Last updated on November 8th, 2017 at 08:53 am

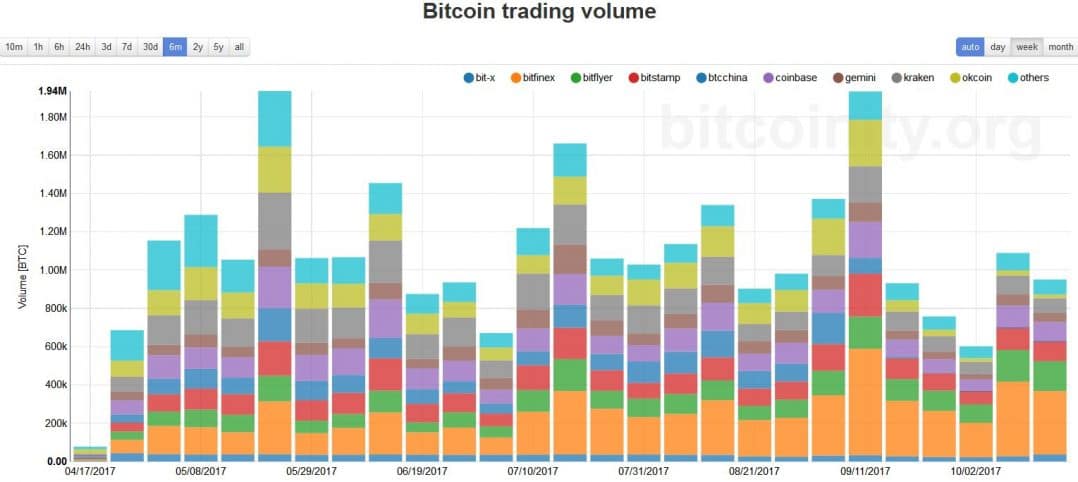

Bitfinex is the world’s biggest Bitcoin exchange by volume. 5.77 million bitcoins traded through Bitfinex from mid-April to mid-October 2017—nearly twice the volume of Bitfinex’s nearest competitors, including Kraken (3.65 million BTC) and Coinbase (3.06 million BTC).

High volume is important for traders as it ensures a low spread, which is the difference between the best bid and ask prices.

Courtesy of Bitcoinity.org, here’s a graph of volume over this period, with Bitfinex shown in orange:

So if Bitfinex is the biggest, it has to be the best, right? Well…

Bitfinex Difficulties

It’s no secret that Bitfinex has experienced its share of problems. The April 2016 theft of nearly 120,000 BTC from Bitfinex stands as the second-largest Bitcoin heist in history, dwarfed only by the loss of around 750,000 BTC by Mt. Gox.

The key difference between Gox and Bitfinex is that the latter made its clients whole. Although not all accounts were affected, Bitfinex made the decision to spread the loss among all its clients; all users took 36% “haircuts” on their account values. One year later, all clients were fully compensated—at least those who’d held their BFX tokens, which represented IOUs from Bitfinex.

The problems didn’t end there for Bitfinex. In April of 2017, Bitfinex’s bank accounts were frozen by its correspondent bank, Wells Fargo. This situation persisted for weeks, leading to client complaints and all kinds of distortions in Bitfinex’s pricing. Normal service was eventually restored—although US dollars and US customers are no longer accepted by Bitfinex as a result of these banking headaches.

This means there’s no way to fund your Bitfinex account with fiat currency at the moment.

Advanced Trading Features

Bitfinex features an advanced, customizable GUI, over 50 trading pairs (e.g. BTC/ETH), and plentiful order types, such as limit, market, stop, stop-limit, trailing stop, fill or kill, and scaled orders. These features combine to make it a popular exchange with more sophisticated cryptocurrency traders.

Currency Support and Fees

Bitfinex is technically an all-crypto exchange at current.

Bitfinex does, however, support Tether (USDT), the quasi-fiat token unofficially pegged to the US dollar’s price. Indeed, Bitfinex is a major shareholder in Tether and is probably the majority holder of these coins.

While Tether is very useful to traders, being (generally) as stable in price as the USD without the related disadvantages of slow and expensive international transfer times, it remains vulnerable to significant regulatory risk.

Free deposits and fairly cheap withdrawals are available for Bitcoin and the following altcoins and ICO tokens: Litecoin, Ethereum (Classic), Zcash, Monero, Dash, Ripple, Iota, EOS, Santiment, OmiseGO, Bcash, NEO, Metaverse ETP, Qtum, Aventus, EDO, and Bitcoin Gold.

Markets and Services

Besides providing about 51 currency trading pairs for a variety of currency pairs (for a moderate maximum taker fee of 0.2% or a maker fee of 0.1%), Bitfinex also provides markets for so-called Chain Split Tokens (CSTs). These present a way for Bitcoin holders to speculate about the success of future hard fork attempts, such as SegWit2x.

For those who wish to trade major amounts ($100,000+) of cryptocurrency privately, Bitfinex provides an over-the-counter (OTC) trading facility. This service matches, and presumably secures, major private deals.

Margin trading and margin funding

Margin trading essentially multiplies a trader’s market exposure through leverage, whereby a $10 move in the Bitcoin price at 10x leverage would result in a $100 profit or loss. Bitfinex offers a maximum of 3.3x leverage.

Margin funding allows users to lend liquidity to margin traders in return for daily interest payments. To calculate the potential returns, we recommend the helpful BFXdata calculator.

Warning: Margin trading amplifies both upside and downside risk and is not recommended for new traders. Margin funding locks your funds on Bitfinex for the duration of the loan.

Buying Limits

As Bitfinex lists a 0.1% taker fee for those who trade $30 million or higher per month, it may be assumed that no buying limit exists beyond market supply.

Privacy

Bitfinex requires verification for Tether usage and expedited cryptocurrency withdrawals. However, the exchange remains perfectly usable for those who only wish to provide an email address. Bitfinex also offers direct access via a Tor hidden service.

Conclusion

If you’re new to cryptocurrency and looking to get your first coins, Bitfinex is not for you. The lack of fiat funding options makes it impossible to buy crypto with regular money. Even if you do manage to fund your account, the complicated interface will certainly take time to master and will make costly mistakes more likely. Newcomers are advised to stick with a simpler exchange that offers a variety of familiar payment options.

On the other hand, if you’re an experienced cryptocurrency trader, Bitfinex likely offers everything you need and more. The chief draw is probably the platform’s high Bitcoin and Ethereum liquidity, but its margin funding, leverage, and multiple order types offer a lot of flexibility.

Steven Hay

I’m a former futures trader. My keen interest in matters financial, economic and political eventually led me to conclude that the current, debt-based fiat system is broken. It was a natural step from there to investing in gold and, in early 2013, Bitcoin. Although I’m not very technical, I’ve learnt about Bitcoin through study, asking questions, running ecommerce and marketing sites and working as a journalist. I’ve always loved writing and my current focus is on creating guides which inform others about Bitcoin’s advantages.

Latest posts by Steven Hay (see all)

https://99bitcoins.com/bitfinex-review-the-worlds-biggest-exchange-by-volume/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD