July 30, 2020

By Benson Toti

Approximatly 31.86 million Ethereum addresses are currently in profit, more than the total number of Bitcoin addresses with balances

As Ethereum’s price spiked above $300, more and more addresses holding Ether balances became profitable, data from Into the Block’s Historical In/Out of the Money (HIOM) metric shows.

The HIOM indicator allows one to figure out the cost at which an address/investor acquired a token, and thus the percentage of total addresses deemed to be in profit or “in the money”.

The Defiant has reported that about 31.86 million addresses holding Ethereum balances are in profit. In terms of percentages, 72% of addresses with a balance are “in the money” now that Ethereum’s price is above $315.

Ethereum price surge means millions of holders are in profit

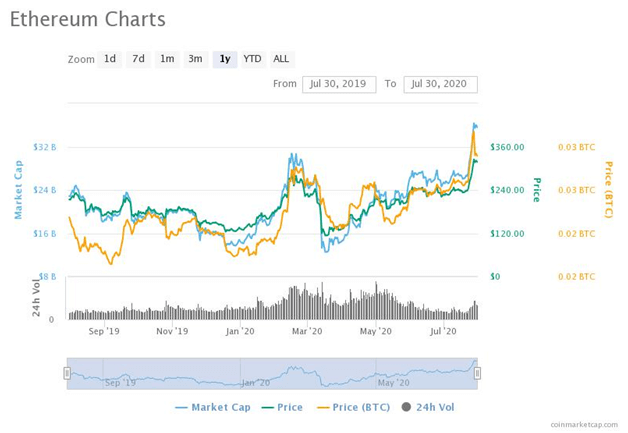

Ethereum price last hit figures above $300 in 2019, meaning the growth in addresses coincided with millions of new investors buying the token at bargain prices. Most of these holders purchased Ether at prices below $300, while a significant number came in when markets crashed in March and sent ETH/USD to new lows around $100.

The number of addresses in profit has more than doubled compared to those in the same period a year ago. As ETH/USD traded at around the $300 mark in 2019, about 13.5 million holders were in profit.

Growth in the on-chain activity on the Ethereum network has also seen the total number of active addresses spike in the last seven months. From last year, there has been a 170% increase in the network’s daily active addresses.

The percentage of long term investors in Ethereum — also called ‘hodlers’— has also spiked since the turn of the year. Data shows that those who have held the digital asset for over a year have grown by nearly 10 million since July 2019.

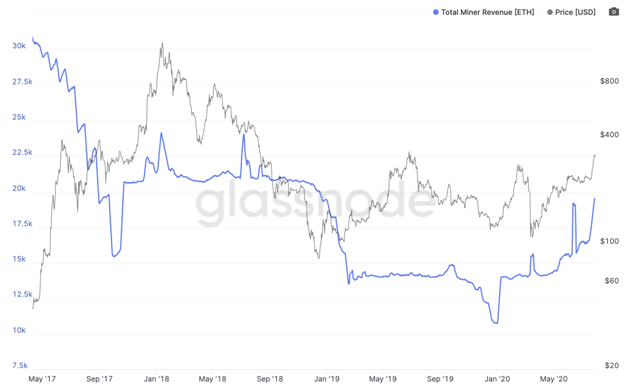

Meanwhile, miners on the Ethereum network have recently hit a jackpot with a surge in network fees. As the platform prepares for a switch to a proof-of-stake system via an ETH 2.0 upgrade, miners have recorded their biggest increase ever in revenue margins.

The last time miner revenue from fees hit current levels was in the third quarter of 2018, with an average of about 3% recorded to the period around April 2019. The revenue from fees has increased since, making a steep climb in recent months to currently average about 30%.

Ethereum price has spiked by about 25% in the past week.

https://coinjournal.net/news/up-to-72-of-ethereum-wallets-are-in-profit/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD