Traders and investors are all waiting for the next bullish cycle. With the current downward trend, it shows that Bitcoin and other cryptocurrencies will continue to receive pressure from the Federal Reserve in the upcoming weeks. So far, what has this growing regulatory pressure done to the Cryptocurrency Industry? Does the current situation of the market indicate a buy signal and a good entry for those that want to start up their crypto journey? Do you think that Bitcoin and other altcoins will break out from this current bearish cycle?

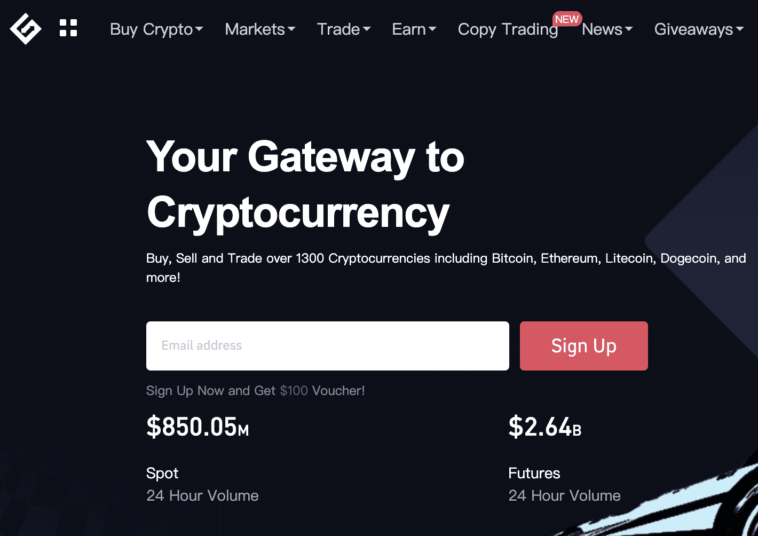

The Bitcoin price is $31123.29 and the world’s number one cryptocurrency is currently down by 0.75% in the last 24-hours on the Gate.io exchange platform. Gate.io is a top 10 global cryptocurrency exchange platform where you can buy, sell and trade Bitcoin and other cryptocurrencies very fast and very securely. The platform is easy to navigate for beginners and has trading charts and educational platforms for traders and investors including the latest news in the cryptocurrency market.

How Bitcoin Crash Has Caused Some Investors $12 Billion Losses

Some traders and investors have been selling off their Bitcoins so as to avoid potential losses, while others have decided to hold till Bitcoin gets to the moon. Historically, whales usually accumulate more Bitcoin when the market is full of red candles, so they buy the fear and hold for a long term so as to generate higher long-term returns. This could be the right time for Bitcoin and altcoins to address the technical issues and consolidate. Why are lots of short-term traders and investors not accumulating Bitcoin in the midst of this bearish cycle? This could be the best time for institutional traders and investors to buy more of the dip.

The Federal Reserve’s decision to increase the interest rate has caused some institution traders and whales a loss of more than $12 billion in the valuation of their assets. The top-5 companies cfr with the most prominent BTC positions include Tesla, Microstrategy Inc, Block.one, MTGOX K.K, and the Tezos foundation have suffered major losses due to the Fed’s increase in interest rate according to OKLink, the world’s first Blockchain big data company based in Hong Kong. Will the whales accumulate more or sell off their holdings for fear of another increase in an interest rate? Will institutional investors open long positions or will they wait for a breakout at major resistance at $35,000 and $40,000? With the strong resistance at $30,000, should one accumulate more BTC?

The general stock and crypto market has been bearish this week since the bears took over the market. The Bitcoin price live and altcoins are currently facing testing times and these may continue in the next few weeks. So institutional traders and investors need to hold. In the crypto world “hold is gold’. After a bear market, it has been proven that then comes the bull market, so it could be a good time for both short-term and long-term investors to ‘buy the dip’. Let us watch the market to see what price the candlestick will close this week.

––––––––––––––––––

This is a sponsored article. Learn how to reach our audience here.

This article is not a direct offer, recommendation, or endorsement of any products, services, or companies mentioned. Blockgeeks.com does not provide investment, tax, legal, or accounting advice. Crypto is risky, do your own research, invest safe.

The post The Effect Of The Bitcoin Crash On The Cryptocurrency Industry appeared first on Blockgeeks.

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD