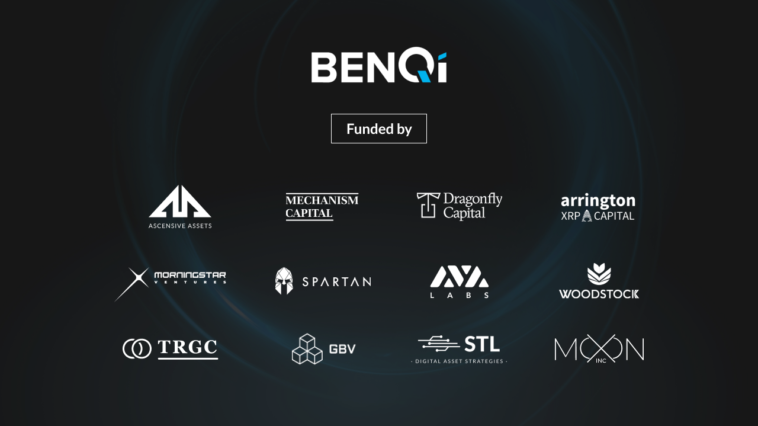

PRESS RELEASE. BENQI, a liquidity market operating on the Avalanche network, has completed a private funding round. A total of $6 million was raised in a round led by Ascensive Assets.

A number of leading investors on blockchain and the emerging Avalanche ecosystem also participated. These include Mechanism Capital, Dragonfly Capital, Arrington XRP Capital and The Spartan Group. Other backers were Morningstar Ventures, Vendetta Capital, TRGC, Genesis Block, Woodstock and Rarestone alongside Ava Labs and leading liquidity provider Skynet Trading.

Built on Avalanche’s highly scalable network, BENQI combines elements of defi and tradfi to create a liquidity protocol in which idle assets can be utilized. By locking these assets into the BENQI protocol, Avalanche users will be able to earn interest on their assets and obtain credit through over-collateralized loans.

The decision to build on Avalanche was influenced by its high degree of decentralization, scalability, and low fee environment, particularly when compared to Ethereum. BENQI ultimately aims to become a cross-chain defi hub that will bridge Ethereum, Polkadot, and Binance Smart Chain through Avalanche’s subnets.

Assets that are locked into the BENQI protocol can be used to generate yield-bearing tokens or to issue assets that are borrowed and locked into other defi protocols to generate additional yield.

Governance of BENQI’s native protocol will be overseen by QI token holders, who will have the ability to determine key matters pertaining to risk policies, fiscal management, and platform upgrades. 50% of all QI tokens will be issued through liquidity mining, giving participants an opportunity to earn rewards commensurate with their efforts.

The BENQI mainnet is scheduled to launch in Q2, 2021 accompanied by a public sale of the QI token on Pangolin exchange.

About BENQI

Developed by an experienced team of blockchain designers, BENQI is a protocol to unlock greater liquidity within the defi market. BENQI enables defi users to make their assets work harder to generate additional yield. Built on Avalanche’s high speed smart contract network, BENQI will evolve into a cross-chain defi hub that’s positioned at the heart of decentralized finance.

Learn more:

https://t.me/BenqiFinance

https://twitter.com/BenqiFinance

https://medium.com/@benqifinance

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

https://news.bitcoin.com/benqi-closes-6m-round-to-create-algorithmic-liquidity-market-on-avalanche/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD