The Bitcoin network is currently at its strongest, with the hash rate hitting a new all-time high 63 days after the May supply squeeze

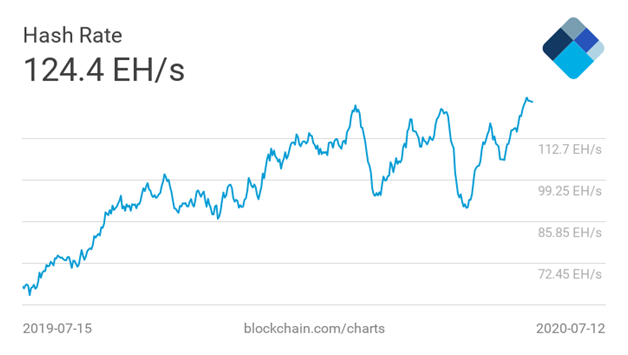

Total computing power on the Bitcoin network has hit a new all-time high: clocking 125 EH/s for the first time since the mining rewards were cut by half in May.

The hash rate value, whose seven-day moving average now stands at 124.4 EH/s, beats the 123.8 EH/s high recorded in the days leading up to the last halving.

With the added hash rate, the largest cryptocurrency by market cap is arguably at its strongest and healthiest.

Fundamentally, miners have switched on their mining rigs at a time when the network’s mining difficulty has been projected to adjust upwards by more than 9.5%, from 15.78 T to 17.29 T.

No miner capitulation yet

Bitcoin’s hash rate hitting new highs renders the theory that the network faced an imminent ‘death spiral’ irrelevant for now. The theory postulates that Bitcoin miners are likely to dump their machines or move on to other networks after the latest rewards cut also cut miner revenue.

More pointedly, Bitcoin’s hash rate tanked in the days after the halving as Bitcoin Cash and Bitcoin SV had their computing power spike to new highs.

Although the price of Bitcoin has stagnated below long term resistance at $10k, it appears FUD about miner capitulation is out of the question — for now at least.

The entry of new and more efficient mining devices, like Bitmain’s S19 and S19 Pro, means miners are contributing more computing power to the network.

Bitcoin’s bulls will be noting the historical significance of current network strength. In the past, specifically after the 2012 and 2016 halvenings, prices surged to local highs in the second half of the year after each event.

Bitcoin price stagnates below $9,400

Bitcoin’s price has stalled around $9,300, with the inactivity likely to continue for a while as volatility lingers close to its lowest since the last bull market.

Notably, however, the cryptocurrency market usually follows such an extended phase of consolidation with a surprise move.

In the short term, BTC/USD is likely to linger between $9,300 and $9,400, with the price hitting the lower boundary of a declining triangle if sellers have their way. The area around $9,000 to $8,600 is a key support zone for buyers, with any spikes in the short-term likely to be quelled at around $9,400.

https://coinjournal.net/news/bitcoins-network-strength-peaks-as-hash-rate-surges-to-new-all-time-high/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD