October 26, 2020

By Benson Toti

The price of Bitcoin closed this past week at $13,113 – its highest level since January 2018

Bitcoin (BTC) is trading at around $13,106, slightly off its weekly close of $13,113 and just lower from its 2020 high of $13,350.

BTC/USD closed the week with a +13.6% candle, posting the highest close on the timeframe since January 2018. The daily close is also on course to hit the highest level after sustaining the candle above $12,900 on multiple days this past week.

Despite not hitting $14,000 yet, investors are bullish that its price will continue higher.

Investors bullish about BTC/USD

According to Moritz Helden, head of Quant Research MunichRe Investment partners:

“The view on Bitcoin is still very positive despite or maybe because of the recent rally. While Gold is also expected to increase, upside potential is expected to be lower (short term) compared to Bitcoin”.

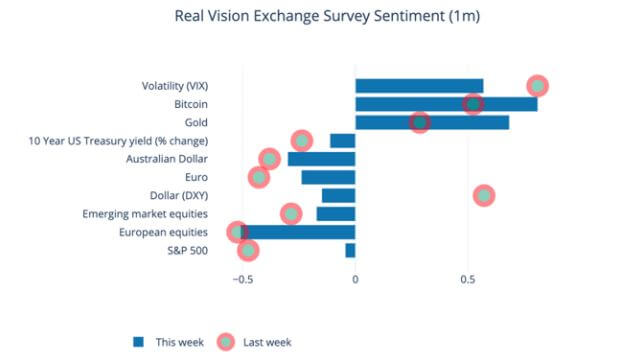

The researcher was commenting on last week’s survey results by Real Vision that showed nearly 60% of respondents hold a bullish outlook for Bitcoin.

On-chain analytics firm Santiment recently noted that Bitcoin’s price surge over the week had pushed its correlation with the S&P 500 to 0. According to the platform, it marked the lowest BTC’s price action that had correlated with the stock market since May.

The decoupling came amid a wave of positive crypto related news, especially in the wake of PayPal’s announcement allowing its users to buy, hold and sell crypto on its platform.

But investors are likely to be keen on events around the US election and the US dollar index. According to Bloomberg, the stock market is looking bullish a week to the election, and on positive news around another stimulus package.

If stocks rally post the election, then Bitcoin could continue its uptrend and look to hit a new all – time high. However, the reverse could see the recent decoupling pass as only a temporary break and halt the upside.

From a technical perspective, BTC/USD is strong as long as the price remains above the trend line, and the SMA – 100 and SMA – 200 level.

https://coinjournal.net/news/investors-bullish-on-bitcoin-as-us-election-week-rolls-in/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD