ETH price against the US dollar jumped to its highest level yet, touching highs of $2,402.

Ether’s price reached a new all-time high of $2,402, achieving the remarkable price level in the shadow of Bitcoin’s rally to $65,000.

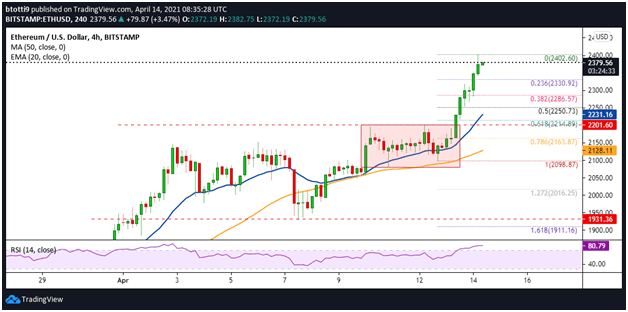

For ETH bulls, the price gains have come on the back of a steady recovery since the crash to $1,942 on 7 April. An upside correction was first capped at $2,197, with ETH/USD range bound between $2,080 and $2,200.

Fresh gains over the past 24 hours had seen ETH pierce multiple resistance points before bears forced the bulls to catch a breather at the new ATH.

As of writing, ETH is trading near $2,379, with bears trying to take control. However, the technical picture suggests bulls have the advantage and could push higher in the short term.

ETH/USD analysis

Ether is currently trading above the 20-day exponential moving average and the 50-day simple moving average. The curves of the moving averages are sloping upwards to suggest further gains are likely.

The ETH/USD pair is trading with a bullish bias as prices stay above an uptrend line formed since the breakout above $2,200. The RSI on the 4-hour chart is within overbought territory, but not overextended.

Although profit-booking could contribute to short-term dips, ETH could break higher still if bulls hold on above $2,250. In that case, prices could rise to $2,500, with buy-side pressure likely to catapult it towards the new medium-term target of $3,000.

On the downside, the Fibonacci retracement level at $2,330 would be the first line of defence for the bulls. A robust anchor is at the 50% Fib level, currently located at $2,250.

If bulls rebound off this level, they could resume the uptrend and aim for the aforementioned price levels.

On the contrary, further declines would plunge ETH/USD towards the 20-day EMA ($2,231) and the horizontal cushion near the 78.6% Fib level at $2,168. The 50 SMA on the 4-hour chart suggests the $2,128 price level will act as a major support zone.

https://coinjournal.net/news/ethereum-price-hits-new-ath-of-2402-whats-next-for-eth/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD