Since its release in early 2009, Bitcoin has been the trailblazing leader of the cryptocurrency revolution. Countless imitators have come and gone but Bitcoin remains dominant, despite nearing the current limits of its transactional capacity.

Ethereum, created mid-2015, is Bitcoin’s strongest rival… But can Ethereum deliver on the hype surrounding its complicated technology, as well as recover from the recent spectacular failure of the DAO, to usurp Bitcoin’s primacy?

- Created

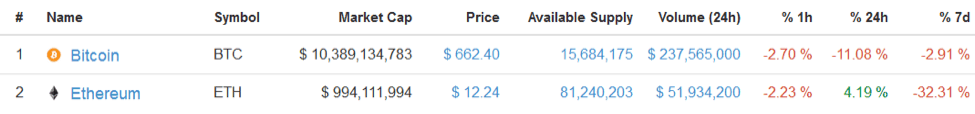

- Market cap

- Popular support

- Blockchain

- Scalable

- Mining

- Supply

- Development

- Hash rate

- Initial distribution

Bitcoin

- 2009

- Over 10 billion

- High

- Proof of work

- Not at the moment

- ASIC miners

- 21 million

- over 100 contributers

- 1.8 ExaHash

- Mining

Ether

- 2015

- Under 1 billioin

- Low

- Proof of work

- Yes

- GPUs

- 81 million

- Small core team

- 3 TeraHash

- Initial Coin OfferingICO

Complimentary or Competing Cryptocurrencies?

How valid is the frequent claim that Bitcoin and Ethereum aren’t direct competitors but rather complimentary aspects of the new, blockchain-based economy? The peaceful coexistence theory holds that the web is vast and deep enough for Bitcoin and Ethereum to carve out their respective niches:

Bitcoin specialising in its role as digital gold; offering a dependable monetary system free from unbounded inflation and political intervention.

Ethereum evolving into the world computer; a blockchain-based programming language enabling code-based contracts and decentralised applications.

In practice, matters are more complex. Given the extensibility of cryptocurrency, neither coin has a clearly defined sphere of operation. There is considerable overlap between their functions and markets, with nothing to prevent user migration.

For example, additional layers built upon Bitcoin, such as the Rootstock.io smart contact platform, threaten to trespass on Ethereum’s playground. Rootstock promises to do everything Ethereum can, with the added security of a two-way peg to the more secure Bitcoin network.

Likewise, Ethereum has become a popular trading and investment instrument, infringing upon Bitcoin’s domain as “magic internet money.” Ethereum’s daily trading volume, insofar as such figures can be trusted for either currency, is currently about 1/5th that of Bitcoin:

Bitcoin VS Ethereum – Competitive Factors

The following user scenarios serve to illustrate the frequent necessity of choosing between Bitcoin and Ethereum:

- Traders and Investors allocating capital according to expected returns and perceived safety,

- CEOs and Founders must choose the best platform to serve their business,

- Developers have only so much time to contribute to open source projects,

- Miners invest in different types of hardware depending on which coin they mine,

- Media disseminates only the most compelling stories to their audience, etc.

Peaceful coexistence is a myth; Bitcoin and Ethereum clearly compete for users. The good news is that such competition should ultimately produce better cryptocurrencies.

Bitcoin VS Ethereum – Popular Support

Bitcoin users tend to be politically and economically conscious. Many users support certain principles, such as individual sovereignty and free markets. There exists a definite aversion to central planning and control, so Bitcoin is often revered as the counter to central banks and big governments.

Ethereum users tend to be less ideologically-motivated. They are generally content to vest ultimate authority in Vitalik Buterin, inventor of Ethereum. The community’s focus tends to be on the technology’s future business and financial applications.

The network effect, expressed mathematically by Metcalfe’s law, states that a network’s value is proportional to its number of users. Whether we’re talking fax machines, social media or cryptocurrency; people are more likely to join popular networks. As the first cryptocurrency, Bitcoin has a clear first-mover advantage here.

Bitcoin VS Ethereum – Scripting Language

Bitcoin transaction data doesn’t just confer ownership of coins; it also conveys certain instructions relating to transaction. For example, a recently-implemented change allows sent coins to be locked for a custom time period. The set of possible instructions is known as Bitcoin’s scripting language and it’s intentionally limited to transactional processing.

Ethereum’s primary innovation was to expand this set of instructions into a fully-featured programming language such as JavaScript, which Ethereum’s language closely resembles. This is what is meant by Ethereum being “Turing-complete.”

Risk vs. Reward: The undeniable fact is that, by adding complexity at the protocol level, Ethereum presents a larger attack surface to adversaries. This heightened risk of attack makes Ethereum an inferior store of value. Further, there is no decisive advantage gained from Ethereum’s scripting language which could not be duplicated via protocol-separate code. Bitcoin may be in trouble if Ethereum ever develops such a killer app but until then…

Bitcoin VS Ethereum – Blockchain

Bitcoin has a Proof of Work blockchain which is currently composed of 1 megabyte blocks. These blocks are mined on average every 10 minutes by SHA-256 hashing. Bitcoin mining is primarily performed by ASIC devices. Bitcoin’s blockchain can process around 3 transactions per second.

Ethereum currently has a Proof of Work blockchain, although a proposed fork will switch it to Proof of Stake (PoS). The Ethereum blockchain is composed of blocks of variable size. Blocks are mined on average every 15 seconds by hashing a modified Dagger-Hashimoto algorithm. This algorithm is designed to resist processing by ASIC devices; as a result Ethereum mining is primarily performed by graphics cards. Ethereum’s blockchain can process around 25 transactions per second.

Scalability: Ethereum appears to have a clear advantage in terms of blockchain scalability. Bitcoin is in the process of upgrading its transactional capacity.

Security: In terms of blockchain security, massive infrastructure investment by Bitcoin miners has resulted in a peak Bitcoin hashrate of 1,803,059,256 GH/s (1.8 ExaHash). This greatly exceeds Ethereum’s hashrate, which peaked at a comparatively paltry 3,010 GH/s (3 TeraHash). The monetary cost to perform a 51% attack on Bitcoin is proportionately greater.

Decentralisation: Hashrate distribution among mining pools is fairly equal between Bitcoin and Ethereum on a percentage basis.

The majority of Bitcoin mining occurs in China due to favourable economic factors. This raises a red flag in terms of the potential pressure the Chinese state could exert on the Bitcoin mining network. While Bitcoin could alter its mining algorithm to thwart any takeover attempt, this “mining hardware reset” would doubtless prove tremendously destructive.

Although Ethereum mining in its current state resembles the glory days of individual-level Bitcoin mining, its planned switch to PoS will likely increase centralisation. Gavin Andresen, former Bitcoin lead developer, succinctly critiqued PoS thus: “I think proof-of-stake is hard coded, ‘the rich get richer’ and is deeply unfair.”

Mining: Ethereum is profitable to mine on high-end GPUs, especially given low power costs. Advanced graphic cards are available for under $200 and can also run games and other apps. However, before investing in a mining rig, aspiring Ethereum miners should consider that the upcoming change to PoS will invalidate their investment.

Bitcoin is only profitable when mined with specialised ASIC hardware running on very low cost electricity. High-end ASIC hardware costs over $2000 per unit and has no purpose besides mining Bitcoin. The pace of ASIC hardware advancement is slowing as it approaches the limits of semiconductor miniaturisation technology; it can be hoped that this process, perhaps in combination with the increasing power generation efficiencies, will eventually lead to a more widely-dispersed Bitcoin mining network.

Bitcoin VS Ethereum – Supply

Bitcoin’s total supply will be strictly limited to 21 million coins. Bitcoin’s issuance is halved roughly every 4 years. As of the next halving in July 2016, Bitcoin’s inflation rate will drop to an annual rate of ~5%. Future halving events, combined with coins lost through user error, will ultimately result in a deflationary currency.

Ethereum’s issuance by miners is capped at an annual rate of 18 million ETH. This represents an inflation rate of ~20% at the current supply. As ETH is not consumed by running programs but instead sent to the miner of the associated transaction, Ethereum’s value is likely to decline in the long term.

Implications: All else remaining equal, the purchasing power of a deflationary currency will rise over time whereas the relative value of an inflationary currency will fall. Bitcoin therefore encourages saving and benefits early adopters who bought in cheaply. Ethereum encourages spending and lowers the cost of entry for newcomers.

Bitcoin VS Ethereum – Initial Distribution

Bitcoin is thought to have been mined exclusively by Satoshi Nakomoto in its early phase. At that time, there was no barrier to the entry of other miners, other than Bitcoin’s obscurity. It’s estimated that Satoshi owns roughly 5% of total supply. As Satoshi’s coins have yet to move, some speculate they may be inaccessible.

Ethereum’s distribution took the form of an ICO (Initial Coin Offering), whereby 31,529 BTC was traded for 60,102,216 ETH in advance of the Ethereum blockchain’s launch. Approximately $14m USD was raised in this fashion by the Ethereum Foundation, which awarded itself 12m ETH; roughly 14% of the current total supply.

Fairness: Bitcoin had a demonstrably fairer launch. The Ethereum Foundation’s majority stake is somewhat concerning given the intended switch to Proof of Stake mining. Under PoS, the likelihood of minting new tokens is proportional to holdings. This raises the possibility of the further concentration of self-awarded wealth.

Bitcoin VS Ethereum – Development

Bitcoin’s codebase benefits from over 100 Core contributors and several alternative implementations. With over $10b in assets on the line, they take a conservative approach to development. All proposed improvements must undergo peer review and rigorous testing prior to being merged.

The perceived slow pace of this process, at least in terms of scaling, led to contention (the so-called Blocksize Debate) and the eventual estrangement of numerous users, several companies and even a few developers. Core developers are now under considerable pressure in terms of delivering scaling solutions without compromising security.

Ethereum is the brainchild of Vitalik Buterin, who handled its initial development along with 3 other skilled developers. They were able to pick and choose ideas from the development of Bitcoin and altcoins and introduce new ideas of their own. However, literally anyone can code a smart contract which runs on top of Ethereum. Herein lays both opportunity and danger.

Certain estimates put the number of bugs per line of contract code at 1 in 10. As seen with the draining of The DAO and numerous minor incidents, investing in such contracts without proper code review can lead to serious loss. More work is required to secure smart contracts before they can reliably underwrite new ways of doing business.

A Developing Story: both coins face considerable challenges if order to realise their full potential. However, this industry tends to attract some of the world’s best and brightest minds, who invariably relish intellectual challenge.

Final Word

Bitcoin has more lives than a cat, by an order of magnitude. Betting against Bitcoin is just not advisable, as many have learnt to their detriment. If SegWit, the Lightning Network, Rootstock, Elements and other exciting developments play out as expected, Bitcoin will retain its crown with ease.

Ethereum is no safe bet, which is not to say it couldn’t pay off handsomely. The uncertainty surrounding its prospects increases its volatility, making it a great instrument for traders.

In the short term, much will depend on how the DAO crisis is resolved. Medium term, there’s considerable uncertainty around the PoS fork and how it’ll impact network security and incentives. Long-term, doubts remain regarding Ethereum’s high rate of inflation and its significant pre-mine. If it’s to survive, it must also evolve past dependence on a single trusted authority, in the person of Vitalik.

P.S.

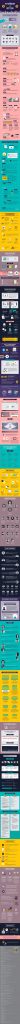

We’ve just gotten this really cool infographic from bargainroo.com and gutcher.de that really details the exact differences (it’s a bit long but it’s worth it). Enjoy!

Steven Hay

Latest posts by Steven Hay (see all)

- Antminer L3 / L3+Scrypt Miner Review – Is It the Best Litecoin? – July 14, 2017

- How to Use Your Bitcoin Wallet to Get Free Coins – June 25, 2017

- Bitcoin Volatility Explained – May 23, 2017

https://99bitcoins.com/bitcoin-vs-ethereum-cryptocurrency-comparison/

BTC-USD

BTC-USD  ETH-USD

ETH-USD  LTC-USD

LTC-USD  XRP-USD

XRP-USD