Uniswap is the largest DeFi platform by total value locked and by trade volume among DEXes.

As of September 29th, 2020, (8:00 UTC) the total value locked in DeFi protocols was around $11.11 billion. The dominant platforms with the highest TVL are Uniswap, Maker, Aave and Curve Finance, all of which have more than $1 billion in assets locked on the Ethereum blockchain.

But among decentralized exchanges (DEXes), Uniswap has the largest amount in TVL at nearly 50%.

DeFi Pulse, which tracks data in the decentralized finance (DeFi) space, indicates that $4.2 billion is locked in DEXes. Of that amount, Ethereum-based Uniswap has $2.07 to give it a dominance index of 49.47%.

Curve Finance has the next highest figure of total value locked at $1.23 billion, followed by Balancer at $486 million.

Uniswap clone Sushiswap, which had threatened to overtake the former via its “vampire mining” approach, has slipped to fourth with about $389 million in locked assets. Sushiswap accounted for more than $1.4 billion of the ecosystem’s TVL at its peak in mid-September.

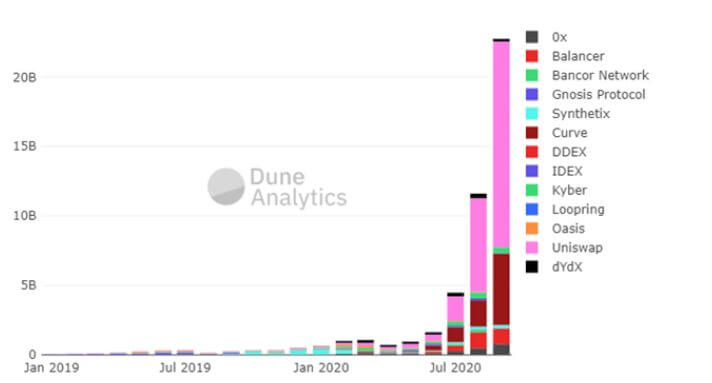

Largest DEX by volume

The rise in the total value locked in Uniswap coincided with the launch of its governance token UNI, with a spike in trading volume observed over the past two weeks. At the moment, Uniswap is the largest DEX by trading volume.

According to blockchain firm Dune Analytics, the decentralized exchange space has grown by over 150% in the past month and by more than 23% over the past 24 hours. In the time frame, trading volume hit $24.11 billion in 30 days and over $3.7 billion over the past 7 days.

In the past 7 days, trading volume on Uniswap has surpassed $2.4 billion, or over 63% of all volume on DEXes. Curve Finance is the second largest DEX by 7-day trading volume with about $872 million, or 23.1%.

In terms of users, Uniswap has seen over 104,000 unique addresses over the past 7 days, with Kyber Network trailing it by a mile at just 1,827 unique addresses over the same period.

The market action for the UNI token isn’t so good for bulls at the moment though. According to CoinMarketCap, UNI/USD trades around $4.19, down 14% in the past 24 hours and around 2% over the past 7 days. The token traded at a high of $8.6 on Coinbase on September 20 before plunging to lows of $3.7 alongside the crypto market over the past week.

Currently, bulls are facing a tough hurdle around $5.5, above which a retest of all-time highs remains achievable.

https://coinjournal.net/news/63-percent-of-dex-trading-volume-is-on-uniswap/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD