Increase in the number of addresses with less than 0.1 bitcoins means most small investors are using the downturn in prices to increase their Bitcoin holdings

Even as the bears push prices to their lowest levels since the halving, it appears the market is taking current price levels as buying opportunities, especially small investors that can only buy in satoshi units — the term for fractional amounts of less than one bitcoin.

Bitcoin’s price has declined nearly 12% in the past two weeks, touching a low of $8,630 on Monday as it moved lower from its recent highs at $10k levels.

But the drop is providing an opportunity for some retail investors; given the surge in unique addresses with 0.1 or less bitcoin.

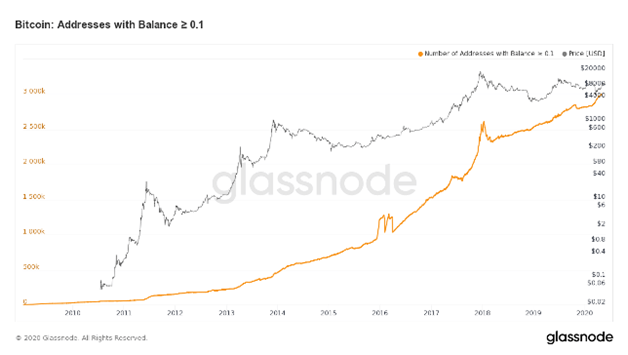

According to Glassnode, addresses with 0.1 bitcoin or lower have increased to 8,478,746. The same metric is seen when it comes to addresses holding 0.1 bitcoin or less, cumulatively rising over the last couple of months to hit a new all-time high at 3,053,004.

According to the Glassnode data, an increase in buying from small investors has been recorded in the weeks since Bitcoin halved its block rewards.

Ethereum addresses have also surged in recent months, hitting the 40 million mark as sentiment continues to grow. On May 22, the number of addresses holding at least 100 Ethereum coins reached 47,722, the all-time high that has come despite price struggles that have seen the cryptocurrency lose more than 80% of its value since rallying to an all-time high in January 2018.

Accumulation phase

For a while, it’s been institutional investors that have looked to accumulate greater Bitcoin holdings. Either way, an increase in addresses holding less than 0.1 bitcoin indicates retail investors are looking to accumulate.

Buying Bitcoin on the dip has more to do with the fact that anticipation is high within the crypto community about the potential for higher gains in the next few months. If history repeats itself, Bitcoin might hit a new bullish cycle in late 2020, and continue to rally throughout 2021.

Although the increase in the number of addresses holding cryptocurrencies doesn’t necessarily mean more people are buying coins (one trader can hold several wallet addresses), it still points to an increase in buying.

Meanwhile, Reddit co-founder, Alexis Ohanian, has said that an increased inflow of talent into crypto could mean the cryptocurrency market could see an uptick in prices. Speaking in an interview on Yahoo Finance Live, Ohanian added that Bitcoin was “here to stay,”, revealing:

“I’ve had a percentage of my wealth in crypto for quite some time now and I still feel pretty good about it, I don’t want to change too much of it.”

Earlier in the month, billionaire Paul Tudor Jones said that he was buying bitcoin, calling it the best bet to hedge against inflation.

https://coinjournal.net/retail-investors-increase-their-holdings-as-bitcoins-price-hovers-below-9000/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD