September 11, 2020

By Benson Toti

Yearn.finance leads DeFi tokens with a 22% price surge as Coinbase Pro adds support.

Tokens in the decentralized finance (DeFi) space declined an average of 50% between their highs and lows beginning September 1st to September 10th. Total value locked also fell from around $9 billion to $6.6 billion.

Although most of the tokens registered significant rebounds in between, a slowdown in the market means the average drawdown remains 30%, as of writing.

Yearn.finance, Aave, Maker saw the least drawdown and are trading near prices seen at the start of the month. On the other end of the spectrum is SUSHI token, which tanked massively at the end of last week. Despite a 105% rally since its price against the US dollar is 64% of its September peak.

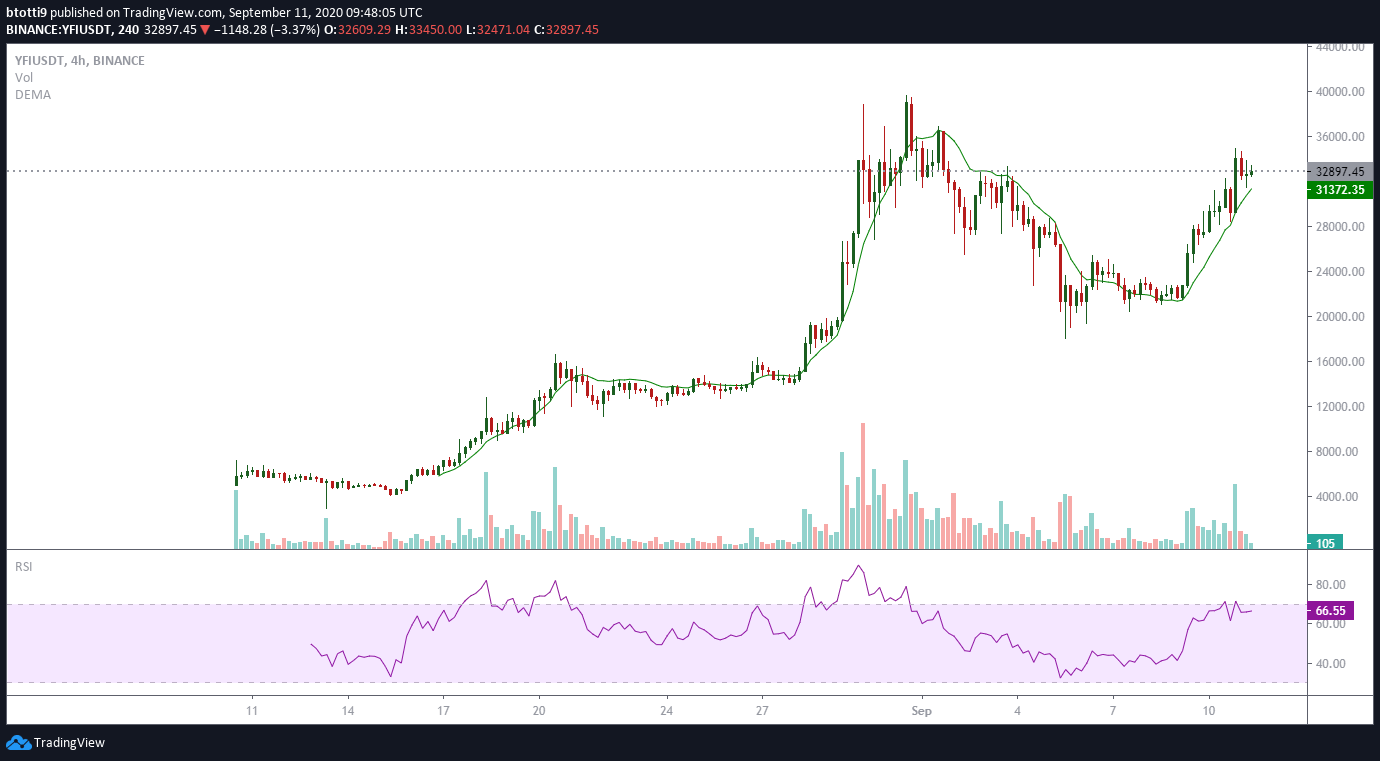

Yearn.finance (YFI)

YFI/USD price dropped from highs of $34, 315 to lows of $18, 250 before an impressive 83% surge since the low saw it trade around $33,000 on September 10.

As of writing, the governance token is trading 22% higher on the day at $33,270. The token is set to trade on Coinbase Pro starting next week, a likely scenario that could push it higher.

The protocol has also launched StableCredit, a new offering that allows for decentralized lending and stablecoins. The popular yield farming token has a market cap of $998 million as of writing and an intraday trading volume of $704 million as per data from CoinMarketCap.

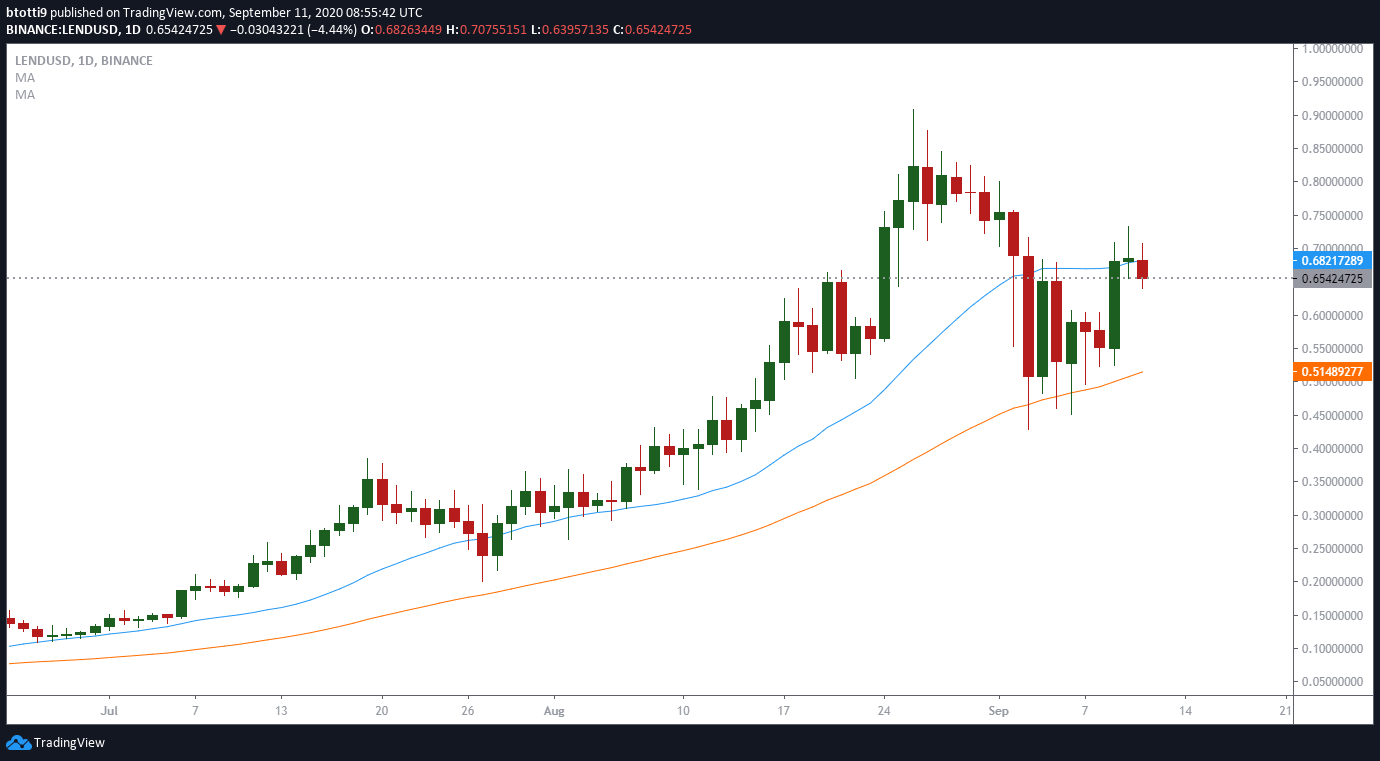

Aave (LEND)

Aave traded at a low of $0.45 after a 40% drawdown in the first week of September. The trading price of LEND/USD has since recovered by 54% and is now just 8% from early September highs of $0.75. LEND/USD has dipped below the SMA 20 ($0.68) and could drop to lows of $0.60. If that happens, the SMA 50 provides healthy support at $0.511.

Aave is the top DeFi protocol with $1.4 billion in total value locked, ahead of Curve, and yearn.finance. The token changes hands at around $0.65 as of writing.

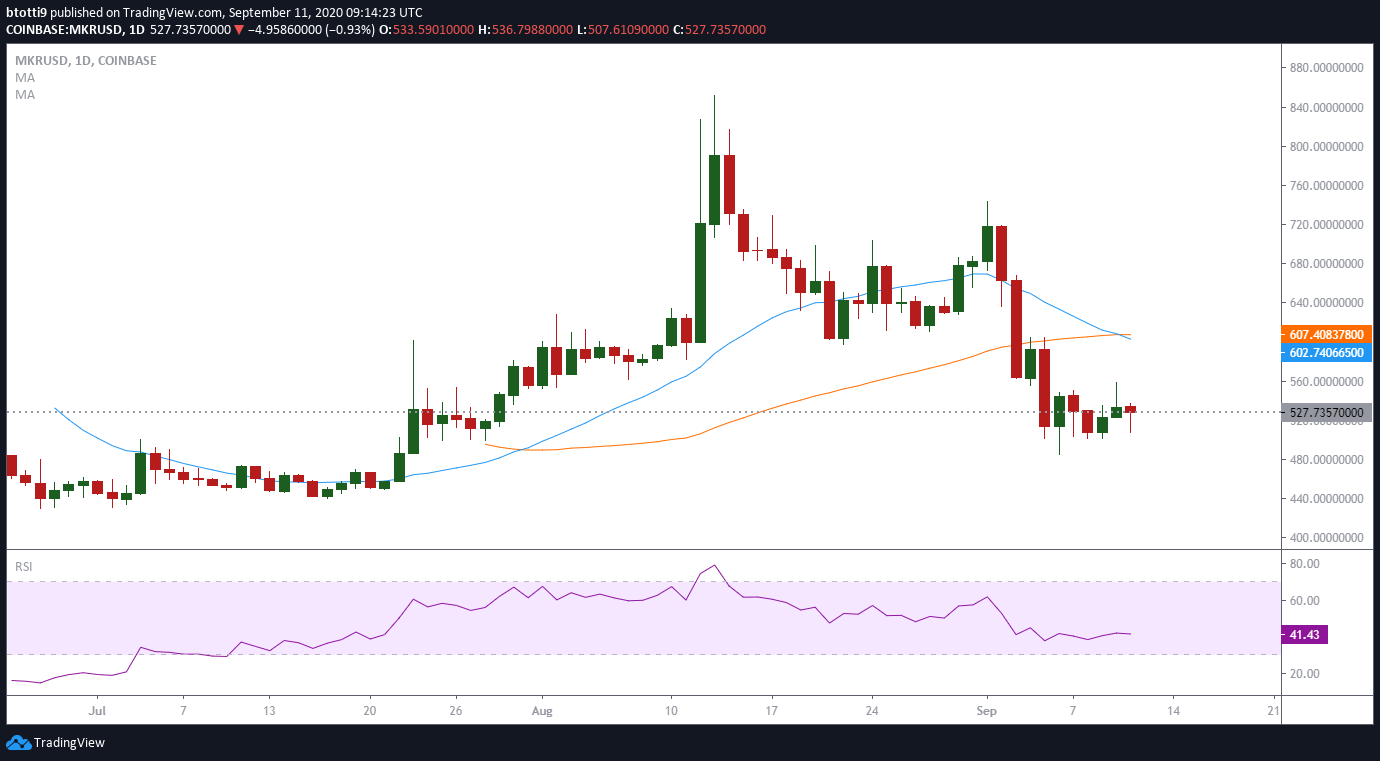

Maker (MKR)

MKR/USD price dropped 30% from a high of $743 to lows of $481 this past week. Although the Ethereum-based token rebounded 11%, its price is still nearly 22% adrift of September highs. As of writing, the pair is changing hands around $527, but bulls are losing to the bears.

The pair has crossed below the 20-day and 50-day moving averages, with a flatlining RSI pointing to the lack of conviction. If action remains unconvincing on either side, MKR/USD is likely to trade sideways between $590 and a monthly low of $481.

According to Santiment, the top Maker whale (with non-exchange holdings) transferred a massive 39% of their MKR tokens to Aave. The whale address reduced the tokens from 248.6k to around 151.1k, a likely indicator of impending volatility.

https://coinjournal.net/news/defi-price-update-yearn-finance-yfi-maker-mkr-aave-lend/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD