This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

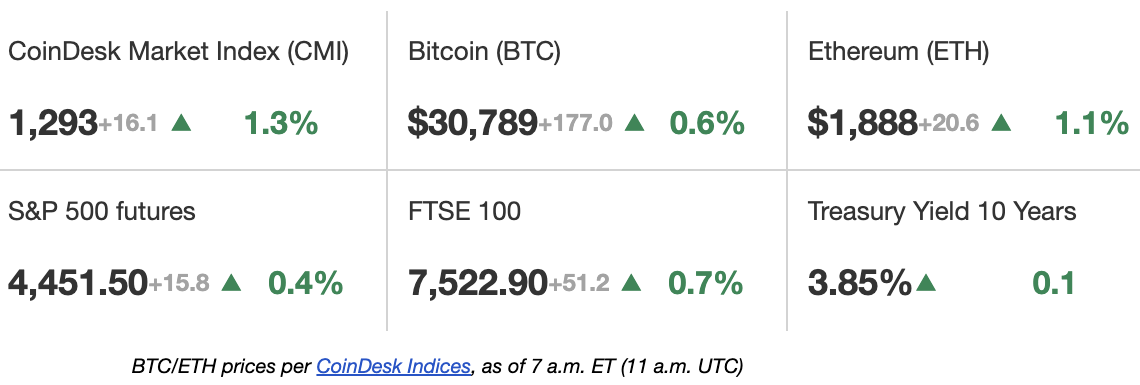

Latest Prices

Top Stories

Asset management giant Fidelity has refiled paperwork for its Wise Origin Bitcoin Trust, a spot bitcoin exchange traded fund (ETF). The move comes roughly two weeks after BlackRock’s (BLK) iShares unit submitted paperwork for the iShares Bitcoin Trust, also a spot bitcoin ETF. Fidelity in 2021 had originally applied to launch the Wise Origin Bitcoin Trust, but that effort was rejected by the U.S. Securities and Exchange Commission (SEC) in 2022. Since the BlackRock spot ETF filing earlier in June, a number of other fund companies have done similar, including Invesco (IVZ) and WisdomTree (WT), and a report earlier this week said a Fidelity filing was imminent. Bitcoin (BTC) didn’t move a lot on the news Thursday afternoon, but an overnight rally took the price briefly above $31,000. It’s since fallen back a bit to $30,800.

Bitcoin cash (BCH) continues to rally at a breakneck speed in the wake of Fidelity, Charles Schwab and Citadel-backed EDX Markets’ decision to debut on June 20, with BCH being one of the only four coins available for trading on the exchange. The cryptocurrency has gained another 30% in the past 24 hours to a 14-month high of $320, taking its cumulative gain since EDX’s debut on June 20 to 183%, CoinDesk data show. The latest price surge is backed by a notable increase in trading activity on South Korea’s most prominent digital assets exchange, Upbit.

Binance, the world’s largest cryptocurrency exchange by market value, said its institutional clients are optimistic on the outlook of crypto for the next year and beyond, according to a survey it conducted between March and May 2023. The study – undertaken by Binance Research and the Binance VIP & Institutional team – surveyed 208 clients, nearly a quarter of whom had assets under management (AUM) above $100 million and just over half of whom had AUM less than $25 million. Just shy of two-thirds of respondents (63.5%) said they are positive on the outlook of crypto for the next year and 88% said they are optimistic for the next decade, according to the report.

Chart of the Day

-

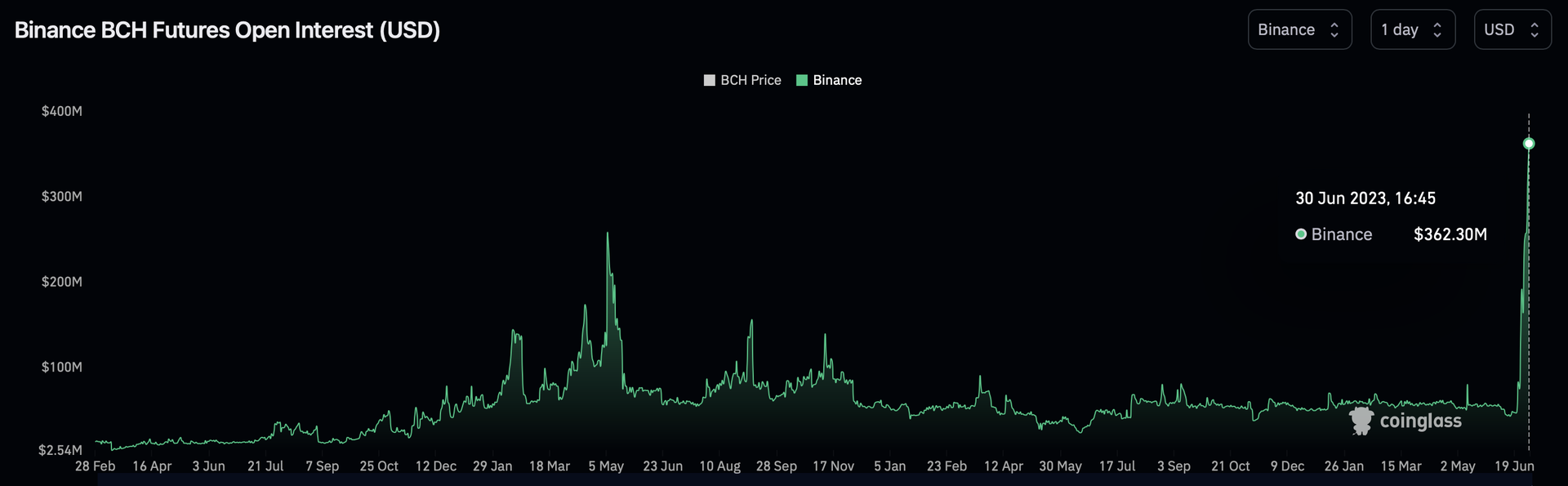

The chart show changes in notional open interest in futures tied to bitcoin cash since February 2020. Open interest refers to the number of active contracts at a given point of time.

-

The dollar value locked in open contracts has surged to $362 million from $50 million in ten days, indicating an influx of new money into the market.

-

The cryptocurrency’s spot market price has jumped over 183% since June 20.

-

Source: Coinglass

Trending Posts

Edited by Stephen Alpher.

https://www.coindesk.com/markets/2023/06/30/first-mover-americas-fidelity-joins-the-rush-for-spot-bitcoin-etf/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD