This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

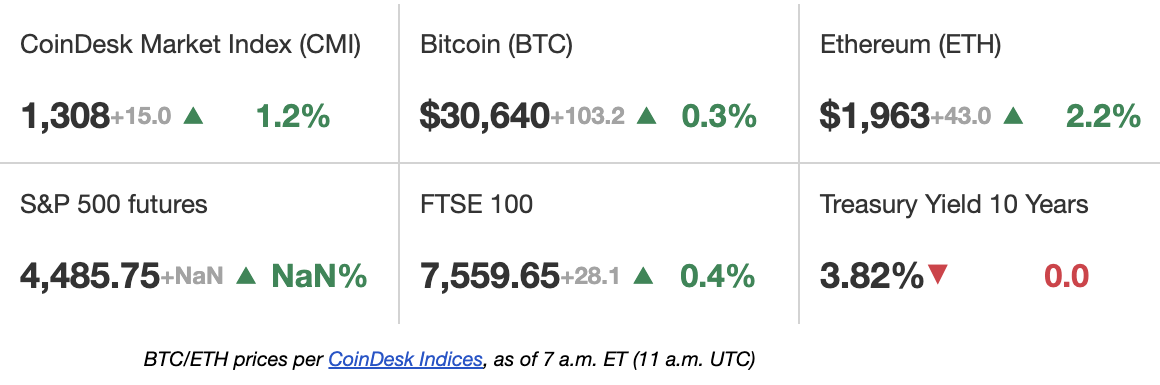

Latest Prices

Top Stories

Ether, the token of the Ethereum blockchain, jumped 61% in the first six months of the year. Traders are now betting the rally could extend in the second half. On Friday, an investor purchased roughly 63,250 “bull call spreads” tied to ether and due for expiry on Dec. 29, according to data source Amberdata. The trade involved the sale of a call option at the $2,500 strike price to partly fund the purchase of a call option at the $1,900 strike. The strategy cost an initial $10 million because the trader entity shelled out more to buy the $1,900 call than they received from selling the $2,500 call. A call buyer gets protection from the seller against price rallies. In return, the seller receives an upfront premium from the buyer.

The U.S. Securities and Exchange Commission’s (SEC) stance on spot bitcoin exchange traded funds (ETF) is a difficult one to hold, and the probability for approval is fairly high, brokerage firm Bernstein said in a research report Monday. Bernstein notes that the SEC already allows futures-based bitcoin ETFs, and recently approved leverage based futures ETFs on the premise that futures pricing comes from a regulated exchange like the CME. According to analysts led by Gautam Chhugani, the SEC believes that a spot bitcoin ETF would not be dependable because the “spot exchanges (e.g. Coinbase) are not under its regulation, and thus spot prices are not reliable and prone to manipulation.”

Crypto service providers in Singapore would need to deposit customer assets into a statutory trust before the end of the year for safekeeping, the Monetary Authority of Singapore (MAS) announced on Monday. The requirement comes after the MAS received public consultation around enhancing customer protection initiated in October 2022. “This will mitigate the risk of loss or misuse of customers’ assets, and facilitate the recovery of customers’ assets in the event of a DPT (Digital Payment Token or Cryptocurrency) service provider’s insolvency,” the central bank said. The MAS has also restricted cryptocurrency service providers from facilitating lending and staking of tokens by their retail customers but institutional and accredited investors could continue to take advantage of these services.

Chart of the Day

-

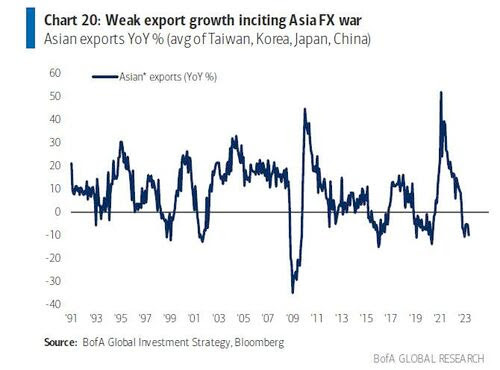

The chart shows the average year-on-year growth rate of four Asian economies – Taiwan, South Korea, Japan and China.

-

The export growth rate has tumbled, signaling a slowdown in the global economy. It also means Asian nations may resort to currency devaluation, boosting demand for perceived inflation hedges like gold and bitcoin.

-

Source: BofA Global Research

Trending Posts

Edited by Sheldon Reback.

https://www.coindesk.com/markets/2023/07/03/first-mover-americas-fidelity-joins-the-rush-for-spot-bitcoin-etf/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD