Major crypto exchange OKEx said it could not get in touch with one of its private key holders

The price of Bitcoin dropped by nearly 3% during early morning trades on Friday, October 16th, touching lows of $11,200 on most exchanges.

The dip followed a notice from crypto exchange OKEx advising its customers that all crypto withdrawals would stand suspended as of 11:00am (Hong Kong Time) today.

According to the exchange, the move to suspend all withdrawals relates to an ongoing investigation involving one of its private key holders. The concerned party is said to be “currently cooperating with a public security bureau“.

OKEx added in the statement:

“We have been out of touch with the concerned private key holder. As such, the associated authorization could not be completed.”

Apart from withdrawals, other functions on the platform remained operational, with an assurance that all customer funds were secure.

OKEx is one of five major exchanges that hold nearly 10% of Bitcoin’s circulating supply. Crypto users will note that the news of a police investigation at the top platform comes barely two weeks after US authorities filed court cases against derivatives exchange BitMEX.

BTC/USD

As of the OKEx announcement, Bitcoin was trading above $11,500. But the sharp decline sent the BTC/USD pair below the 10-day and 50-day simple moving averages on the hourly charts.

As of writing, the cryptocurrency is struggling to form an upside momentum. Despite touching highs of $11,362 over the past hour, bulls have failed to nail down an upside. BTC/USD is changing hands around $11,221, with the price still below the 10 and 50 SMA.

The RSI is downsloping on the daily chart, to suggest the price might move down further still. If bears push lower in later trading sessions, the 100 SMA provides a major support line of around $10,800. This area is of interest to both bulls and bears, the level at which BTC/USD faced multiple rejections on the uptrend from lows of $10,200.

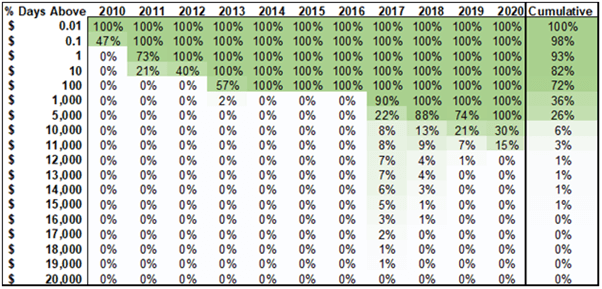

While the price is capped around $11,150 and $11,350, preventing a decline to sub-$10,000 levels is key to bulls. It also means that Bitcoin will extend the number of days spent above $10,000 and the percentage of days above $11,000 since inception.

According to the table below, shared by Andre Martinez of Dalpha Capital, Bitcoin’s price has spent 30% and 15% of days in 2020 above the two price pegs.

https://coinjournal.net/news/bitcoin-drops-3-after-okex-suspends-all-withdrawals/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD