This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

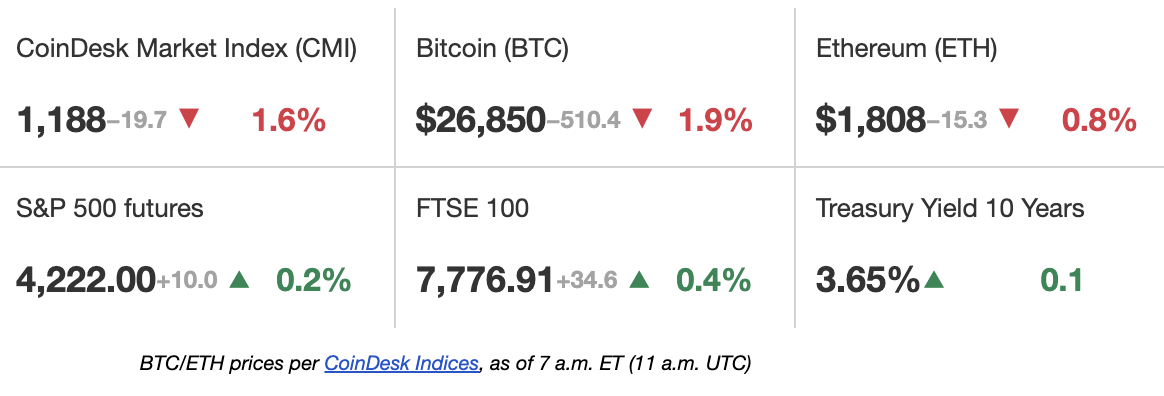

Latest Prices

Top Stories

An onchain metric suggests that litecoin (LTC), the 12th largest cryptocurrency by market value, is trading at discounted prices. Litecoin’s market value to realized value (MVRV) Z-score was negative at press time. A sub-zero score indicates the cryptocurrency is undervalued relative to its fair value, according to analytics firm Glassnode. The market capitalization is calculated by multiplying the total number of coins in circulation by the crypto’s price. The realized value is a variation of the market cap that adds the market value of coins when they last moved on the blockchain. It excludes all coins lost from circulation (more than 15%) and is said to reflect the real or fair value of the network.

The stablecoin universe continues to shrink and a sustained recovery in crypto prices is unlikely until this stops, JPMorgan said in a research report Thursday. A stablecoin is a type of cryptocurrency that is pegged to another asset, such as the U.S. dollar. “Headwinds from the U.S. regulatory crackdown on crypto, the unsettling of banking networks for the crypto ecosystem and the reverberations from last year’s FTX collapse are weighing on the stablecoin universe which continues to shrink,” analysts led by Nikolaos Panigirtzoglou wrote.

Digital asset financial services firm HashKey Group is planning to raise funds at a $1 billion valuation, according to a Bloomberg report on Friday. The Asia-based HashKey is in preliminary talks to raise between $100 million to $200 million, according to the report, which cited people familiar with the matter. The firm is looking to capitalize on Hong Kong’s re-emergence in recent months as a potential crypto hub as the city has looked to formulate a clear regulatory structure for digital assets. Hong Kong is looking to attract crypto firms to its shores as a means of generating greater investment and capital, following a few years of restrictions related to COVID taking their toll on the economy.

Chart of the Day

-

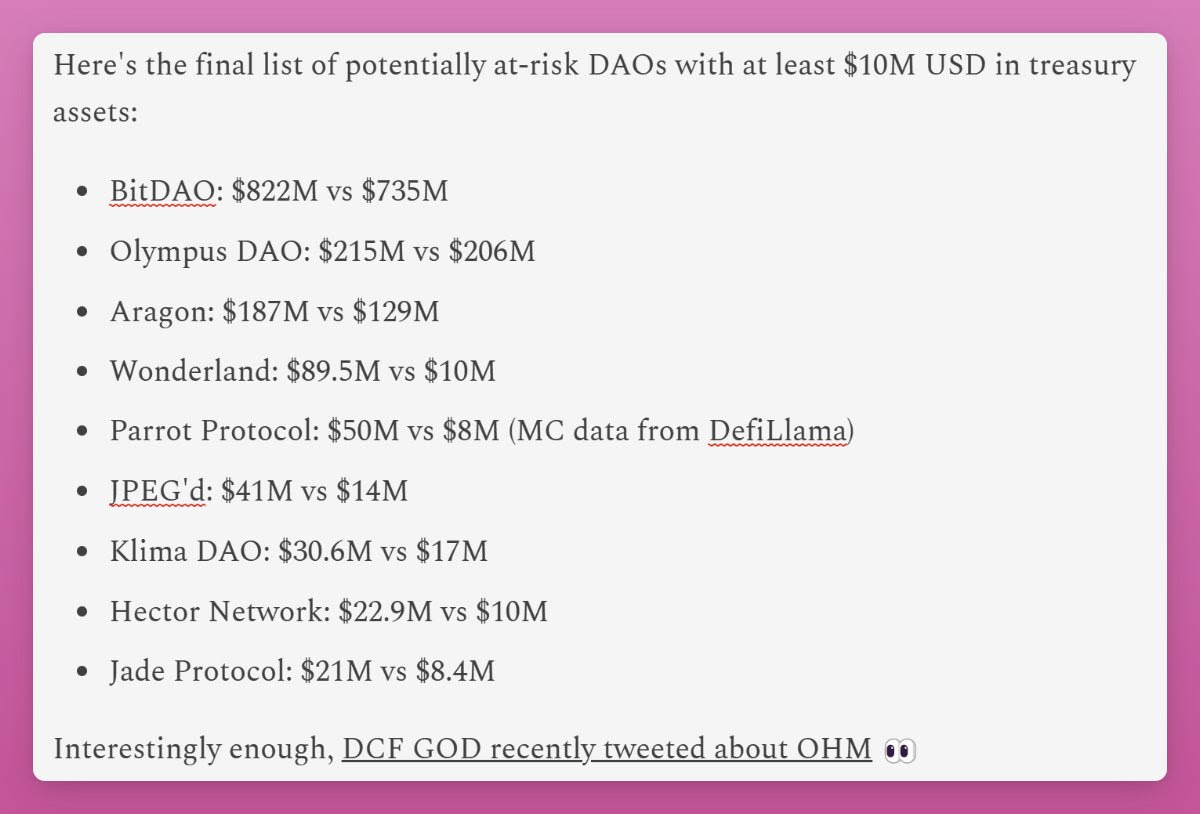

The chart by pseudonymous DeFi analyst Ignas shows that there currently are eight decentralized autonomous organizations (DAOs) with Treasury holdings less than the market capitalization of their respective tokens. (Treasury balances do include holdings of their own coins).

-

Per Ignas, these DAOs can be targeted by the so-called RFV raiders or supposed activist investors looking to take over the DAO to manipulate the price of tokens for financial gains.

Trending Posts

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

https://www.coindesk.com/markets/2023/05/19/first-mover-americas-bitcoin-rebounds-amid-optimism-on-debt-ceiling/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD