This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Bitcoin (BTC) has chalked up a more than 20% price gain since Thursday last week, and may now take a breather. That’s the message from crypto services provider Matrixport’s Bitcoin Greed & Fear Index (GFI), which has jumped to 93% from under 10% in roughly one week. The index attempts to track the overriding market emotion, with readings above 90% signaling greed, or excess optimism, and those below 10% representing extreme fear or pessimism. “Our Bitcoin Greed & Fear Index has reached exuberant levels in record time. It could be well advised to lock in some gains for short-term traders,” Markus Thielen, head of research and strategy at Matrixport, said in an email.

Crypto custody firm Prime Trust has “a shortfall in customer funds” and was unable to meet all withdrawal requests this month, the Nevada Department of Business and Industry said Thursday. The department’s Financial Institutions Division, which oversees state-regulated trust companies, ordered Prime Trust to cease all activities that violate Nevada regulations, alleging that the company’s “overall financial condition … has considerably deteriorated to a critically deficient level.” Prime Trust is “operating at a substantial deficit” or may even be insolvent, the order said. “On or about June 21, 2023, Respondent was unable to honor customer withdrawals due to a shortfall of customer funds caused by a significant liability on the Respondent’s balance sheet owed to customers,” the order said.

Banking giant JPMorgan (JPM) has expanded its blockchain-based settlement token JPM Coin to euro-denominated payments, Bloomberg reported on Friday. JPM Coin went live with euro payments on Wednesday, according to the report, which cited the bank’s head of coin systems for Europe, Basak Toprak. German tech firm Siemens conducted the first euro payment on the platform. Since its inception in 2019, over $300 billion in transactions have been processed using JPM Coin, making it one of the most extensive uses of blockchain technology by a traditional financial institution. The system allows JPMorgan’s institutional clients to make wholesale payments between accounts around the world using blockchain tech.

Chart of the Day

-

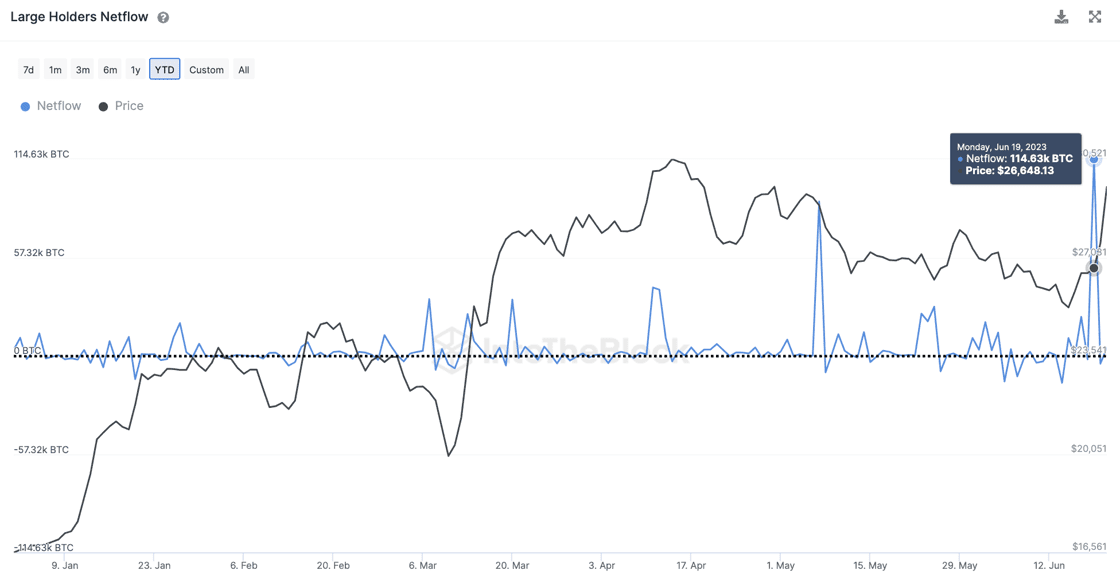

The chart shows net flow of coins into addresses owning 0.1% or more of BTC supply since January.

-

Early this week, net inflows into the so-called large holders’ addresses rose to an year-to-date high of 114,630 BTC.

-

“Not only are large transactions climbing, whales appear to be accumulating,” IntoTheBlock said in the latest edition of the weekly newsletter. “Comparing this with CEX net flows, we can confirm that the entities accumulating are not exchange-related as their net flows were negative while large holders’ were highly positive.”

Trending Posts

Edited by Sheldon Reback.

https://www.coindesk.com/markets/2023/06/23/first-mover-americas-bitcoin-may-take-a-breather/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD