This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

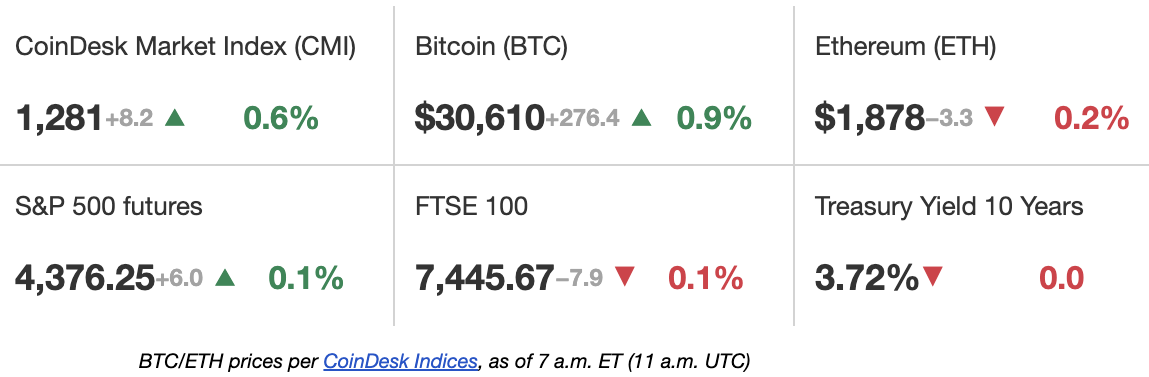

Latest Prices

Top Stories

The European Union (EU) on Tuesday secured a political deal on new bank-capital legislation, including for crypto assets, after lawmakers sought “prohibitive” rules to keep unbacked crypto out of the traditional financial system. The agreement was announced in a tweet from the European Parliament’s Economic and Monetary Affairs Committee after a meeting among representatives of the European Parliament, national governments and the European Commission, which had first proposed the new rules back in 2021. The deal must now be voted on by member states in the EU’s Council to become legislation, a process that could take several months.

Cryptocurrency custody technology provider Fireblocks has started offering support for cloud service providers Amazon Web Services (AWS), Google Cloud Platform, Alibaba Cloud, Thales and Securosus, the company announced Tuesday. The moves are part of Fireblocks’ effort to make its services accessible to a wider range of businesses and allow it to serve a market of banks whose IT infrastructure is deployed on premise and cloud-based solutions, a spokesperson said. With the new additions, the enterprise platform is covering the majority of the cloud industry’s market share.

OKX has launched “Nitro Spreads,” a feature on its over-the-counter (OTC) institutional liquid marketplace that allows traders to make complex basis trades in one-click. Basis trading refers to trading the difference between an asset’s price on two separate markets in an attempt to generate returns, for example, on spot vs. futures markets. OKX’s Nitro Spread automates this kind of trade into one-click. Traders can apply this feature across any combination of spot, perpetual and futures contracts listed on the exchange, said the company.”In the current complex market environment, institutions demand reliability, predictable returns and genuine innovation when choosing a trading venue,” said Lennix Lai, global chief commercial officer at OKX. “This is especially true in basis trading, where precision and flawless execution are paramount,” he added.

Chart of the Day

-

The chart shows the percentage of bitcoin (BTC) miner revenue transferred to centralized exchanges since December 2020.

-

On June 22, miners transferred coins worth $128 million, the equivalent of 315% of their daily revenue.

-

Miners are running down their coin stash amid the price rally

Disclaimer: This article was written and edited by CoinDesk journalists with the sole purpose of informing the reader with accurate information. If you click on a link from Glassnode, CoinDesk may earn a commission. For more, see our Ethics Policy.)

Market Insight

Digital asset investment products last week witnessed the largest single weekly inflows in a year after nine consecutive weeks of outflows, according to a report from European digital asset manager CoinShares.

Bitcoin-related products were the primary asset for inflows, with $188 million, or 94% of the total. Short-bitcoin products saw total outflow of $4.9 million, their ninth consecutive week of net exits, according to the report.

The rush of inflows came alongside a big rally in the price of bitcoin as a number of high profile traditional financial (TradFi) institutions followed BlackRock’s lead in filing for a spot bitcoin exchange traded fund (ETF). These applications included re-filings for previously rejected spot bitcoin ETFs from tradfi asset managers like Invesco and WisdomTree.

Trending Posts

Edited by Stephen Alpher.

https://www.coindesk.com/markets/2023/06/27/first-mover-americas-crypto-funds-see-largest-inflow-in-a-year/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD