Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

Ether rose to $1,994 on Thursday, reaching the highest point since August.

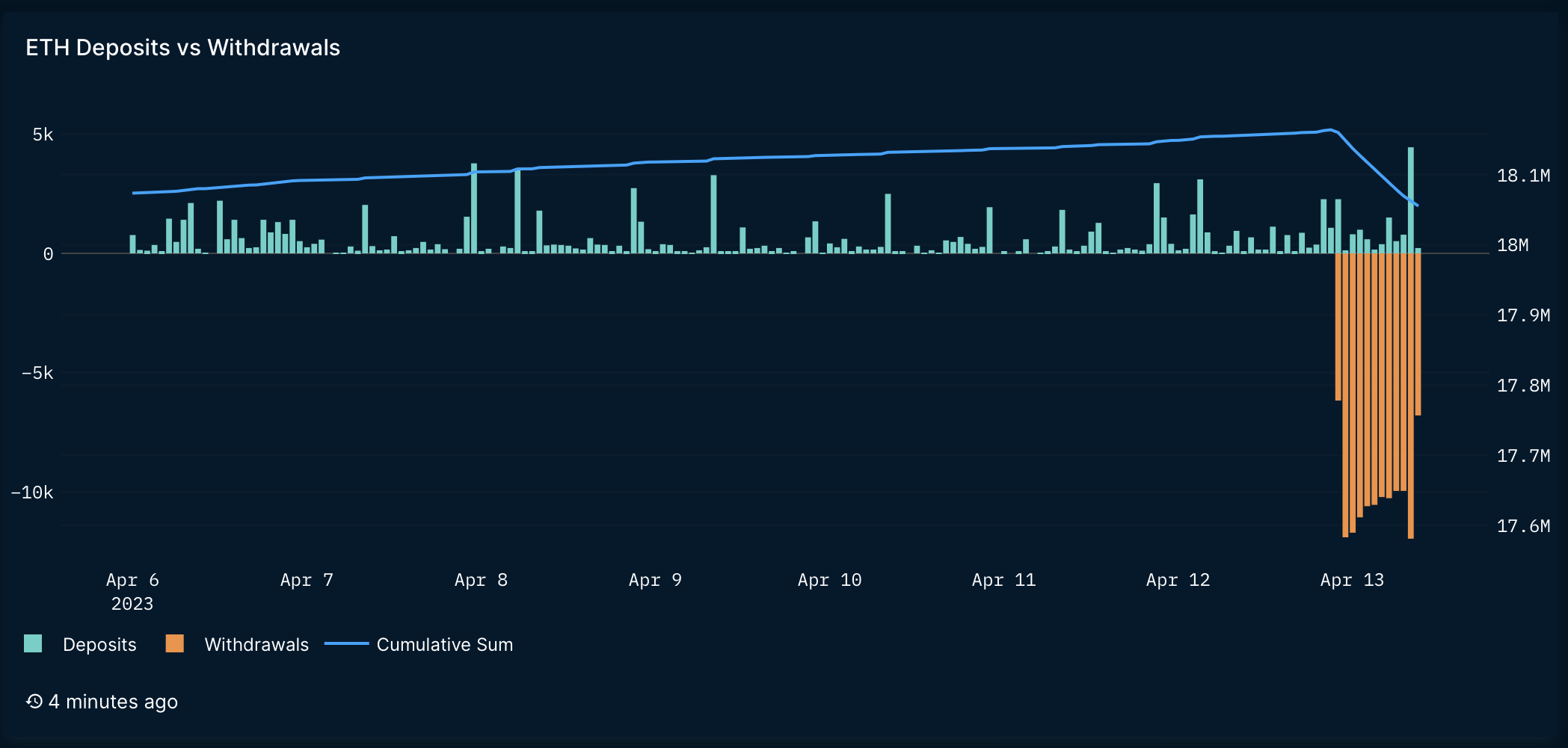

The rally to an eight-month high comes off the back of a successful network upgrade called Shanghai, or Shapella. The upgrade implemented during Asian hours enables withdrawals for users who have staked their ether, a process that helps secure and validate transactions on the blockchain. In the initial hours after the upgrade went live, ether traded fairly flat.

The second-largest cryptocurrency by market value has gained over 3% since the upgrade, while market leader bitcoin has added less than 2%, CoinDesk data show. The ether-bitcoin ratio has risen over 2.5%.

“We’re seeing a ‘sell the rumor buy the fact’ redux. ETH underperformed BTC with uncertainty around the upgrade and potential supply dynamic from the unlock. Now the risk event has past, no substantial selling pressure, market can unwind short hedges and rebalance towards to ETH,” David Brickell, director of institutional sales at crypto liquidity network Paradigm, told CoinDesk.

Heading into the pivotal hard fork, analysts were divided on how the backward-incompatible upgrade would influence ether’s price, with some anticipating an investor rush to liquidate holdings.

So far 108,402 ETH have been unstaked (Nansen)

The selling pressure, however, is likely to be less than what the market initially feared, according to North Rock Digital’s founder Hal Press.

“There was a large backlog of 15k [validators] waiting to enter the exit queue, which did so in a linear fashion. Now that they have been processed its flatlined. Puts us on schedule to clear the queue in ~2 weeks and is in line with my earlier estimate of ~$300m of total sell pressure,” Hal Press tweeted.

“This is still much more bullish than my baseline assumptions from a couple weeks ago,” Press added.

Overall the demand for unstaking ether has been moderate, as a sizable portion is currently held at a loss. The biggest unstaker so far has been Kraken, which is shutting down its staking service for U.S. users as part of a settlement with the Securities and Exchange Commission.

“Over 77% of ETH being withdrawn has been from the exchange Kraken and the majority of withdrawn ETH by validators outside of this is rewards, not rewards plus original stake. This is a more constructive than the market had potentially anticipated,” Lewis Harland, portfolio manager at Decentral Park Capital said.

“With withdrawal restrictions in place and liquid staking derivatives like Lido not implementing withdrawals until May, we think the market is realizing they over indexed on the upgrade concerns allowing for ETH to finally test the $2,000 level once again,” Harland added.

Liquid staking solution Lido makes up around 31% of all ether deposits. So far 108,402 ETH have been unstaked, according to data source Nansen.

Year-to-date, ether is up 65.25%, compared to bitcoin, up 82.04%.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

https://www.coindesk.com/markets/2023/04/13/ether-rallies-to-2k-after-shanghai-upgrade-outshines-bitcoin/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD