As a cryptocurrency information resource, we get a lot of questions. We make every effort to provide helpful answers in plain English and, of course, user questions give us a lot of information too. They let us know what newcomers to the space find important, difficult, or confusing.

One question which has been coming up a lot lately is…

How Do I Mine Ripple (also known as XRP)?

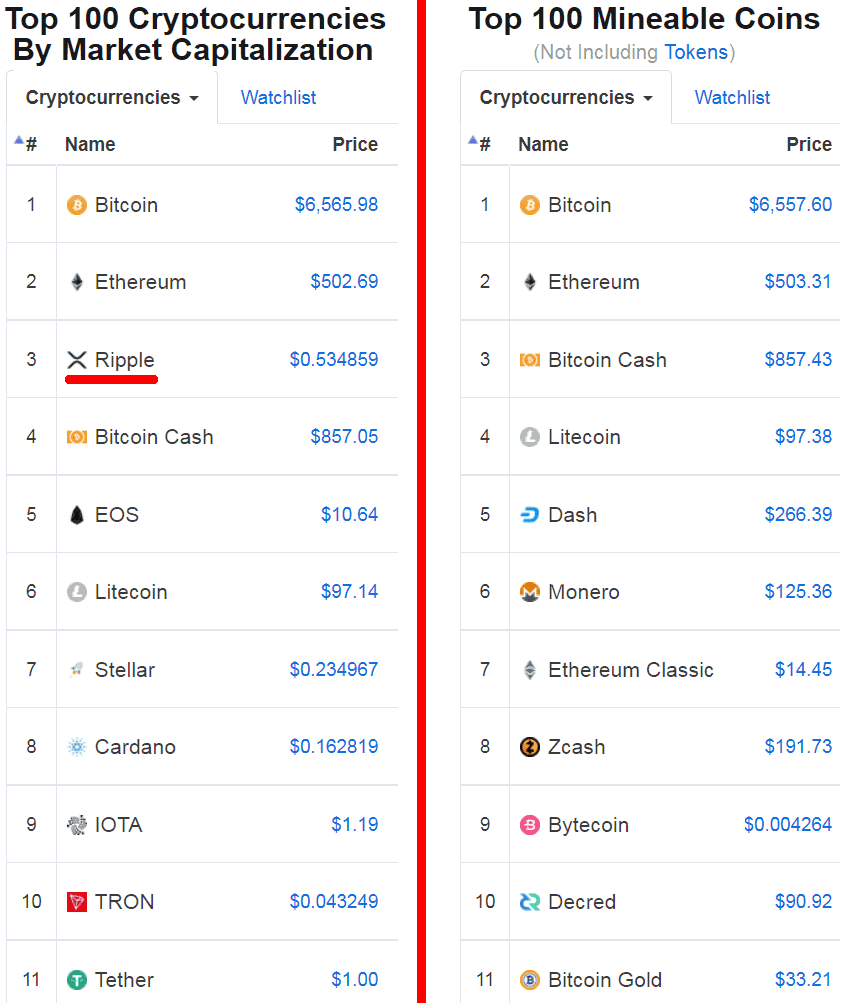

Well, to answer it simply, you can’t. In fact, many of the coins we’re used to seeing in the coin price rankings aren’t mineable. Compare these two lists from CoinMarketCap, showing all coins vs. mineable coins:

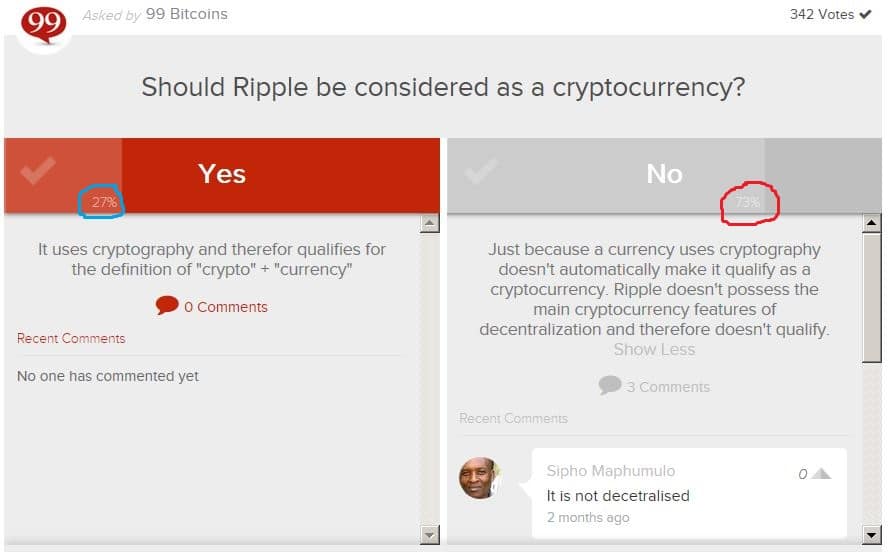

The reason Ripple can’t be mined is that it’s not a true cryptocurrency, according to our definition of the term, various experts, and our reader poll:

Ripple is instead a centralized crypto asset, which is exclusively issued by the Ripple company and controlled by that company and several financial industry partners. Indeed, Ripple describes XRP as a “digital asset for payments”:

Why Can’t Ripple be Mined?

Mining is only useful in the case of decentralized cryptocurrencies, like Bitcoin. By remaining open to anyone with the necessary skills and resources to mine, Bitcoin theoretically prevents any single entity from controlling the blockchain.

Ripple explicitly controls the network, with all keys necessary for operation controlled by Ripple.com. Although a series of distributed servers (only 2 of which are not controlled by Ripple at the time of writing) are used to “validate” transactions, this setup is too centralized to be termed a blockchain or even a distributed ledger.

Incorporating mining would therefore be a complete waste of energy and money for Ripple’s purposes. In much the same way as AMZN shares are issued by the Amazon company, XRP was issued directly by the Ripple company rather than being mined into existence. The only way to acquire Ripple is therefore to buy or earn it.

Here are Some Ripple Basics

Symbol: XRP

Current Supply: 39,245,304,677 (39 billion) XRP

Supply Cap: 100,000,000,000 (100 billion) XRP

Ripple Pros:

- Ripple transactions are extremely fast, confirming within seconds,

- Ripple can reach 50,000 transactions per second in throughput,

- The Ripple network requires no significant electrical consumption.

Ripple Cons:

- the system may be easily shut down or altered by the state

- transactions occur at the company’s discretion and may be reversed or frozen

- full trust is placed in the company to wisely and honestly manage the system.

What is Ripple trying to Achieve?

Rather than trying to replace the banking system like Bitcoin, Ripple intends to improve it. Ripple’s success therefore ultimately depends on acceptance by major banks and central banks. The highly-conservative banking industry is unlikely to make the jump any time soon, according to Ripple themselves and NYT fintech journalist, Nathaniel Popper.

A further point of concern is that Ripple remains unsupported by major American exchanges, besides Kraken. A Coinbase listing would probably do a lot for Ripple.

If you have any further questions on getting hold of Ripple, see our complete guide to the process, How to Buy Ripple in 3 Simple Steps. Hope this cleared a few things about Ripple and about why it can’t be mined.

The History of Ripple

RipplePay was created by Ryan Fugger in 2004, 5 years before Bitcoin’s release, with the intention of replacing banks. It allowed for peer-to-peer lending and payments but users could default on obligations. RipplePay was an interesting model but didn’t catch on.

Inspired by Ripplepay, Jed McCaleb founded the eDonkey file sharing network. McCaleb was also the creator of Mt. Gox. In 2011, the eDonkey team began work on a cryptocurrency in which mining work was replaced by social consensus (similar to the approach of modern cryptos like EOS). In 2012, McCaleb bought out RipplePay and renamed the project to OpenCoin.

OpenCoin implemented the Ripple Transaction Protocol (RTXP) as a means to send money directly and rapidly between users. Customs tokens, representative of real-world assets, were made possible within RTXP, raising the question of XRP’s purpose. Financially-compliant Ripple Gateways, such as the Bitstamp exchange, manage the interchange between the RTXP network and other assets. These Gateways shifted trust away from network peers to authorized financial institutions.

OpenCoin conducted a major XRP giveaway in early 2013, awarding 1000 XRP to any BitcoinTalk forum user who requested it. This year marked the point at which the current XRP asset was implemented. OpenCoin also succeeded in raising a lot of venture capital funding in 2013. McCaleb left the company around this time and went on to create Stellar, which is similar to Ripple. OpenCoin then changed its name to Ripple Labs, shortening this to just Ripple in 2015.

Sometime around 2013, Ripple pivoted away from being a transaction protocol for users to being a specialized settlement network for banks. Ripple then added numerous features to aid compliance, such as the ability to freeze user assets. The first bank to get involved was Germany’s Fidor Bank, followed by America’s CBW bank. Several other banks and payment services have since gotten involved in the Ripple project.

Author Update:

This article has proven rather controversial and received some strongly critical feedback. I’d like to address some of the points raised in the comments section, which are also summarized on the XRP FUD Bingo site.

I stand by my definition of a blockchain as a decentralized linked list of data segments. Ripple uses HashTree rather than a standard blockchain. According to Global Coin Report, HashTree is a “functional programming data structure that provides consensus to the ledger by comparing and validating the summarized data.” Whether or not HashTree can be considered a blockchain, it’s certainly not decentralized. That’s OK for banks and corporations, who want to be in control of their ledger, but at best it means Ripple is a “permissioned ledger.”

As for the existence of validators proving Ripple is distributed, I believe 2 non-Ripple validators were first added to the default Unique Node List only this week? And yes, one can in theory create a custom list of non-affiliated validators, but even so I contend that Ripple would be centralized. See “The Ripple story” from BitMex Research; a Ripple client needs to download 5 keys from Ripple.com to operate. It doesn’t get much more centralized!

There’s some doubt that users of custom keys or UNLs would even converge on the same ledger as Ripple. Unless this is demonstrated in practice, I’m strongly inclined to trust to the research of BitMex and “blockchain” expert Peter Todd, who also concluded that Ripple is centralized.

As for state censorship of the Ripple network, it’s asserted that this is impossible because Ripple is “decentralized.” I disagree. Assuming the validators even aid decentralization, they are known and thus subject to state pressure. It goes without saying that the Ripple company and its partner banks would comply with the state.

When it comes to the possibility of freezing assets, this is exactly what happened (2) to the former head of Ripple, Jed McCaleb. Some of Jed’s XRP was frozen by Bitstamp at the behest of the Ripple company. There is a clear precedent.

In summary, the negative perspectives on Ripple in this article largely accord with those of respected industry experts, who’ve researched this subject in considerable depth. As such, I don’t believe these points can be glibly dismissed as mere bias or FUD.

https://99bitcoins.com/ripple-mining/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD