Although the leading cryptocurrency saw a decline in March this year along with the global economy, it has shown a remarkable recovery over the last few months

Bitcoin had been on an upswing this year before the pandemic began. The sharp corrective move started at the end of February when COVID-19 started spreading throughout Europe and the US. Had it not been for the coronavirus pandemic, the world would have most likely seen Bitcoin reach $11,500 in April 2020.

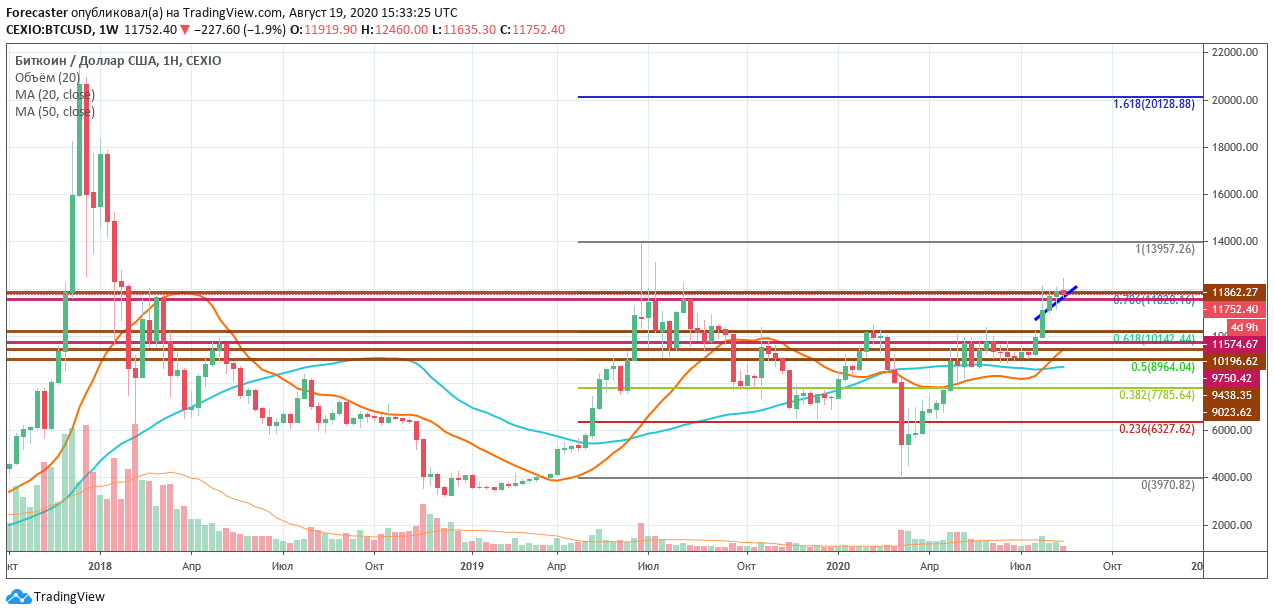

Bitcoin recently broke through the weekly resistance level at $11,507 that was established in July and August 2019.

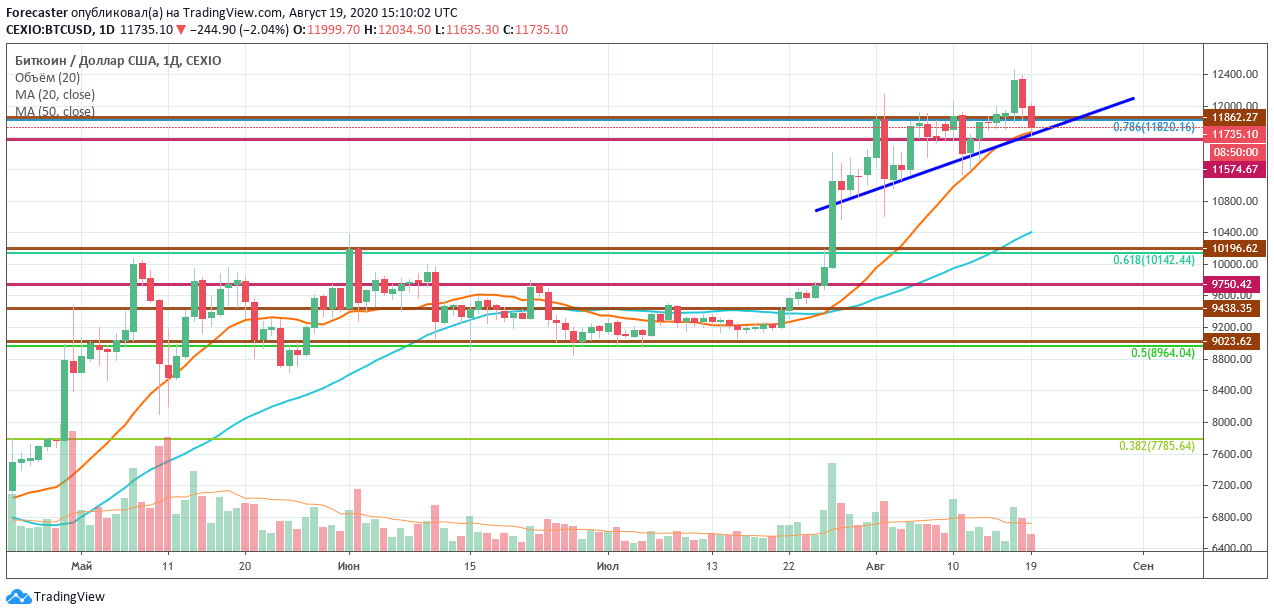

Currently, the only technical level for Bitcoin to break on its way to last year’s high at $13,957 is the 0.786 Fibonacci retracement level sitting at $11,820. If BTC can close above these levels, then we could see $14,000 per BTC in a matter of weeks.

We are now seeing a local upside move on the daily chart with Bitcoin edging higher, paving its way through the weekly resistance level seen at $11.762 and the daily one at $11,862. On top of it the daily level almost coincides with the 0,786 Fibonacci level, which makes the $11,800 zone quite a crucial one for understanding Bitcoin’s next big move.

If the asset manages to continue its steady ascent on the daily chart, following the bottom trend-supporting line (the blue one), resistance will become supported. In this case, there is no major resistance on the chart for Bitcoin until its historical high.

However, we should likewise pay attention to the fundamental components of the market, not dismissing traditional financial sectors. Looking at riskier market assets globally, we can see a number of stocks recovering at a good pace. As for potential benefits for Bitcoin from that, it may stimulate an additional influx of capital into digital gold as investors’ appetite for risk-heavy assets grows.

With the Fibonacci retracement stretched from last year’s high to this year’s low, we can see that the 1.618 level indicates $20,128 as the target level. However, it is too soon to give this prediction any support at this time.

Presently, those who have invested in Bitcoin will have to wait patiently and see if it goes higher in the long term. For those who are actively trading Bitcoin, this is a key moment for understanding whether it can make a considerable move upward in the near term. This August is likely to give us an answer to this question.

And again, because there is no pronounced technical resistance from the current daily resistance level at $11.862 right on to the historic high, we should all the more closely watch the BTC chart development right now. If the breach is made soon, $14,000 per BTC is a very real possibility before the end of 2020.

This article has been written by Konstantin Anissimov, Executive Director at CEX.IO.

CEX.IO is a multi-platform exchange that offers a variety of crypto assets to trade, an integrated mobile-app and is available in many countries around the world — including 43 US states.

https://coinjournal.net/news/bitcoin-may-see-14000-by-the-end-of-august-2020/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD