LINK/USD has traded at a high of $4.48 after recovering from lows of $1.70 in March

Chainlink, one of the hottest crypto assets currently in the market, could see its value increase fivefold thanks to high demand.

According to Weiss Ratings, Chainlink is set for a massive adoption period that could push its current price five times higher. Although it has traded sideways in the past seven days, its price outlook remains pointed to the north for the medium and long term.

A good start to the year so far sent prices up by 144%. Weiss Ratings says the price of LINK against the US dollar could spike even higher as growth across the smart contracts space means added adoption for the token.

Exponential demand could drive adoption and thus influence price

Chainlink offers a platform that traditional enterprises can leverage to easily connect and securely integrate with blockchain-based smart contracts. Enterprises can use the platform’s native cryptocurrency in transactions.

As per Weiss’ report, Chainlink fulfils a space in the ecosystem that is likely to benefit from an exponential growth in demand.

“The near-exponential growth of smart contracts also means near-exponential demand for Chainlink, going forward,” Weiss wrote in their report.

Google already uses the crypto platform, as do the other 20 projects including Aave, Synthetix and Compound.

According to Weiss, all these are fundamental factors could see the token “trade as high as $20.” Such a level would put the asset’s value almost five times higher.

Chainlink price outlook

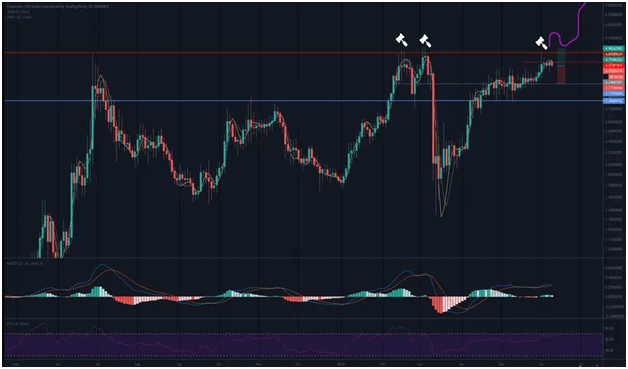

Chainlink traded at a low of $1.78 on January 2 but then rallied to a high of $4.48 on March 4. The crypto market crash of March 12 saw LINK/USD plunged to lows of $1.70. The altcoin has nonetheless printed higher since, topping $4.45 on June 2 to give it a 144% price surge.

But despite being on an upward trajectory for most of the year so far, LINK/USD is likely to retrace to lows of $3.70 before a new uptrend takes it past its all-time high of $4.80. According to this chart by Sparkster, the token has formed three hammers and a 13% drop short term is more likely before a spike materialises.

“When it moves back up, it may move fast, so traders will be looking to buy the Dip,” the trader notes.

As of press time, the price of Chainlink against the US dollar is $4.38, with gains capped below 1% on the day.

https://coinjournal.net/news/demand-for-chainlink-could-cause-further-price-hike-above-the-144-gained-this-year/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD