as well as vote on governance issues. Users can also benefit from credit delegation, a feature that allows them to earn when authorized investors take up loans with collateral provided by third-party assets.

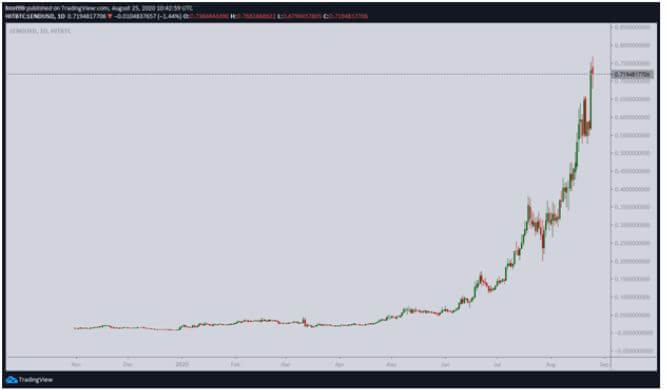

LEND/USD price

As well as in the amounts being locked in contracts, Aave has been on a tear in the market lately. Over the past month, its governance token LEND has outperformed most other DeFi tokens.

LEND/USD traded at about $0.30 at the beginning of the month. However, a rally in the crypto market has so far seen it hit a high of $0.77. The token is more than 25% up over the past week and more than 200% higher over the past month.

The value of LEND/USD has surged more than 1000% since June 1, with the token’s price now nearly 3,900% up year-to-date.

https://coinjournal.net/news/aave-top-of-defi-leaderboard-with-1-45-billion-in-total-value-locked/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD