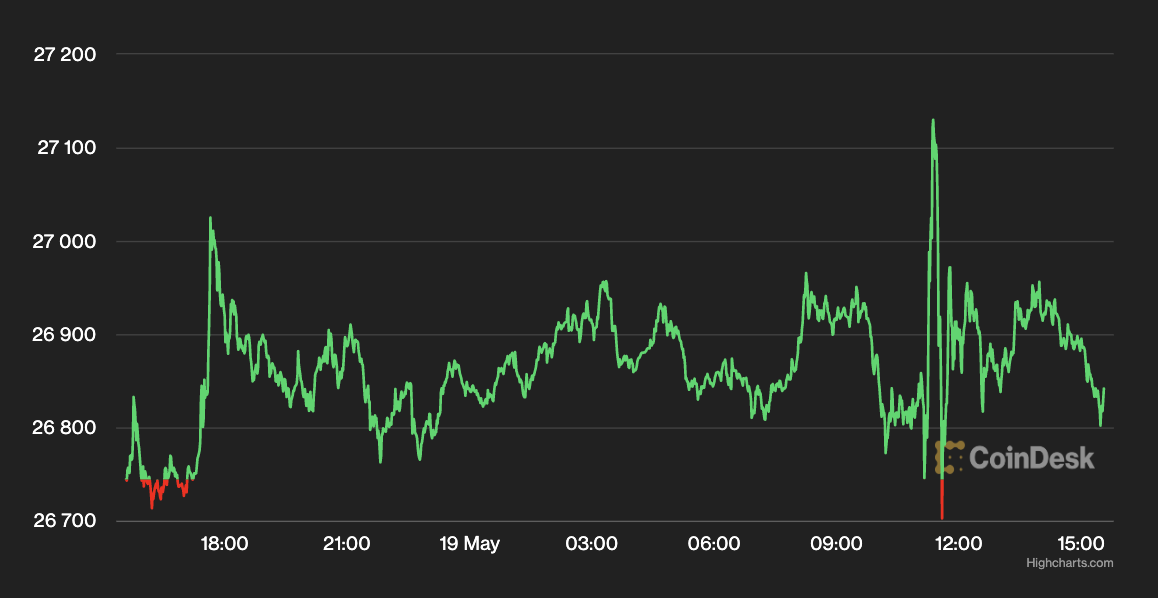

Bitcoin (BTC) continued to hold below $27,000 as U.S. Federal Reserve Chair Jerome Powell said stress in the banking sector might allow the central bank to ease back on rate hikes as it looks to curb hot inflation.

The largest cryptocurrency by market capitalization was recently trading at around $26,800, up roughly 0.3% in the past 24 hours, according to CoinDesk data. BTC’s price rose to nearly $27,200 late Friday morning as Powell – appearing with former Fed Chair Ben Bernanke at the Thomas Laubach Research Conference – said credit stress could mean interest rates would not have to go as high as previously thought.

“The financial stability tools helped to calm conditions in the banking sector,” said Powell. “Developments there, on the other hand, are contributing to tighter credit conditions and are likely to weigh on economic growth, hiring and inflation,” he continued. “As a result, our policy rate may not need to rise as much as it would have otherwise to achieve our goals.”

Powell said the assessment of the upcoming interest rate decision will be “an ongoing one” as he previously highlighted in the press conference following May’s Federal Open Market Committee (FOMC) meeting. “Having come this far, we can afford to look at the data and the evolving outlook and make careful assessments,” he said.

The CME FedWatch tool showed that 79% of traders expect the U.S. central bank will pause rate hikes in its next policy meeting in mid-June, and many expect a rate cut to take place later this year.

“The Fed Chair appears content with signaling patience with regards to future tightening,” Edward Moya, senior market analyst at foreign exchange market maker Oanda, wrote in a Friday note. “Bitcoin held onto its gains as debt-limit struggles abruptly ended and as Fed Chair Powell signaled openness to pause the Fed’s tightening campaign.”

Most top assets in the crypto market turned green in the afternoon. Ether (ETH), the second-largest cryptocurrency by market capitalization, was hovering around $1,809 on Friday afternoon, up 0.8%. Decentralized smart contracts platform Injective Protocol’s INJ jumped 10% for the day to trade at $7.07. Layer 2 blockchain Optimism’s OP was one of the laggards on Friday, dropping by 3% to $1.66.

The CoinDesk Market Index (CMI), which measures the overall crypto market performance, was up 1% for the day.

Equity markets were modestly lower Friday afternoon, with the S&P 500 down 0.2% and the Dow Jones Industrial Average and tech-heavy Nasdaq each lower by about 0.35%.

In bond markets, the 2-year Treasury note yield rose 3 basis points to sit around 4.30%, while the 10-year Treasury note yield rose 4 basis points to 3.69%.

Edited by Stephen Alpher.

https://www.coindesk.com/markets/2023/05/19/bitcoin-hovers-below-27k-as-fed-chair-powell-makes-modestly-dovish-comments/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD