Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

A lesser-known but historically reliable bitcoin price indicator has flipped positive, signaling the onset of a major bull market.

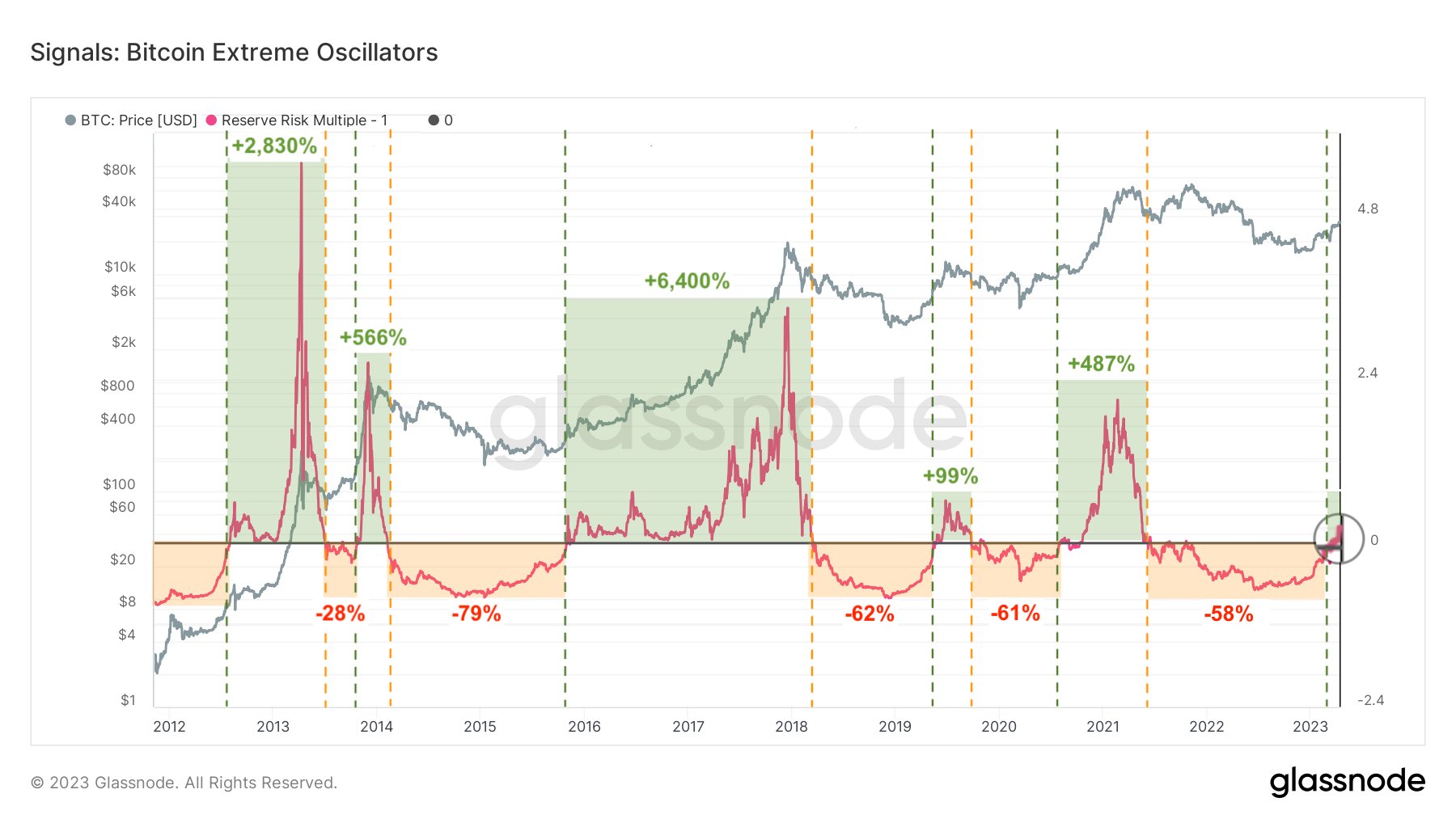

Bitcoin’s reserve risk multiple has crossed above zero, turning positive for the first time since October 2021, according to blockchain analytics firm Glassnode.

The previous crossovers above zero paved the way for parabolic price rallies. “In 2012, 2013, 2015, 2019, and 2020, it resulted in gains of 2,830%, 566%, 6,400%, 99%, and 487%, respectively,” on-chain analyst Ali Matrinez tweeted Monday.

Glassnode defines reserve risk as a long-term cyclical indicator, comparing the incentive to sell at the going market price to long-term holders resisting the temptation to liquidate. A lower reading indicates strong conviction among HODLers – slang for long-term crypto investors – and vice versa.

The reserve risk multiple is calculated by dividing the daily indicator value by its 365-day moving average.

Previous crossovers above zero paved the way for sharp price rallies. (Glassnode, Ali Martinez) (Glassnode, Ali Martinez)

The reserve risk multiple’s previous crossovers above and below zero accurately predicted major bullish and bearish trends.

If history is a guide, the latest positive crossover means the cryptocurrency’s 80% year-to-date rally to ten-month highs above $30,000 may be only the first milestone in its upward journey.

The bullish implication is consistent with bitcoin’s tendency to chalk up outsized rallies in months leading up to the mining reward halving. This programmed code reduces the pace of the cryptocurrency’s supply expansion by 50% every four years. Bitcoin’s fourth reward halving is due in April next year.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

https://www.coindesk.com/markets/2023/04/18/lesser-known-bitcoin-indicator-flips-positive-after-18-months/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD