Sui, the buzzy layer 1 blockchain boasting a $2 billion valuation, launched its mainnet on Wednesday as it jockeyed to edge out rival Facebook-offshoot Aptos and other decentralized finance (DeFi) heavyweights.

The token trades at $1.33 at press time, a significant rise from the pre-sale price of $0.03 and the public sale price of $0.10. The market capitalization currently stands at $687 million, according to CoinGecko.

The blockchain, founded by ex-Meta (META) employees, has more than 200 projects in its directory and another 100-odd projects vying to build on its network.

Although Sui developers promised fast transaction speeds, speeds averaged around four transactions per second (4tps) on Wednesday, data from Sui’s blockchain explorer shows. Aptos, meanwhile, is pushing out speeds of 9tps.

Sui faced several stumbling blocks on the decentralization front, however.

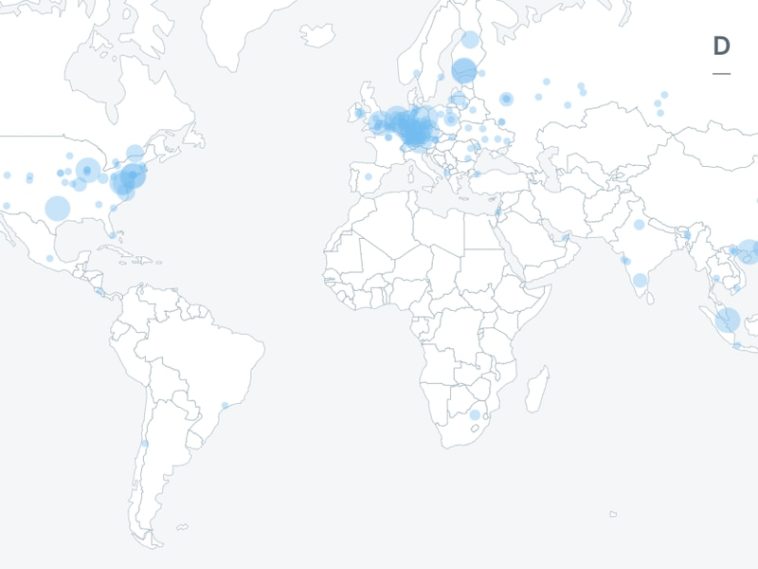

The network has more than 2,100 nodes operating across 43 countries. But, those nodes are primarily concentrated in Germany and the U.S., with a smattering of nodes running across Asia and eastern Europe. It’s worth noting that the network is still in its infancy, and that over time the distribution of validators will likely become more distributed.

The distribution of token holders also remains unclear at press time.

Mysten Labs, the blockchain’s core contributor, topped up its coffers with $300 million through a series of raises last year to support construction of the network’s central infrastructure and fast-track the Sui ecosystem’s adoption.

Its success in securing VC funding pre-launch has invited comparisons to Aptos, another relatively young blockchain with a large VC backing. Both blockchains were designed by teams from Diem, Meta’s failed stablecoin gamble, formerly known as Libra, that was shelved by the tech giant in 2022. And Move, a Rust-based programming language that was developed at Meta, undergirds both networks.

Tokenomics Tussle

Critics have blasted Sui for its tokenomics in recent weeks.

In April, Sui disappointed some of its community members by announcing it would forgo an airdrop. Instead, SUI, the platform’s native token for governance and gas, became available to community members for three cents per token in an early sale on three exchanges — OKX, KuCoin and ByBit. There was a later token sale for $0.10 per token capped at 10,000 tokens per person.

Meanwhile, Binance added support for SUI to BNB and TUSD holders through its bootstrapping portal, Launchpad, earlier this week. Users in the U.S. were not eligible for the early sale program.

Edited by Oliver Knight.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

https://www.coindesk.com/business/2023/05/03/sui-mainnet-goes-live-token-trades-at-133/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/dcfcc5f4-a693-418d-a529-bb8e772f39d1.png)

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD