- DAI stablecoin holders are adding to positions as crypto prices range.

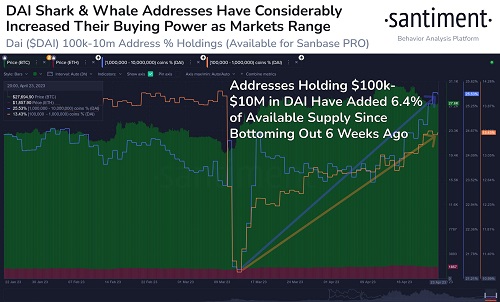

- Addresses with 100k-10 million DAI added 6.4% of supply in the past six weeks.

- The overall holdings for this cohort had dropped significantly as Bitcoin and Ethereum prices pumped in mid-March, Santiment data shows.

On-chain data shows large investors, the sharks and whale addresses with $100,000 to $10,000,000 worth of DAI have recently added to their positions. Addresses with 100,000-1 million DAI hold over 13% of supply while those with 1 million- 10 million DAI currently hold over 25% of supply.

Whales buy DAI stablecoin as markets range

As the crypto markets see fresh volatility, market data provider Santiment has highlighted that after the rotation that followed Bitcoin and Ethereum prices pumping in mid-March, sharks and whales have added 6.4% of DAI.

“Even with crypto markets rollercoastering in April, top stablecoins like $DAI are being accumulated by sharks & whales. Since $DAI was exchanged for pumping $BTC & $ETH in mid-March, $100k-$10m DAI addresses have added 6.4% of the supply back since,” Santiment noted.

As of 23 April 2023, addresses with $100k- $1 million in DAI held 13.43% of the stablecoin’s supply, while addresses with $1 million-$10 million of DAI held about 25.53% of current supply. These cohorts have increased their buying power since their holdings bottomed out around mid-March, on-chain data showed.

The chart below that Santiment shared on Twitter indicates the above scenario.

What is Dai (DAI)?

DAI is the native stablecoin for major lending protocol Maker, whose governance token MKR currently trades around $688. Dai is the first decentralised, crypto-collateralised stablecoin, with its value pegged 1:1 to the US Dollar.

One of the benefits of Dai is with its use in mitigating price volatility in a crypto market where digital asset prices can swing wildly at any given time. The token is also highly composable with dApps, including DeFi industry’s leading projects Uniswap and Compound.

What does whales’ buying of DAI mean for crypto prices?

Typically, large whale transactions involving stablecoins has preceded major accumulation of crypto tokens such as Bitcoin and Ethereum. This is so because buying of stablecoins such as DAI, Tether and USD Coin have usually indicated whales positioning of money in readiness for buying.

BTC and ETH prices have recently retreated from highs above $31k and $2.1k respectively as those who bought at the top seemingly sell.

Share this article

Categories

Tags

https://coinjournal.net/news/dai-whales-have-added-6-4-of-stablecoins-supply-since-mid-march/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD