- Brian Armstrong sold over 29,000 shares ahead of SEC lawsuit.

- Fox Business journalist says the sale was perfectly legal.

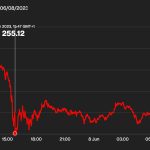

- Coinbase shares are currently down 35% versus their YTD high.

Shares of Coinbase Global Inc were hit hard this week after the SEC sued the crypto exchange. But the sell-off was relatively less damaging to CEO Brian Armstrong.

Did CEO Armstrong do anything illegal?

Reportedly, the Chief Executive sold 29,730 shares of the company in total only a day ahead of the SEC’s complaint prompting many to question if it had anything to do with insider trading.

According to Eleanor Terret – a Fox Business journalist, though, it was a perfectly legal sale as it was planned even before Coinbase was served a “Wells Notice”. Her recent tweet reads:

According to the SEC filings database, this was part of a pre-planned stock sale initiated in August 2022 that was intended to comply with Rule 10b5-1(c).

The SEC lawsuit resulted in an increase in Ethereum withdrawals at Coinbase this week (read more).

Some in crypto community are still not happy

Terret’s explanation, though, was not sufficient to satisfy everyone in the crypto community.

Some of them continue to see offloading shares at least as a lack of loyalty or a lack of confidence on CEO Armstrong’s part. David Orr – a Twitter user, for instance, wrote on the social platform:

It’s a fairly easy process to cancel/terminate a 10b5 plan. The optics here are terrible given his PR campaign to label himself and Coinbase as saviors of crypto.

Nonetheless, it remains to be known if such comments will make Coinbase CEO adjust the schedule of his future share sales. Versus their year-to-date high, Coinbase shares are currently down about 35%.

Share this article

Categories

Tags

https://coinjournal.net/news/coinbase-ceo-sold-company-shares-ahead-of-sec/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD