Last updated on February 26th, 2018 at 04:08 pm

What are the five common mistakes of 90% of Bitcoin traders?

How do I even start trading?

How do I read all of these confusing price charts that I see online?

Well, stick around… Here on Bitcoin Whiteboard Tuesday, we’ll answer these questions and more.

Bitcoin Trading Resource Section

Chris Dunn – Free Bitcoin trading webinar (great for additional trading education)

Coinigy – Bitcoin trading software

The following sites are suited for Bitcoin trading:

Bitfinex – read our Bitstamp review

Cex.io – read CEX.io our review

Gemini – read Gemini our review

Bitstamp – read Bistamp our review

Kraken – read Kraken our review

For additional exchanges visit our Bitcoin exchange page.

If there’s one thing we get asked A LOT here on 99Bitcoins, it’s how to trade Bitcoins. So we decided to dedicate this episode of Bitcoin Whiteboard Tuesday to teaching you what Bitcoin trading is all about.

This lesson will be longer than usual, but I assure you, it will be worth your time. We’re going to cover four major topics:

- The definition of Bitcoin trading

- The main terms you’ll encounter when trading on exchanges

- A very short intro into reading price graphs

- And finally, we’ll go over some common trading mistakes

Let’s get started….

Bitcoin Trading vs. Investing

So what is Bitcoin trading, and how is it different from investing in Bitcoin?

Well, when people invest in Bitcoin, it usually means that they are buying Bitcoin for the long term. In other words, they believe that the price will ultimately rise, regardless of the ups and down that occur along the way.

Usually, people invest in Bitcoin because they believe in the technology, ideology, or team behind the currency.

Bitcoin investors tend to HODL the currency long-term. HODL is a popular term in the Bitcoin community that was actually born out of a typo of the word “hold”—in an old 2013 post in the BitcoinTalk forum.

So while Bitcoin investors buy and HODL for the long term, Bitcoin traders buy and sell Bitcoin in the short term, whenever they think a profit can be made.

Traders view Bitcoin as an instrument for making profits. Sometimes, they don’t really care about the technology or the ideology behind the product they’re trading. Of course, people can still trade Bitcoin if they do care about it. And many people out there invest and trade at the same time.

But why are so many people looking to trade cryptocurrencies (especially Bitcoin) all of a sudden?

Here are a few of the reasons:

First, bitcoin is very volatile. In other words, you can make a nice amount of profit if you manage to correctly anticipate the market.

Second, Unlike traditional markets, Bitcoin trading is open 24/7. Most traditional markets, such as stocks and commodities, have an opening and closing time. With Bitcoin, you can buy and sell whenever you please.

Finally, Bitcoin’s unregulated landscape makes it relatively easy to start trading—without the need for long identity-verification processes.

Trading method types

For example, day trading involves conducting multiple trades throughout the day, and trying to profit from short-term price movements. Day traders spend a lot of time staring at computer screens, and at the end of the day, they usually just close all of their trades.

Scalping is a day-trading strategy that a lot of people are talking about. Scalping attempts to make substantial profits on small price changes, and it’s often referred to as “picking up pennies in front of a steamroller.”

Scalping focuses on extremely short-term trading, and it’s based on the idea that making small profits repeatedly limits risks and creates advantages for traders. Scalpers can make dozens—or even hundreds—of trades in one day.

Meanwhile, swing trading tries to take advantage of the natural “swing” of the price cycles. Swing traders try to spot the beginning of a specific price movement, and enter the trade. Then they hold on until the movement dies out, and take the profit. They try to see the big picture without constantly monitoring their computer screen. Swing traders can open a trading position, and hold it open for weeks (or months), until they reach the desired result.

So now that you know what trading is, how is it actually accomplished? How can someone predict what Bitcoin will do?

The short answer is that no one can really predict what will happen to the price of Bitcoin. However, some traders have identified certain patterns, methods, and rules that allow them to make a profit in the long run. No one exclusively makes profitable trades, but here’s the idea: At the end of the day, you should still see a positive balance, even though you suffered some losses along the way.

Fundamental vs. Technical analysis

People follow two main methodologies when they trade Bitcoins (or anything else, for that matter): fundamental analysis and technical analysis.

Fundamental analysis looks at the big picture. In Bitcoin’s case, fundamental analysis evaluates Bitcoin’s industry, news about the currency, technical developments of Bitcoin (such as the lightning network), regulations around the world, and any other news or issues that can affect the success of Bitcoin.

This methodology looks at Bitcoin’s value as a technology (regardless of the current price) and at outside forces (in order to determine what will happen to the price). For example, if China suddenly decides to ban Bitcoin, this analysis will predict when the price will probably drop.

Technical analysis tries to predict the price by studying market statistics, such as past prices movement and trading volumes. It tries to identify patterns and trends in the price, which may suggest what will happen to the price in the future.

Technical analysis assumes the following: Regardless of what’s currently happening in the world, price movements speak for themselves, and tell some sort of a story that helps you predict what will happen next.

So which methodology is better?

Well, like I said in the beginning, no one can accurately predict the future. However, a healthy mix of both methodologies will probably yield the best results.

Understanding Bitcoin Trading Terms

Now let’s continue to break down some of the confusing terms and statistics you’ll encounter on most of exchanges.

Bitcoin exchanges are online sites where buyers and sellers are automatically matched. An exchange is different than a Bitcoin company that sells you Bitcoin directly, such as Coinmama. This type of company will usually charge a higher fee. An exchange is also different from a marketplace such as Local Bitcoins, where buyers and sellers directly communicate with each other, in order to complete a trade.

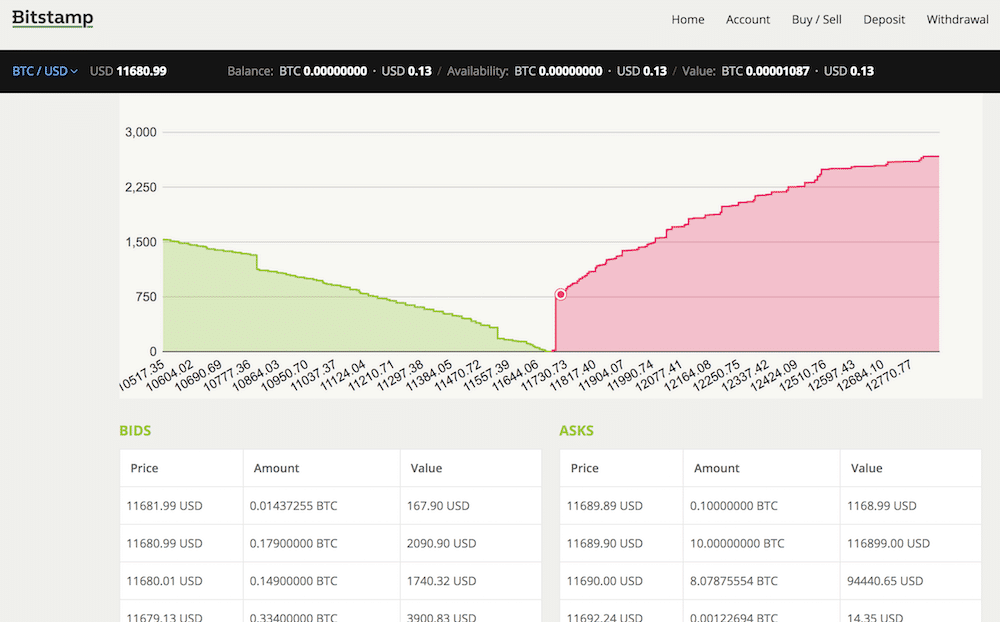

The order book

The complete list of buy orders and sell orders are listed in the market’s order book, which can be viewed on the exchange. The buy orders are called bids, since people are bidding on the prices to buy Bitcoin. However, the sell orders are called asks, since they show the asking price that the sellers request.

Whenever people refer to Bitcoin’s “price,” they are actually referring to the price of the last trade conducted on a specific exchange. This important distinction occurs because there is no single, global Bitcoin price that everyone follows. And sometimes, Bitcoin’s price in other countries can be different from Bitcoin’s price in the US, since the major exchange in these countries include different trades.

Aside from the price, you will also sometimes see the terms high and low. These terms refer to the highest and lowest prices in the last 24 hours.

Another important term is volume. It stands for the number of overall Bitcoins that have been traded in the given timeframe. Significant trends are usually accompanied by large trading volumes, while weak trends are accompanied by low volumes.

A healthy upward trend is accompanied by high volumes (when the price rises) and low volumes (when the price declines). If you are witnessing a sudden change of direction in the price, experts recommend checking how significant the trading volume is, in order to determine if it’s just a minor correction or the beginning of an opposite trend.

So now, you know most of the terms you’ll encounter on the average exchange. It’s time for us to move on, and go over the types of orders that you can place on an exchange.

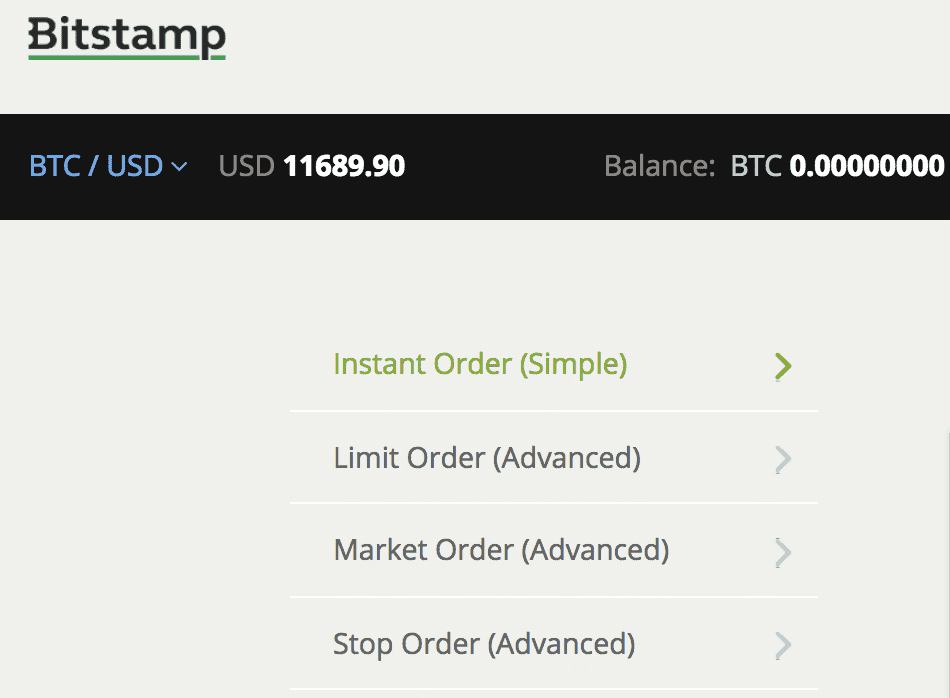

Three Types of Orders

A market (or instant) order refers to an order that will be instantly fulfilled at any possible price So if you put a market order in to buy five Bitcoins, you will find the cheapest sellers possible, until it accumulates enough sellers to hand over five Bitcoins.

In other words, you might end up buying three Bitcoins at one price, and the other two at a higher price. In a market order, you don’t stop buying Bitcoin until the amount requested is reached. With market orders, you may end up paying more than you intended, so be careful.

Meanwhile, with a limit order, you will only buy or sell Bitcoin at a specific price that you decide on. In other words, the order may not be entirely fulfilled, since there won’t be enough buyers or sellers to meet your requirements.

Let’s say that you place a limit order to buy five Bitcoins at $10,000 per coin. Then you could end up only owning 4 Bitcoins, because there were no other sellers willing to sell you the final Bitcoin at $10,000. The remaining order for 1 Bitcoin will stay there, until the price hits $10,000 again, and the order will then be fulfilled.

A stop-loss order lets you set a specific price that you want to sell at in the future, in case the price dramatically drops. This type of order is useful for minimizing losses. It’s basically an order that tells the exchange the following: If the price drops by a certain percentage or to a certain level, I will sell my Bitcoins at the preset price, so I will lose as little money as possible.

A stop-loss order acts like a market order. In other words, once the stop price is reached, the market will start selling your coins at any price until the order is fulfilled.

Maker and Taker fees

Other terms that you may encounter when trading on exchanges are maker fees and taker fees. Personally, I still find this model to be one of the more confusing ones, but let’s try to break it down.

Exchanges want to encourage people to trade. In other words, they want to “make a market.” Therefore, whenever you create a new order that can’t be matched by any existing buyer or seller, you’re basically a market maker, and you will usually have lower fees.

Meanwhile, a market taker place orders that are instantly fulfilled, since there was already a market maker in place to match their requests.

Takers remove business from the exchange, so they usually have higher fees than makers, who add orders to the exchange’s order book.

For example, perhaps you put a limit order in to buy one Bitcoin at $10,000 (at most), but the lowest seller is only willing to sell at $11,000. Then you’ve just created a new market for sellers who want to sell at $10,000. So whenever you place a buy order below the market price or a sell order above the market price, you become a market maker.

Using that same example, perhaps you place a limit order to buy one Bitcoin at $12,000 (at most), and the lowest seller is selling one Bitcoin at $11,000. Then your order will be instantly fulfilled. You will be removing orders from the exchange’s order book, so you’re considered a market taker.

Reading Price Graphs

Now that you’re familiar with the main Bitcoin exchange terms let me give you a short intro into reading price graphs.

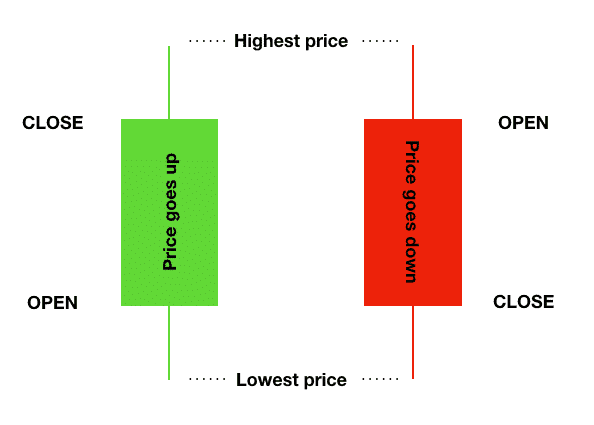

Japanese candlesticks

They are based on an ancient Japanese method of technical analysis, used in trading rice in 1600’s. Each candle shows the opening, lowest, highest, and closing prices of the given time period. That’s why you’ll sometimes see people refer to candles as OHLC (Open, High, Low, Close).

Depending on whether the candle is green or red, you can tell if the closing price of the timeframe was higher or lower than the opening price. If a candle is green, it means that the opening price was lower than the closing price, so the price went up overall during this timeframe. On the other hand, if the candle is red, it means that the opening price was higher than the closing price, so the price went down.

In the image, you can see the opening price in the wide-bottom part of the candle, the closing price in the wide-top part on the candle, and the highest and lowest trades within this timeframe on both ends of the candle.

When we’re in a bull market, most of the candlesticks will usually be green. And if it’s a bear market, most of the candlesticks will be red.

bull or bear markets

These markets are named after these animals because of the ways they attack their opponents. A bull thrusts its horns up into the air, while a bear swipes its paws downward. So these animals are metaphors for the movement of a market. If the trend is up, it’s a bull market. But if the trend is down, it’s a bear market.

resistance and support levels

Occasionally, Bitcoin’s price seems to hit a virtual ceiling, and you can’t break through it for a long time. That’s a resistance level. So if Bitcoin fails to break $10,000, the resistance level is $10,000. Usually, at a resistance level, you will see a lot of sell orders, and that’s why the price fails to break through that specific point.

Meanwhile, there’s also a support level. In other words, there’s a price that Bitcoin might not go below. Support levels act as floors by preventing the price of an asset from being pushed downward. A support level will be accompanied by a lot of buy orders set at the level’s price. The high demand of a buyer at the support level cushions the downtrend.

Historically, the more frequently the price has been unable to move beyond the

support or resistance levels, the stronger these levels are considered.

Here’s a common characteristic of both support and resistance levels: They are usually set at a round number, since most inexperienced traders tend to buy or sell when the price is at a whole number.

So usually, you’ll see a lot of buy or sell orders around prices like $10,000, rather than a price like $10,034. Because so many orders are placed at the same level, these round numbers tend to act as strong price barriers.

Psychology also creates support and resistance levels. For example, until 2017, it seemed expensive to pay $1,000 per Bitcoin. So there was a strong resistance level at $1,000. But once that level was breached, a new psychological resistance level was created: $10,000.

Common trading mistakes

You now know the basics of Bitcoin trading. However, there’s still a lot more to it. Since we can’t possibly go over everything in one lesson, I want to direct you to additional resources that will take you to the next level of trading.

Take a look at the resource section at the end of this video. Then you can find out about advanced Bitcoin trading lessons, the top Bitcoin trading tools, and the best Bitcoin exchanges for starting your trade.

But before we end this video, let’s go over the most common mistakes that people make when they start trading—in the hopes that you’ll be able to avoid them.

Mistake #1 – Risking more than you can afford to lose

The biggest mistake you can make is to risk more money than you can afford to lose. Take a look at the amount you feel comfortable with. Here’s the worst-case scenario: You’ll end up losing it all. If you find yourself trading above that amount, stop. You’re doing it wrong.

Trading is a very risky business, and if you invest more money than you’re comfortable with, it will affect how you trade, and it may cause you to make bad decisions. Mostly, you may end up losing a portion of your money that you can’t do without.

Mistake #2 – Not having a plan

Another mistake that people make when starting out with trading is not having an action plan that’s clear enough. In other words, they don’t know why they’re entering a specific trade, and more importantly, when they should exit that trade. So clear profit goals and stop-losses should be decided before starting the trade.

Mistake #3- Leaving money on an exchange

Moving on, NEVER leave money on an exchange that you’re not currently trading with. If your money is sitting on the exchange, it means that you don’t have any control over it. If the exchange gets hacked, goes offline, or goes out of business, you may end up losing that money. Whenever you have money that isn’t needed in the short term for trading on an exchange, make sure to move it into your own Bitcoin wallet or bank account for safekeeping.

Mistake #4 – Giving into fear or greed

Two basic emotions tend to control the actions of many traders: fear and greed. Fear can appear in the form of prematurely closing your trade, because you read a disturbing news article, heard a rumor from a friend, or got scared by a sudden dip in the price (that will soon be corrected).

The other major emotion, greed, is actually also based on fear: the fear of missing out. When you hear people telling you about the next big thing, or when market prices rise sharply, you don’t want to miss out on all the action. So you may get into a trade too soon, or even delay closing an open trade.

Remember that in most cases, our emotions rule us. So never say, “This won’t happen to me.” Be aware of your natural tendency towards fear and greed, and make sure to stick to the plan that was laid before you started the trade.

Mistake #5 – Not learning the lesson

Regardless of whether or not you made a successful trade, there’s always a lesson to be learned. No one manages to only make profitable trades, and no one gets to the point of making money without losing some money on the way.

The important thing isn’t necessarily whether or not you made money. Rather, it’s whether or not you managed to gain some new insight into how to trade better next time.

Let’s wrap it up…

We’ve spent a great deal of time today talking about Bitcoin trading, but I have to warn you: The majority of people who start trading Bitcoin stop after a short while, because they don’t successfully make any money.

Here’s my opinion: If you want to be successful at trading, you’ll have to put in a significant amount of time and money to acquire the relevant skills, just like any other venture. If you want to get into trading just to make a quick buck, then perhaps it’s better to just avoid trading altogether. There’s no such thing as quick, easy money—without a risk or downside at the other end.

However, if you’re committed to learning how to become a professional Bitcoin trader, take a look at our resource section below. Then you can get the best possible tools, and continue your education.

You may still have some questions. If so, just leave them in the comment section below.

https://99bitcoins.com/bitcoin-trading-guide/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD