Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

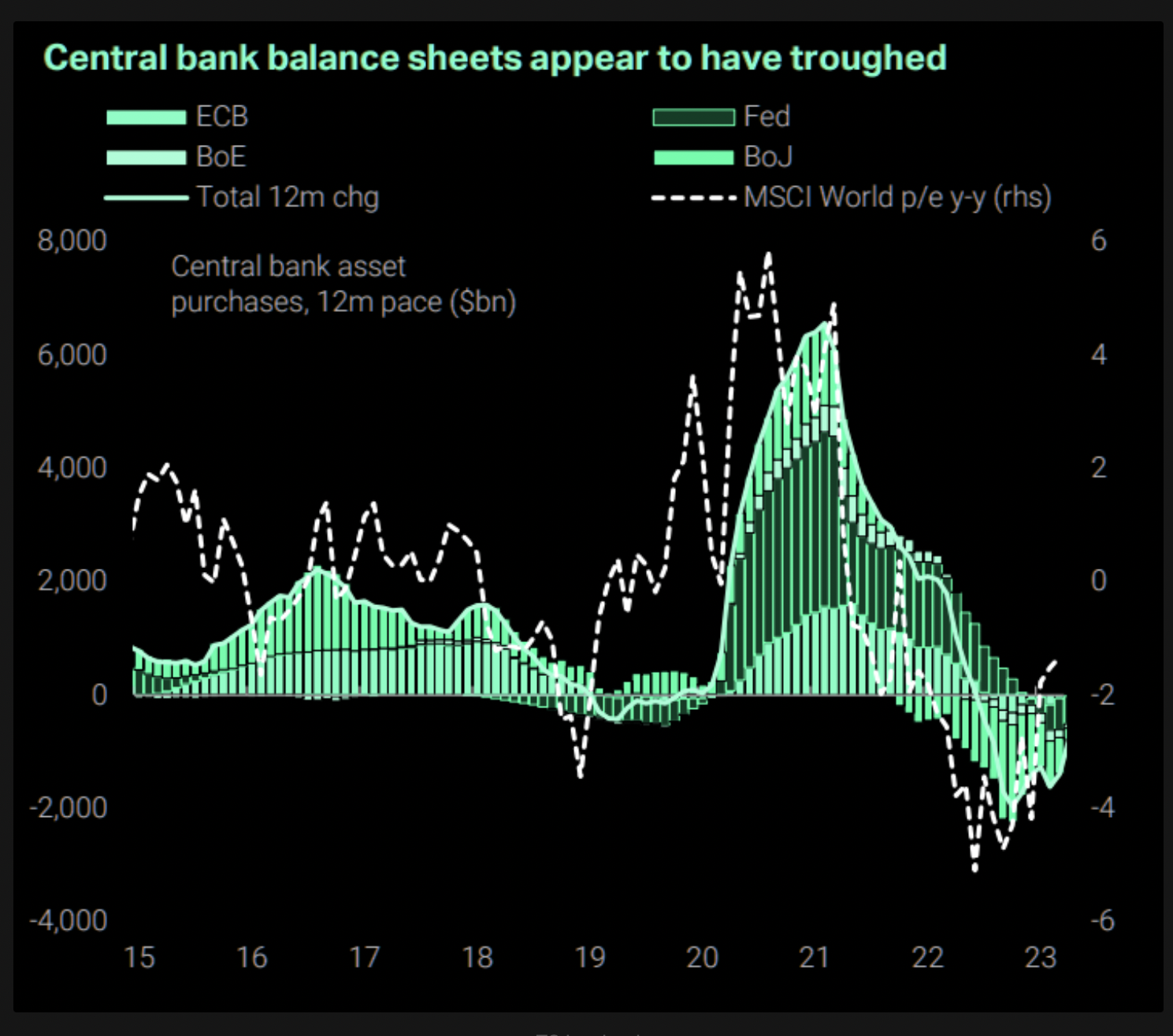

The world’s leading central banks appear to have stopped shrinking their balance sheets, a tactic they adopted last year to control inflation in a program that destabilized risk assets, including cryptocurrencies.

The so-called quantitative tightening ended recently and the cumulative balance sheet of major central banks – the U.S. Federal Reserve (Fed), European Central Bank (ECB), Bank of England (BOE) and Bank of Japan (BOJ) – has troughed, according to data tracked by macroeconomic research firm TS Lombard and sourced from The Market Ear newsletter.

“The ‘delta of the delta’ has reversed lately. Possible tailwind for markets,” Thursday’s edition of The Market Ear said, referring to the dip in the size of the banks’ balance sheets.

Central bank balance sheets appear to have troughed. (TS Lombard, The Market Ear) (TS Lombard, The Market Ear)

Expansion of central banks’ balance sheets is widely considered bullish for risk assets, including bitcoin.

That’s because entities involved in financial markets are often the first recipients of the money newly created through balance sheet expansion, according to a theory proposed by 18th-century Irish-French economist Richard Cantillon. These entities use the money received to drive asset prices higher.

The jury is still out on whether the Fed’s recent extension of loans to local lenders will result in fresh money creation. Meanwhile the BOJ continues to print money through bond purchases, compensating for the ECB and BOE’s shrinkage. The Chinese credit impulse has recently bottomed out in a sign of renewed credit expansion relative to the size of the economy.

Edited by Sheldon Reback.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

https://www.coindesk.com/markets/2023/04/14/g4-central-bank-balance-sheets-look-to-have-troughed/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD