Bitcoin continues drawing the interest of many, including millionaires who are heavily investing in the asset

The epic Bitcoin rally at the end of last year caught the attention of many people. The subsequent run towards a new ATH at the beginning of the year brought with it new investors who have since injected a lot of funds into the market. Finbold’s data shows that several investors have continued directing their funds into the asset even as it goes through a market correction.

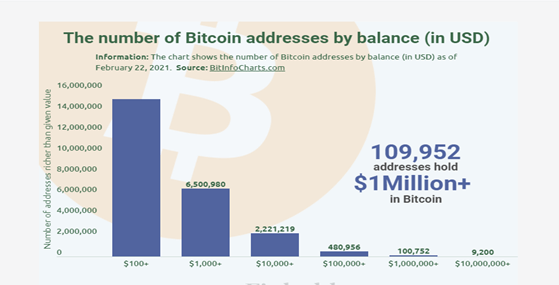

The data revealed there were 109,952 Bitcoin addresses with more than $1 million as of yesterday. Of these, only 9,200 addresses hold more than $10 million, with the rest having a balance in the region of $1 to $9 million. A total of 480,956 addresses have a balance of around $100,000. Bitcoin addresses worth around $10,000 sum up to 2.2 million.

A further 6.5 million wallets hold Bitcoin worth $1,000 to $9,000. A staggering 15.08 million addresses representing balances of around $100 make up the largest group of Bitcoin holders.

It is impossible to narrow down the specific owners of the address having a value of more than $1 million or any other group for that matter. Even so, it can be safely assumed the bulk of this category is comprised of institutional investors and early adopters. This is because it is easier for institutional investors to come up with the capital required to fund such balances than retail investors.

Similarly, it can be concluded that retail investors own the majority of the addresses with lower balances. Several reasons have driven individual investors towards Bitcoin, with the most common ones being portfolio diversification, the need to experiment, and fear of missing out on the crypto asset.

There are varying opinions on the matter of individual investors having massive Bitcoin balances. Many have argued along the lines of wealth concentration when such holders decide to leave the assets unmoved for long periods. Industry experts have observed a surge in volatility when these large BTC holders move a significant sum of Bitcoin in one transaction.

Still and all, the Bitcoin price shift is being influenced mostly by institutional investors as opposed to individual investors. The latest rally that saw Bitcoin set a record high above $58,000, for instance, was sparked by Tesla’s entry into the sector.

https://coinjournal.net/news/there-are-now-over-100000-bitcoin-whale-addresses/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD