Bitcoin price shot below $9,000, total market cap falls by $15 billion and miners send a year-high record amount of bitcoins to exchanges

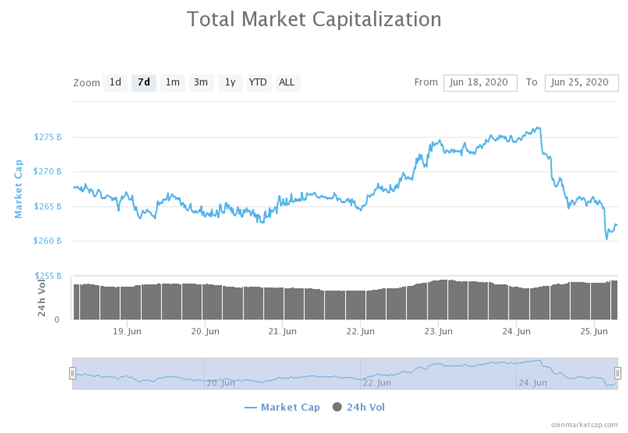

The crypto market is hoping to bounce back from a huge slump in prices that saw the cryptocurrency market capitalisation cut by more than $15 billion.

On Wednesday, Bitcoin’s price sank to intraday lows of $8,989, dipping below the important support region at $9,000.

The plunge means that BTC/USD will continue to struggle to break $10,000 — having already sank twice below $9k twice over the last month.

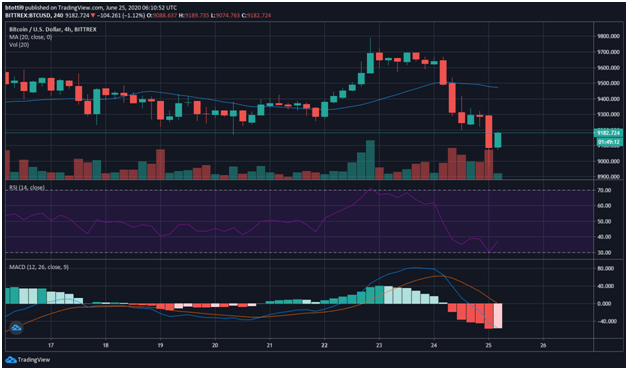

Bitcoin price picture

As of press time, the BTC/USD pair is exchanging hands 4.83% lower than its price in the past 24 hours. The decline has seen its value drop from $9,289 at opening to the current price around $9,120.

Although the bulls are pushing higher, aided by a strong Asian trading session, the overall trend remains bearish, which is likely to pile on more downward pressure in later trading sessions. This is more likely given the shrinking volatility of Bitcoin in recent months.

A look at the 4-hour chart indicates that sellers retain the advantage, so a further attempt to push prices below $9k could materialise. The RSI is pointing up but remains deep within oversold territory, while the MACD is also negative, displaying a possible bearish divergence.

The extent of the sell-off is also illustrated by the jump in reported volume, with the current session seeing $2 billion more worth of trades executed above yesterday’s $7.7 billion. If bulls fail in their attempts to wrestle control from sellers, the bearish scenario may see prices fall to $8,900 again.

If sentiment improves throughout the day, a move for prices in the region of $9,300-$9,400 could be possible.

Bitmex liquidations and miner outflow

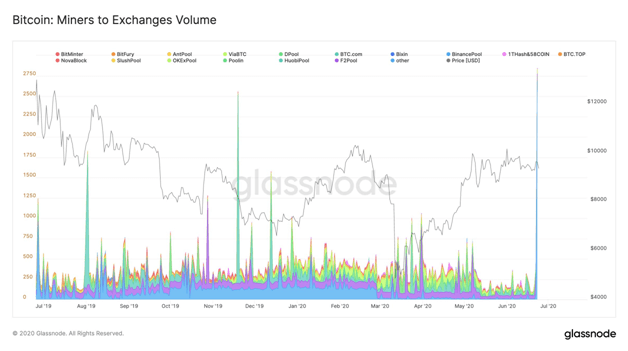

According to the on-chain data platform Glassnode, Bitcoin’s decline to $9,000 levels happened at the same time as “the largest flow of bitcoin from miners to exchanges in over a year.”

According to the data provider, the large outflow occurred primarily from transfers made to cryptocurrency exchange Bitfinex.

As can be seen on the chart below, the last time miners sent this much Bitcoin to exchanges was in November 2019.

https://coinjournal.net/news/bitcoin-price-update-sell-off-sees-15bn-lost-from-market-cap/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD