sunshineprofits.com / ARKADIUSZ SIEROŃ / JULY 19, 2017

Last week, the Bank of Canada raised interest rates. What does it mean for the U.S. dollar and gold?

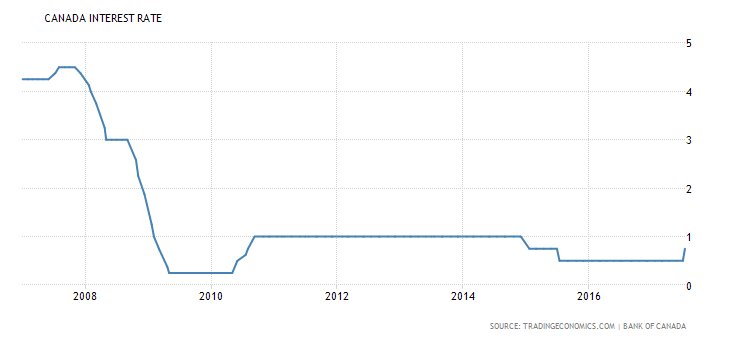

On Wednesday, one week ago, the Bank of Canada increased its target for the overnight rate from 0.50 percent to 0.75 percent. The bank rate and the deposit rate, which create the operating band, were raised to 1 percent and 0.5 percent, correspondingly. As one can see in the chart below, it was the first hike in seven years. Still, the key policy interest rates remain at a very low level.

***

Although the upward move was generally expected, the BOC took a surprisingly hawkish tone, as it considered recent softness in inflation temporary. The official reason behind the hike was that “recent data have bolstered the Bank’s confidence in its outlook for above-potential growth and the absorption of excess capacity in the economy”. However, the BOC could be also worried about the housing market or it did want to stay behind the hawkish Fed.

The post BOC’s Hike and Gold appeared first on Silver For The People.

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD