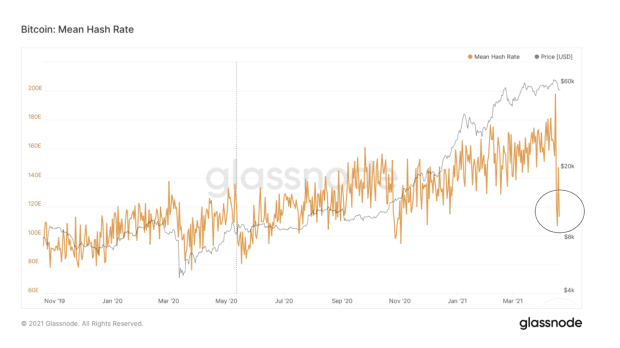

A recent plummet in hash rate and spike in transaction fees has raised some questions about Bitcoin’s resilience. But they shouldn’t.

Over the weekend, the Bitcoin hash rate dropped off a cliff, leaving many industry participants wondering what had happened. Over the last couple of days, information and context has been provided by industry experts as to what was behind this steep fall in hash rate.

For instance, this Twitter thread by Mustafa Yilham does a great job explaining the current situation.

TLDR: A large amount of Bitcoin miners in the Xinjiang region had to shut off their machines, due to a water leakage in a coal mining plant that led the central and local governments in China to temporarily shut down operations at other coal mining operations. As it is still the “dry season” in China, a majority of Bitcoin mining operations leverage under-utilized/over-supplied electricity sources, of which a majority in China (about 80%) are currently located in the Xinjiang province, where the shutdowns were occurring.

While a plummet in hash rate caused by regulations in a single country left many worried about the resilience of the Bitcoin network, the response was largely an overreaction to a small sample size of slow blocks, early in a difficulty adjustment.

The Bitcoin network has a difficulty adjustment every 2,016 blocks, which calibrates the network in order to have blocks mined at an average time of one every 10 minutes. For example, if blocks came in at a speed of once every nine minutes over the last 2,016 blocks (or about two weeks), then the difficulty would adjust upwards by 10% in order to make it slightly more challenging to mine an additional block.

A Viral Loop Of Incentives

What is the impact of a large amount of hash power leaving the network? Does this pose a threat to the long-term security model of the Bitcoin network?

Let’s dig into the viral loop of incentives built into the Bitcoin protocol.

When a large proportion of hash rate shuts off, the pace at which blocks are mined subsequently slows down. The result of this is that fewer transactions are confirmed on the blockchain, and the Bitcoin mempool fills with unconfirmed transactions. Blockspace on the Bitcoin network is a scarce resource, and if you wish to use the protocol and the settlement assurances that come with it, you need to pay up.

The mempool works somewhat like an auction block. Transitions all come with an attached fee, and miners select the highest-paying fees to include if/when they mine a block, which is their direct economic incentive. As a result of lagging hash rate over recent days, along with increasing demand to utilize the Bitcoin network, total miner revenue has reached all-time highs.

Slower blocks lead to fewer transactions, which lead to higher transaction fees, which lead to larger miner profits, which incentivizes additional miners to participate and join the network, which increases hash rate into the future, which increases network security and the settlement assurances of the protocol.

Additionally, a consistent high-fee environment on the Bitcoin blockchain incentivizes the development of scaling solutions like the Lightning Network. Plus, regardless of what happens with miners joining or leaving the network, after a 2,016 block period, the difficulty will adjust downwards or upwards exactly proportional to the amount of how slow or fast blocks were mined compared to a 10-minute average target.

The Bitcoin network is working exactly as designed, and in a world of entropy, the incentive structure of the protocol ensures that blocks will continue to be mined, and that the most robust network on the planet will continue to operate with near 100% uptime.

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD