Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

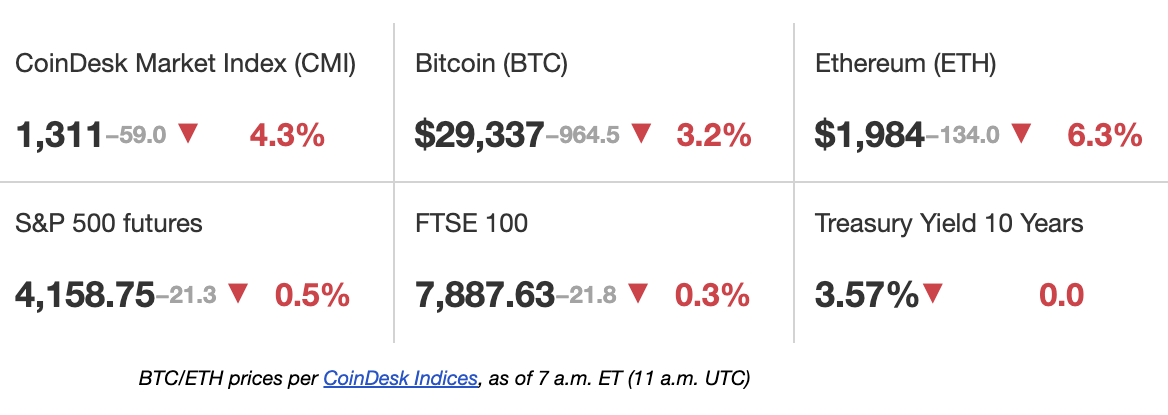

Latest Prices

Top Stories

Bitcoin slid more than 3% to below $30,000 on Wednesday morning. While the sell-off didn’t appear to stem from any immediate fundamental reason, an unexpectedly high U.K. March inflation figure of more than 10% may have influenced market sentiment. Liquidations may have also played a role. “Bitcoin saw some decent liquidations on Binance, which dropped as a consequence of long rekts being washed out early this morning,” said Laurent Kssis, a crypto trading adviser at CEC Capital. There was close to $100 million in liquidations, according to Kssis, who added that many investors are buying at under $29,200. “This was clearly an opportunity for many investors who had anticipated the drop to get back in at lower levels,” he said.

U.S. Securities and Exchange Commission Chairman Gary Gensler refused to say whether ether is a security during a nearly five-hour hearing before the House Financial Services Committee Tuesday. Gensler fended off questions about whether his agency was pushing too hard on proposed rules and providing too little time for public feedback on those rules and about how the SEC was approaching crypto companies that want to operate in the U.S.

Bankrupt crypto exchange FTX’s plan to restart its operations has drawn interest from venture-capital firm Tribe Capital, Bloomberg reported on Tuesday. Tribe, whose portfolio included FTX ahead of the exchange’s collapse in November, is considering leading a $250 million fundraising round, with a $100 million commitment, according to the report. A source told Bloomberg that Tribe Capital co-founder Arjun Sethi met with FTX’s official committee of unsecured creditors in January to go over an informal proposal. “The committee is working with the debtors to evaluate all options to reboot or sell the FTX exchanges and create value for creditors,” FTX creditors’ committee tweeted on Tuesday, adding that there isn’t a set timeline for a reboot or sale at this time.

Chart of the Day

-

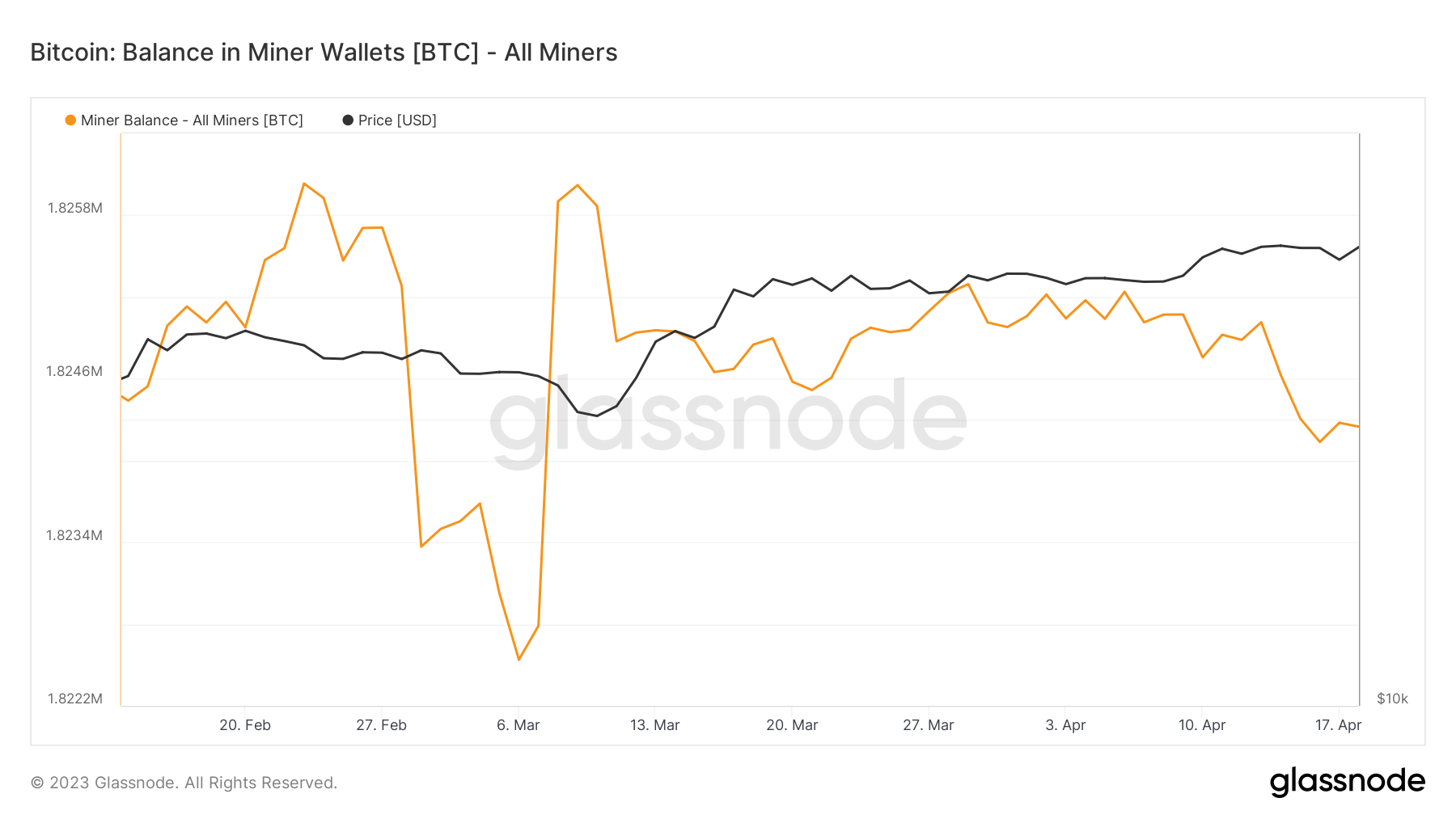

The chart shows the number of bitcoin held by wallets associated with miners since February.

-

The miner balance declined by about 800 BTC last week, a sign those responsible for minting coins are beginning to run down their coin stash again.

-

However, the miner selling seen so far accounts for less than 1% of bitcoin’s average daily trading volume of over $20 billion, suggesting a negligible bearish impact on the cryptocurrency’s price.

Trending Posts

Edited by Mark Nacinovich.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

https://www.coindesk.com/markets/2023/04/19/first-mover-americas-bitcoin-slides-toward-29k/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD